But it does not relieve them of the financial situation

By the end of 2015, the trend is to decrease credit load of Russians. To such conclusion experts of the United credit Bureau (OKB, “daughter of” Sberbank), analyzing the ratio of the average monthly loan payment to the average monthly salary in different regions of the country. However, a positive at first glance, the trend is due to negative processes in the economy.

By the end of 2015 the nominal debt burden in Russia was 37%, while in 2014 it was higher — 41%, says the Bureau. Credit load indicator or PTI (payment-to-income) refers to the ratio of the amount of the monthly loans on all loans of the borrower to the level of his income. Normal banking classification is considered to be an indicator of PTI at the level of 30-35%. In the range of PTI to 35% in the last year were 12 regions in 2014, such regions was 9. However, in 26 regions of Russia, the debt burden still exceeds 50%. In Karachay-Cherkessia, Kalmykia and Dagestan, it can be called critical, as it is noted in the Bureau.

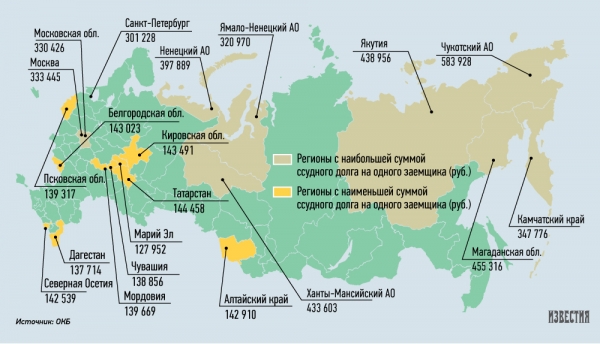

The average monthly payment on all loans of the Russians amounted to 12.7 thousand. On average, in 2015 every person in Russia accounted for 1.7 per credit. This is slightly less than in 2014, when the figure was 1.8. The numbers of monthly payments, depending on the region may vary significantly. So, most loans pay for residents of the Magadan region (27 thousand rubles.), Chukotka (25.5 thousand rubles), the Kamchatka territory (19.8 thousand rubles), the Republic of Sakha (19.6 thousand rubles) and Moscow (18,2 thousand rubles). The lowest payments from borrowers Ingushetia (7,9 thousand), Tambov region (8 thousand) and Chechnya (8.9 thousand rubles).

However, poor payment is not suggests that the credit load is small. For example, in the Ulyanovsk region the index decreased compared to last year and amounted to approximately 9.5 thousand rubles, however, the loan burden has increased by 3 percentage points to 47% — due to the decrease of the average wage.

Although, as noted Deputy General Director of the Bureau Nicholas butchers, the overall trend looks positive, we should not forget that when calculating the index credit load is taken into account nominal income borrowers, while the real income of citizens, according to Rosstat, last year decreased by about 5%.

This means that more and more Russians in the future will experience difficulty servicing their loans — emphasizes Nikolay Myasnikov.

Also, according to him, the debt burden was reflected by the fact that banks began to look not only discipline, but an existing level of credit load. Therefore, borrowers has become more difficult to obtain new credit. In addition, in 2015, significantly decreased average size of the loan. For example, borrowing cash it decreased from 128 thousand to 93 thousand. On average, every Russian borrower owes the Bank 210 thousand rubles, but in many regions the burden of debt in 1,5–2 times above average. This is mainly the regions with the highest average income of the population, which is issued more loans of significant amount. So, the inhabitant of Chukotka on average have almost 590 thousand rubles, the Moscow — nearly 334 thousand.

But a spokesman for the EDB shows indeed a positive change.

— Their positions were able to improve the Kamchatka Krai, Saint-Petersburg and Chukotka. These regions are quite high income, so a small decrease in monthly payment combined with nominal income growth helped to reduce the PTI, he said.

The specialists of OKB noted another positive trend is the increase in the proportion of borrowers with one active loan from 57% to 58%. The number of loans per borrower are the leaders of the Altai Republic, Sakha, Magadan oblast, and Altai Krai.

The least credit from the borrowers of the North Caucasus: Ingushetia, Chechnya and Dagestan of them less than 1.5 on the borrower.

However, stress in the office, the number of borrowers, simultaneously serving two or more loans is still high and exceeds 18 million people.

— If among the owners of one credit late payment allow about 20%, while among owners of two or more loans to such borrowers for almost 40%, while 23% of them do not pay for the debts 90 or more days, — says Nikolay Myasnikov.

National Bureau of credit histories (NBCH, competitor OKB) data does not match with the indicators of RCH. In NBCH uses a slightly different methodology (assessment of the load is investigated by a larger number of parameters). According to NBCH on 01.10.2015 year (the year the Bureau plans to provide data in April), the current debt load of the average Russian borrower has $ 22,70%, a decline of 3.91 percentage points compared with the same indicator as of early April 2015 (26,61%).

Furthermore, according to the national Bureau of credit histories, current debt burden decreased for all categories of borrowers. The greatest decline was recorded in the segment of borrowers with an average income — 4.1% slightly less significant reduction was noted in the PTI segments of borrowers with the lowest (-3,99 p. p.) and the highest income (-3,44 p. p.).

But in NBCH believe that positive at first glance, the data at deep analysis does not show an actual reduction of the debt burden.

— Despite the recorded decline, the debt burden continues to be the main risk when lending to the population. First of all we are talking about the risks of default because of the lack of borrowers capacity to service its obligations, — says marketing Director of NCB Alexey Volkov.

In his opinion, and in 2016 this trend will continue.

— In conditions of high inflation and reduced real incomes decline PTI does not have a significant positive effect on the General situation in the retail lending. At the same time, a relatively low ratio of outstanding debt to annual income indicates a relatively high untapped potential in retail lending in Russia, primarily in the mortgage — predicts Alexey Volkov.

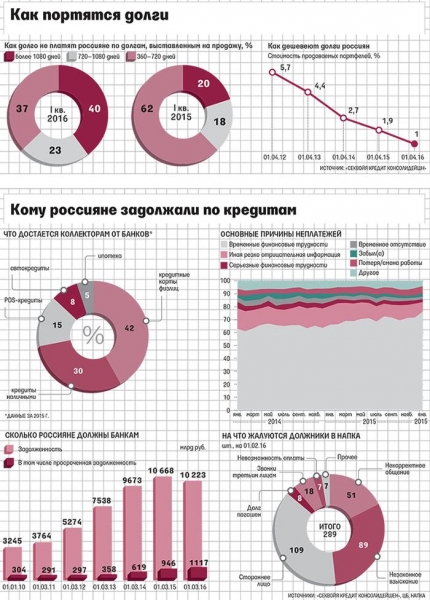

Despite the expectations of the Central Bank, in 2016, retail lending can be revived in all segments, while these expectations are not met. So, as of March 1, loans to individuals in annual terms decreased by 4.4% since the beginning of the year — by 0.8%. If a year ago the population was due to banks 11 trillion roubles, in March 2016 10.6 trillion rubles.