Collection market did not have time to make outlines of civilized law, such activity is still not provided, as there came another crisis. The situation is aggravated by the prepared speakers of the Federation Council Valentina Matviyenko and state Duma Sergey Naryshkin, probably, the most rigid variant of the law on collection activity. Vedomosti interviewed the major players about how they are going to work in conditions, when debts are getting worse and the laws tougher and tougher.

The crisis did not earn

Collectors floundering in older distributions – describes the current situation on the market, the General Director of “Activitiesother” Dmitry Teplitsky: “the Quality of arrears is not the best, as agencies are forced to work with quite old debts 2013-2014 that was not easy from the point of view of recovery”. These loans were granted prior to the crisis.

The real incomes of the population and the effectiveness of the return of problem debts fell and the majority of agencies do not cover their costs of debt servicing, continues Teplitsky: the cost of collecting is growing, and the margins of business falls. The new delay comes much less, he complains, its suppliers are mainly state-owned banks, which are not so dramatically inhibited lending as private.

Private banks, according to Teplitsky, now basically only the second place old debts. Agency fees remain at the levels pre-crisis of 2012-2013, an average of 10%, he adds: “So we, like many, are working with some banks on the verge of profitability or a small loss to keep customers, relying on economic growth, the resumption of lending and getting to work with fresh portfolios”.

This is confirmed by the bankers. Some of the banks started to refuse to work with collection agencies. C mid-2015 on this path was followed, for example, “home credit”, because “working under the Agency scheme less effective than the natural recovery and the cession unprofitable, as the current price is below the fair value of portfolios,” says a Bank representative. The Bank also seeks to reduce the number of private employees working with overdue debts.

“OTP Bank” sells the debt only at the final stage indicates the Bank: “Transfer of debts to external collectors is possible when the probability of collecting the debt are extremely low and the period of delay is already quite big”. C 2015 the OTP improves the quality of the portfolio, which is reflected in the amount of debts transferred for collection under the Agency scheme, the Bank significantly reduced and their domestic workers, says the Chairman of “OTP Bank” Sergey Kapustin, without giving figures.

“VTB 24” sells mainly small debts, without bail, reported the Bank press service: “sell the debts to other banks unprofitable, there are no agencies who can effectively work with them, and therefore ready to offer an adequate price”. In 2016, the Bank increased the arrears due to the adoption of the overdue support of AHML’s mortgage portfolio, he adds.

Bank “East” sells in a year approximately 150,000 to 200,000 cases, the size of the portfolio – about 7 billion roubles every quarter, says operational Director of the Bank Nino Kodua: “We, like last year, sell delay 360+”.

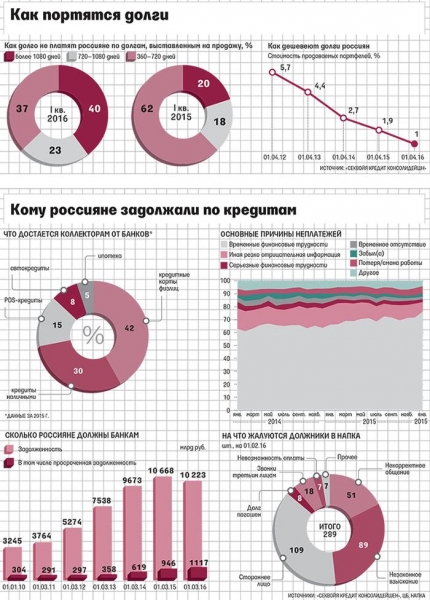

How much is the debt of a nation

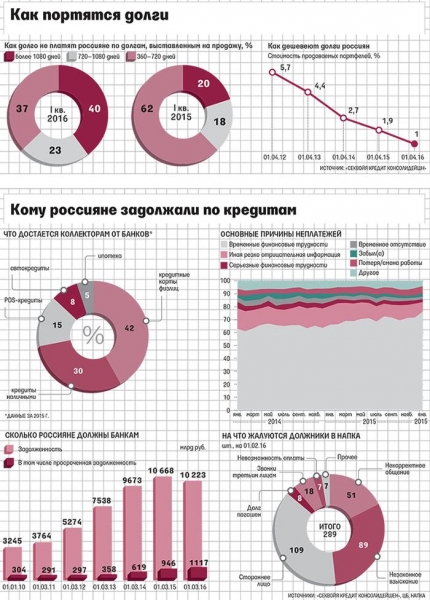

For the old portfolio will not gain much and their prices continue to fall, not happy with the bankers: if 2-3 years ago for a portfolio you could save 5-7% of that value, now the price has fallen to 2%. Because of this, last year was a record-setting number of outstanding transactions (40%) between the banks and the collectors.

The proposed portfolio can rise in price only in case of substantial improvement or improving solvency, but to talk about it sooner, I’m sure the President of “Sequoia credit konsolideyshn” Elena Dokuchaeva.

In the first quarter, the banks put up for sale 76 billion rubles of bad debts, 18% less than in 2015, became a record for the assignment market, according to a review of the Sequoias. With the beginning of the year of assignment held by the agricultural Bank, Sviaz-Bank, ROSBANK, the Bank “Tinkoff”, etc., to the tender documents. About one-third of tradable debt is still up to 20 000 rubles, follows from the data of the First collection Bureau (PCB), the price at the beginning of the year grew to an average of 1.07% against 0,85% in 2015, says one market participant.

In 2015, banks are selling a record amount of the portfolios is on average about 15 billion rubles (10 billion), says Dokuchaeva, but now growth has slowed along with the lending.

This year can be beaten last year’s record, when was put on sale 440 bn of bad loans, optimistic words: “this year the sale will be put to bad debts is not exactly less than in the past: problems the banks have accumulated a lot.” Banks have not yet disclosed plans to sell debt.

Experienced debtors

On average, the borrowers who have banks 10 000-50 000 rubles overdue to a year (and the majority), now slowly pay your debts, follows from statistics of the Association of collectors of NAPCA. Their monthly payments dropped by a quarter from 8000 to 6000 rubles And the share of debtors with more than six-month debt, which is repaid in one payment, fell from 40% in early 2014 to 10% in the end of 2015, follows from the data of NAPCA.

People already heavily burdened with debt, solvency of the population falls, Dokuchayev explains why debtors have less to pay. Estimates of Sequoia, in the last crisis about 80% of borrowers had only one loan, now there are 60% and 25% have two loans. Every fourth borrower with a single loan has a debt problem, says Dokuchaev. Communication with debtors in the beginning of 2016 showed that about 80% of borrowers facing arrears, are in a difficult financial position, she continues, when people no longer hope for revenue growth.

“I won’t pay”

“In Ulyanovsk the bastard threw a Molotov cocktail into the window of the house, there was a child, he was seriously injured. This man was never a collector, he was trying… to get a share from the microfinance organization that he has cleared the debt. It turns out that he threatened three times and three times the family went to the police, complained about threats, three times the police had not risen from his chair,” – told the financial Ombudsman Pavel Medvedev in April, the radio station “Moscow speaking”.

A series of scandals and criminal convictions earlier in the year with the participation of collectors, who threatened the debtors, invading their homes and even raped, have attracted the attention of legislators. In mid-February, Matvienko and Naryshkin introduced a bill to protect the rights of debtors. It sets the rules of engagement creditors, collectors, banks and microfinance institutions – with indebted people, limiting collectors in the methods of working with debtors.

The law has not been passed, but some borrowers are sure collectors here will deny, and refuse to pay, which increases the debt.

The law has not yet been adopted, but the discussion has already led to complete confusion in the minds of borrowers – some of them sure collectors here will deny, and therefore disclaim communion with them, this leads to an increase of fines and penalties, judicial enforcement action, the Director of NAPCA Boris Voronin.

Debtors feel with impunity, they have a new argument not to pay the debts, Teplitsky confirms: “We will wait for the adoption of the law and through him we will act on, and now I won’t pay,” say clients or even refer to the impending death of the collectors.

Expectations of a quick ban collection activity is the cause of 9% of the failures of debtors to pay, indicates Teplitsky. According to NAPCA, even in 2015, much less debtors that after the first conversation with the officer promised to pay the debt. By the end of last year, such assurances have been given only 25% of the debtors or their relatives against more than 45% in the spring of 2014

Asked for the regulation

Now collectors are considered domestic collection service of the banks or foreign companies – Agency working as agents or on the assignment agreement. The market is still no regulator, nobody maintains the registry of companies. By estimations of market participants, from 600 to 1500, and many work in the grey area. Often this is a provincial company of 2-3 people, including the CEO, who sometimes operate on the principles of 90s, without moral and ethical norms and outside the legal field, says Teplitsky.

The bill increases requirements to collectors – debt recovery should be their main activity – introduces the requirement for registered capital: the minimum of 10 million rbl., All companies should be to provide the registry, to be maintained by the state, there will be a Supervisory authority. Also will be limited to the communication of the collector with the debtor – often a personal meeting and two phone calls per week, weekdays communication is forbidden from 22 to 8 hours, and during weekends from 9 to 20. For banks limits set by the Central Bank. The project forbids to apply to the debtors physical force or threaten to damage property, to exert psychological pressure and so on. These proposals had been discussed for a long time, and some are already prescribed in other laws.

Most collectors are afraid of the prohibition to transfer personal data of the debtor without his written consent. Such a clause in the loan agreement will not help – the consent must be given after the occurrence of the delay, and given before the bill recognizes the void. The collector can take the duty to work only with the consent of the borrower, but this is unlikely. And three months after the onset of delay the customer may withdraw from interaction with the claimants, stated in the document.

CB representative said only that the regulator believes that the activities for the collection of overdue debt must be governed by strict standards, this requires the adoption of legislation.

The main plus of the project for the business it will relieve the market from monotony collectors, collectors rejoice. There will be fewer small companies and individuals engaged in the recovery, the market will become more transparent, said Voronin.

As such, the law will significantly simplify the life of debtors, but can hit the collector market and for consumer credit, prevent the collectors and bankers.

The foreclosure market has long needed to be adjusted, the bill is timely and necessary, recognize words, but not so hard.

She was concerned about the possibility of the debtor unmotivated to refuse to communicate and obtain the necessary consent to the transfer of debt to a collection Agency after the debt is simply technically impossible.

Unnecessary restrictions will lead to the fact that some products will become unavailable, said Teplitsky: the failure of the debtor from communication forces the lender to go to court, it will seriously increase the cost recovery. Consumer loans up to 5,000 to 10,000 rubles, which are now most in demand, will simply disappear, he leads by example.

The courts and the bailiffs were loaded up, litigation will take years, and meanwhile, the debts will accrue interest, predicts the President of NAPCA Alexey Savatyugin.

If any collectors activity to be restricted, the banks will bear losses on the loan portfolios, because not all money can be collected, or increase cost recovery, explains Kapustin, and banks will resort to a purely economic measure: adjust the stakes and toughens criteria of selection of the borrower.

Maria KAVERINA