The banking crisis sample 2015-2016 substantially different from the conflicts experienced by the sector in 2009-2010. “Vacation credit” this time more long, the scale of the losses as the banks themselves, and expenditures associated with the relief of problems of banks and their clients significantly more.

In the economy, in contrast to car, looking in the rearview mirror – a rather pointless exercise. Every crisis, as, indeed, rise, unique. Repetition is conditional, the analogy is very relative. Unlike lessons, often trivial, that the crises taught us.

The discussion of actual problems of overcoming of the crisis was devoted to traditional Banking conference, northwestern Federal district, organized by our magazine in the last day of March in Saint-Petersburg.

Hard predictions

Submission to applicable financiers and analysts concerning prospects of development of the domestic banking system in 2016 turned out to be significantly more conservative than we expected. “We believe that in the current year compared to 2015 will worsen the dynamics of deposits of individuals and all segments of the credit market, with the exception pipetech loans to individuals – without preamble began his report to the conference the managing partner of the National Agency for financial studies (NAFI) Paul Samiev. – Under contributions of the population is inevitable deceleration of growth from 25% last year to around 5% this year. In recent times virtually the only driver of market deposits are secured citizens – upper middle class – and even more wealthy. Largely due they provided strong flow of deposits last year, returning their savings to the banking system after an emergency exit in 2014. However, it’s not like they were able to continue as actively provide resources to banks. As for the rest of the income strata of citizens, then they as depositors do not have to count. National surveys show that in recent years significantly increased the proportion of people who do not have the ability to save money. And the accumulated savings of poor public often just miserable – they are equivalent to costs in the range of one week to two or three months and, accordingly, are an important resource of replenishment of the Deposit base of banks”.

As for the credit market, it is advisable to analyze in the context of four major segments – corporate loans large business, SME loans, nepomechie consumer loans and mortgages. The first segment is the most capacious, the aggregate portfolio of loans to large businesses last year amounted to 28.5 trillion roubles, almost twice more than the other three segments combined. Loans to large corporate grew in 2014 and in 2015, although growth slowed considerably. “According to our estimates, this segment will maintain a positive growth rate in the current year, although the braking will continue as the portfolio will grow by 5% against 17% in 2015. All other segments of the credit market will shrink, and most intensively, by 17%, the portfolio of loans to SME, where the decline continues for the third consecutive year, and also on the rise, so that the accumulated compression of the portfolio by the end of this year may reach 23 per cent – said Pavel Samiev. – It is an occasion for serious reflection, because now is a radical reform of the system of state support of SMEs. Maybe it affects the fact that the support has not yet earned, as follows. The matter is compounded by the fact that this segment demonstrated the highest level of delay (about 14%), and the last continues to grow. But deeptechno in the segment of consumer lending, we expect a deceleration of decline to minus 3% or closer to zero for the aggregate portfolio against a negative 13% last year. In this segment, was noted even positive seasonal surge in January of this year, probably not the last. Mortgage portfolio, according to our estimates, will decrease this year by 7%, against a growth of 11% in 2015, although late on mortgages remains at a low level, lower than in the last crisis”.

First among equals

In extremely cool environment of the credit market is highly sensitive and some of the steps of the state violating the principles of competition development in the banking system. “We see an attempt to go the simple ways of living drives the business in the major state banks complained that senior Vice-President of BFA Bank Yury Manulis. – A very good example last year’s amendments to the law “On state defense order”, when it was ordered to the entire chain of procurement, including small contractors and small amounts concentrate in the state-owned banks or banks controlled by the Bank of Russia, with capital from 100 billion rubles. Another example. At the Congress of the chamber of Commerce put forward a suggestion that the company, which for three years successfully working in the field of public procurement, can be free from collateral. Providing Bank guarantees. Thus, banks are deprived of a particular segment of their business. Moreover, the risks are passed with qualified investors, banks for unskilled in this aspect of the state. The fact that three years ‘ experience in public contracts did not guarantee that another government order, which will differ from the previous ones, will fail as well. The Bank, providing a guarantee, studies not only experience in government contracts, but the experience on this particular type of work, as well as resource and material base of the client. With a lack of the resource base of the Bank itself can provide the missing financing in order to ensure the execution of the contract. Attempt to take part of the business from commercial banks leads, among other things, to the transfer of unnecessary risks on the budget.

Trends at the Federal level, it turns out, and got to the Northern capital. According to the Deputy Chairman of International Bank of Saint-Petersburg Valeria Voronkina, the Committee of Finance of St. Petersburg issued an instruction No. 49P, which determined the order of the state regional authorities and companies connected with the city, with commercial banks in terms of placing cash balances. In the end, regional banks, banks without state participation, which are not included in the top 50, it has become quite difficult to compete in the market with the largest banks. Have not improved the situation and the continuation of the process of active revocation of licenses. This created some uncertainty among the corporate clients of commercial banks. As a result, banks were forced to focus in 2015 on the establishment of a safety cushion in terms of liquidity.

<blockquote>the large business Loans and mortgages in the past two years has allowed the total loan portfolio of banks to avoid a significant reduction in</blockquote>

<blockquote>According to forecasts of the NAFI , in 2016, will deteriorate the dynamics of deposits of individuals and all segments of the credit market, with the exception pipetech loans to individuals</blockquote>

Share the risk with the counterparty

Indeed, banks today are forced to maintain excess liquidity. The share of highly liquid assets in total is now about 10%. It is very much. This instability of the system – banks are very afraid of uncertainty and fear, automatically reducing the ROI. Profit of the banking system – the lowest since 2006, return on equity dropped to 1%. A quarter of all credit institutions unprofitable. Hope some of the players that Commission income will be able to cover the lost interest income, did not materialize. Moreover, the banks outside the top 100 by assets, the share of Commission income generally decreased.

However, just “sit” on a cushion of liquidity will not work. Banks need to earn, so you have to figure out who and how to lend. As one of the types of solutions the banks offer signature loans. “These credit solutions allow you to reallocate the interest burden of the borrower directly with its counterparties – said Valeria Voronkina. For example, the widely used loans for the purchase of its own bills, which borrowers are calculated with counterparties. In the end, for the borrower interest rate on the promissory note lending is 4-6% per annum. If the new promissory note holders want to cash immediately, without waiting for the period of its extinction, then go to the Bank with a request to discount this bill of exchange, thus have a certain interest burden in the amount of the discount. Another example of the loan to reduce the interest rate, assetcategory under letters of credit. It is actively used in the construction sector: customers Builder (homebuyers) are placed in the Bank related letters of credit under the transaction for the period of the state registration of transition of the property right to object of real estate. At that period the banks of kreditrisiko, in fact, prolongirovanie these funds at preferential rates of interest, getting to Sebastopol marginal returns.”

<blockquote>Elman Mehdiyev, ARB: “the head of the Bank of Russia Elvira Nabiullina acknowledged that the money allocated for the Bank bailout, become independent of the emission factor”</blockquote>

<blockquote>Pavel Samiev, NAFI: “to avoid the “eternal” of sanctions, it is necessary to fix a specific timeframe for completing the remedial procedures with the achievement of intermediate indicators”</blockquote>

<blockquote>Yuri Manolis, BFA Bank: “a Number of decisions of the state, in particular, a new procedure for working with funds of the state defense order, driving a lively business in the major state banks”</blockquote>

According to the precepts of Buffett

Also occurs symmetrical question: how do banks take companies are not state of the business with which you can build collaboration that you can lend?

Here is the solution of Yuri Manolis of BFA Bank: “It’s either high-margin projects, either already proven themselves in competition projects, or projects with a clear and obvious even on obscuritatem level competitive advantages. But where to get them in the face of declining final demand? Here comes to the aid of the principle of Warren Buffett – to lend what you like, to lend what I know. For example, the construction of housing in attractive areas of the city or the formerly well-structured, stable in time or even from the Soviet era, extensively develop technologies to produce unique products. There are projects in the food industry, is in pharmaceuticals, is in construction.

On the sectoral priorities of ROSBANK, told the regional Director of its North West branch Myasoedov Kirill: “We see great potential in developing relations with companies from the sector of extraction and processing of natural resources – oil, gas, mining, energy, fertilizers etc. are Other priority sectors for banks in terms of financing are the food industry and pharmaceuticals, which received a strong impetus to the development due to the policy of import substitution. However, companies engaged in these sectors needs to develop its business in accordance with long term strategy, while remaining competitive after the abolition of reciprocal sanctions”.

The myth of over-indebtedness

Somewhat apart were the developments in retail lending. In the beginning of last year, this segment has experienced a complete collapse. In the first and early second quarter “street” lending of retail banks, that is outside the perimeter of salary projects of corporate clients, was completely closed. However, in the second half the situation changed. Banks have significantly adjusted their risk policy and lending resumed with new techniques. However, in General, we observe a reduction of the total portfolio of retail loans and a sharp increase in the delay.

“We hope NBCH Index credit health (calculated based on the share of “bad” borrowers among their total number, are considered as bad borrowers having overdue more than 60 days during the last six months) have continuously deteriorated since the beginning of 2012 and only in November last year demonstrated the first fragile signs of a reversal of the negative trend,” he shared with the conference participants exclusive calculations marketing Director of National Bureau of credit histories (NBCH) Alexey Volkov.

By estimates of Alexey Volkov, today 76 million of our fellow citizens have or had a connection directly to the retail credit market, including banking and non-banking segments. In fact, this figure is equivalent to 85 per cent of the total economically active population of our country. Of these, 35 million are currently active unique borrowers, of which about 34 million accounts for banks and borrowers one million customers of MFIs.

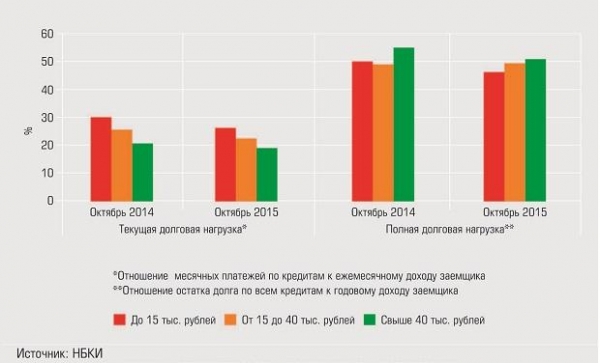

Alexey Volkov surprised many of the participants in the meeting, criticizing the widely walking in public with a myth about the high debt load of the Russian population. “In fact, the figures do not confirm this, – said Alexey Volkov and cited the following arguments. – The current debt burden, i.e. the ratio of monthly loan payments to monthly income, in the past year decreased significantly for all income groups. The highest is the share of low-income groups, with incomes less than 15 thousand rubles per month, however, even here the current level of debt fell by October of last year to just over 26% of monthly income. The values of this indicator below 30% can be regarded as quite reasonable. Significantly decreased and the ratio of the balance owed on all loans to annual income: in October last year, the figure ranged from 46.6% in low income group borrowers to 50.4% in high-income group (monthly income more than 40 thousand rubles)”.

It is encouraging that while in the North-West Federal district the index of credit health is somewhat better than in the whole of Russia. “But this picture defines exclusively Saint Petersburg, said Alexey Volkov. – In a number of regions of the North-West, for example in the Novgorod, Arkhangelsk, Murmansk regions, the debt burden significantly above the national average”.

<blockquote>Kirill meat eaters, ROSBANK: “There is huge potential for cooperation with companies for the extraction and processing of natural resources, as well as import substitution of food and pharmaceuticals”</blockquote>

<blockquote>Valeria Voronkina, international Bank of Saint-Petersburg: “In 2015, the banks were forced to focus on creating a safety cushion of liquidity”</blockquote>

<blockquote>Alexey Volkov national Bureau of credit histories: “the Index of credit health is continuously deteriorating since the beginning of 2012 and only in November last year showed the first signs of a reversal of the negative trend”</blockquote>

“Eternal” sanitation as a non-standard issue

Sharp discussion at the conference was awarded to the issue of new financial banks. Today it is one of the most problematic, painful points of the banking agenda. “Since the fall of 2008 to present, 30 banks have been sent for rehabilitation, and the total amount of funds allocated by the Bank-sanator, as of March 1 of the current year reached almost 1.2 trillion rubles, – said Pavel Samiev. – Purpose of rehabilitation in General good. First of all, is the restoration of normal activities of the Bank. However, in reality, we have a number of examples of sanctions that has lasted for a very long time, but do not yield demonstrable improvements to rehabilitated, or the last so opaque that they are impossible to identify from the outside. Any external audit procedures, the Bank sanctions we do not have. The next important principle of rehabilitation – transfer of the Bank more efficient and conscientious owner. But here, too, guarantees to give, no one can, there are examples when one Bank had to appoint the sanatory the second round. Often not valid yet and is the theoretical advantage of sanctions as a cost savings for the state compared to the option of revocation of license of the Bank had approached the verge of bankruptcy. In reality, reorganization of the increasing costs: if between 2008 and 2013, these costs amounted to an average of 20-30% of the assets of the rehabilitated Bank, then in the next two years this figure grew to 40-50%. At the same time, extremely cheap and long-term funding (usually sanatory received loans from the Central Bank for 10 years at 0.51% per annum in rubles) used by banks-sanatory discretion”.

“Banks – members of Association of Russian banks repeatedly raised the issue that the current scheme of Bank resolution gives the banks-sanatory non-market benefits – developed the theme of Executive Vice-President of the Association of Russian banks Elman Mehdiyev.

<blockquote>In 2015, even low-income households managed to reduce their debt load to a moderate level</blockquote>

In July of last year we suddenly got a powerful ally in the topic. The head of the Bank of Russia Elvira Nabiullina acknowledged that the money allocated for the Bank bailout, become independent of the emission factor and untwist inflation. The next step was in August and September, when the “Russian capital” was declared megacentral. Banks are trying to understand how this Bank will operate in its new capacity, but so far we have not received a response. In the current discussions around changes to the schema and procedures rehabilitation ongoing.”

More or less clear that the required extension of instrumentation rehabilitation of the banks. In particular, we discuss the connection to the readjustment are not credit institutions and directly to individuals-large depositors and large corporate owners of non-financial assets (so-called scheme of Bail-in). And, of course, you want to dramatically improve the transparency of remedial procedures. Pavel Samiev considers that it is necessary to develop a system of indicators of efficiency of sanctions available for external quarterly monitoring. He did not support the objection Yuri Manolis of BFA Bank, which was considered a sufficient criterion of efficiency of rehabilitation of a return to fulfilment by the credit organisation of mandatory banking regulations. “It is necessary to establish a specific timeframe for completing rehabilitation with the achievement of intermediate indicators to avoid “perpetual reorganization”, – said Pavel Samiev. – Finally, the procedure for selection of the nursing home and its change in case of unsuccessful completion of the recovery should be public”.