Banks will help, if you have enough food

The Russians slightly more optimistic evaluate of your financial future: in the hope that will not be worse

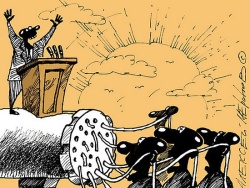

Photo: collage Darya shurupova/Banki.EN

OSM found that in the last month decreased the proportion of Russians who expect that next year their financial situation will deteriorate. Now their number is close to one third and to a quarter of the population. However, 41% of respondents say that they have enough income only for food. Banks.Roux asked the experts how these financial expectations of Russians will decrease the demand for banking products and services.

With the hope of “worse than ever”

According to a survey of Fund “Public opinion” (FOM), the Russians have become more optimistic attitude toward his material future. So, as of the end of February 2016 have reduced not only the percentage of respondents who believe their financial situation is bad (by 4 percentage points to 28%), but also those who believed that next year their financial situation will worsen (by 5 percentage points to 28%). The comparison was with January 2016.

In a representative poll was conducted among 1,5 thousand respondents aged from 18 years old from urban and 104 rural settlements of the 53 subjects of the Russian Federation. Interview mode face-to-face took place at the place of residence of the respondents. The statistical error does not exceed 3,6%.

Its good financial position currently hold just 9% of respondents, and average – 62%. It is logical that in Moscow the proportion satisfied with their position higher (13%), while in towns with population less than 50 thousand people and urban-type settlements – the smallest (6%). It is noteworthy that in the villages the proportion satisfied is 8%.

Beginning in January 2016, according to research FOM, there is a systematic reduction in the share of those who have enough money for clothes but not for large household appliances (40% to 34%). At the same time over the same period, the share of those who do not have enough money even for food (from 11% to 13%), and those who have enough money for appliances, but not on the car (from 14% to 17%).

Experts note that the Russians have shifted focus: they are not interested in major purchases as they focus on the Essentials. For many appliances and cars become a luxury.

The smaller the settlement, the more it is the share of those who do not have enough food (for example, in villages that 17% of respondents). The same situation with those who have enough food, but not clothes. But the option of “Money for clothes enough for large household appliances – no” is chosen most frequently in cities with populations of 50-250 thousand people (39%) and, surprisingly, in Moscow (38%) and in cities with a population of 250 thousand to 1 million people (37%). That can’t afford a car, the most they say the Muscovites (almost a third of the surveyed residents of the capital). This is often enough for the car to residents of major cities (this was stated by every tenth respondents in these cities).

Experts attribute this to the fact that the capital residents prefer and are used to buy more expensive cars.

Since December falls the proportion of people who feel that their financial situation has worsened over the past two-three months, – from 51% to 46%. However, practically has not changed the share of those who noticed an improvement in their financial situation, now it is 6%. The deterioration is mainly seen in cities with populations of over a million people (53% of respondents) and improvement in rural areas (9%).

In General, the interviewed Russians are configured relatively positive year-to-date from 33% to 28% decreased the share of those who expect deterioration of their financial situation over the next 12 months, and increased the proportion of those forecasting improvement, from 15% to 17%. In General, the latter figure is growing since the end of November last year. To improve rely mostly Muscovites (21% of respondents living in the capital) and impairment – residents of major cities (34%).

“People are not stupid”

Banks.Roux asked the experts to comment on how consumer behavior depends on consumer expectations and what financial steps can we expect from citizens in connection with their financial expectations.

“It’s impossible to be in a state of pessimism and expecting the worst”

Natalia Pavlunin, head of Department of retail products of retail business Department Loko-Bank:

— It is difficult to see in the data the signs of optimism — 41% of our fellow citizens still report that income to them at best, enough money for food. Subjective evaluation of his position clients, as well as the behavior of the Bank customers rather indicate that an increasing proportion of citizens, reeling from the shock leaning economic difficulties and beginning to make efforts to maintain their financial well-being. Role play and psychological factors – it’s impossible to be in a state of pessimism and expecting the worst. Sooner or later, comes the feeling that the situation must change. The demand for banking products and services, obviously, depends on the economic status of the population and its confidence in the future. The more confident customers feel, the more active use of banking products. Now to retain good customers, banks have to work much more than before. Aware of this fact and choose good clients, than actively used in relations with banks. On the behavior of Bank clients in General influences the General economic situation in the country.

“In “fat” years, there is additional interest in investing in “skinny” — to the preservation of capital”

Mikhail Krylov, Director of the analytical Department of the IR “Golden Hills-Capital AM”:

— Assessment of the prospects of the economy by 80% correlated with decision making in the area of personal Finance, which determine the demand for banking services. If increases optimism, we are at the dawn of increasing consumption, at least in physical terms. Such movements in public opinion cause changes in mass behaviour in the economy. Of course, not every Russian citizen has the opportunity to invest money in the long run, but people are not stupid. If anyone consumer spending, and dominate not only saves, but also on the income, so it is usually employees of the offices of those same banks. Usually need loans. Their mood is very pessimistic, because in most large financial institutions noted a decline of interest crediting. And these people are likely to take 40-50% less loans in the next year.

Many office workers that have not moved in mechanics, welders and tilers, all of them save not only on major household appliances, and clothing. Is it good or bad, but the result is seriously complicated by the growth of Bank lending. But increased interest in microcredit, loans to paycheck. Conditions in this area at the moment are such that allow to make life easier for those who do not have anyone to take, and maybe even change the model behavior. Bank investment company asset management, is the relationship for a period of more than a year in which financial services institutions are always in demand. Remains open only the question of profitability and the range of such services. In “fat” years, there is additional interest in investing in “skinny” — to the preservation of capital. During the year, probably the emergence of new Deposit services related to investments in gold and silver.

“The Russians simply adapted to changing conditions”

Boris Lipkin, Chairman of the Board of Riabank:

In my view, the Russians simply adapted to changed conditions, the main one is the decline in real income, which confirms the official statistics. If in the past people frightened uncertainty associated with the sanctions, the sharp fall of the national currency, reduction in employment, over time it became clear that a General decline in the standard of living in General has not happened. Communicating with your customers, and this is mainly the owners and management of small and medium enterprises, I would not say that people have the feeling that we have bottomed and are starting to get out of there. Rather, there is an understanding that the policy of optimization of expenses, which all, without exception, conducted in the last year, gave its results — most managed to survive, but the speed dropped several times until it was not even about restoring the pre-crisis levels. What can we say about growth.

Of course, the public mood affect the model of consumption of almost all consumer groups — all begin to save, trying primarily to get out of debt and not taking on new loans, often wonder how to better preserve savings from inflation.

For the low-income people has increased the share of expenditures on food and housing. Accordingly, it is not up to clothes and other consumer goods. People with average income is not so strongly felt the price increase on products, and “inclusive” economy mode helped them to leave more money on more expensive purchases, but rather for saving. This is evidenced by the statistics on deposits (they increased), and momentum trading (they fall).

“The demand for most banking products remains limited”

Stanislav Duginski, analyst at home Credit Bank:

— The demand for banking products is mainly determined by the dynamics of population incomes. The correlation between consumer expectations and the dynamics of disbursements of new loans is not so pronounced. That is, people can be expected to improve their welfare, but also to show a natural care in obtaining new loans.

Overall for 2015, according to Rosstat, the decline in real wages amounted to 9.5%. According to preliminary estimates, this year this indicator can range from minus 3% to minus 4%. The main impact on this will have a gradual slowing down of the inflationary impulse from the devaluation of the ruble and some nominal wage growth (around 5% at year-end). In these circumstances, the demand for most banking products remains limited. In addition, the supply side restrictions – banks have very carefully selected new borrowers to maintain the quality of their assets. An interesting observation in this situation is to switch the population’s demand for more affordable product categories (consumer electronics, mobile phones) and the simultaneous surge of interest in POS-crediting in the respective segments. Considering all these factors, in 2016 we can expect some better dynamics than issuance of new loans, thanks to which the slowdown in credit portfolios is not as significant as in 2015. But at the same time, the demand will continue to exert its influence on this market.

“Our clients generally don’t panic because of the crisis”

Igor Volkov, the President MFX Group financial holding:

Financial markets react to the crisis differently than, for example, markets for food products. In the crisis of 2008, the turnover of brokerage companies has increased significantly, as well as increased customer base. This crisis showed a slightly different result — this kind of explosive growth in our segment has not occurred, but also churn has not happened. Our clients generally don’t panic because of the crisis, they are looking for opportunities how to make money. The overall consumer sentiment in Russia do change. By reducing inflationary expectations and a relatively stable exchange rate of the ruble (despite significant fluctuations in oil prices), people have ceased to fear a possible deterioration in their financial situation. However, to speak about the restoration of living standards in Russia are premature. And the forecasts and the news that we hear, contribute little overly positive expectations. In 2016 is expected to further decline in real income of population within 3%, unemployment will grow at least 6.5%. In the socio-economic situation are now a paradoxical situation. On the one hand, rising poverty and the proportion of those people who don’t have enough money even for essential goods (official poverty in the country exceeds 16%). However, on the other hand, an increasing number of those who earn more than the average. As a result increases as the proportion of those who can purchase durable goods, and those who cannot even buy food.

The direct relationship between consumer sentiment and the demand for loans and other banking products exists: the better consumer sentiment and activity in the economy, the higher the demand for such services. But there is a reverse effect — when people expect to be worse, they begin to stock up for the future through various financial instruments, including Bank loans. Indicative was a recent situation where an increased number of loans for home appliances. People expected it to be even worse, and went to the stores to buy what was sold at the old prices, using borrowed funds. Consumer focus really shifted. And obviously, in a crisis well will earn those who do “goods and services” for the poor.

Anna DUBROVSKAYA, Banki.ru

Source: Banki.ru