Russia will be the company’s sixth loss of all savings

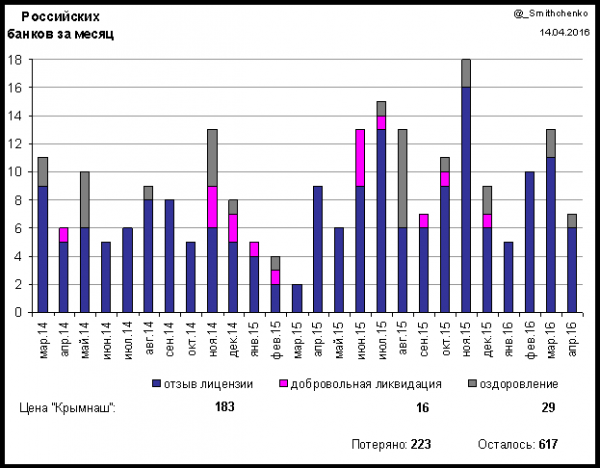

So, in the first quarter of 2016 fell 28 Russian banks: 26 were denied a license and another two translated in a mode of financial recovery. Impressive is not even the extent of bankomata, and its regularity – almost every week announcing the revocation of the license of the next 2-4 banks.

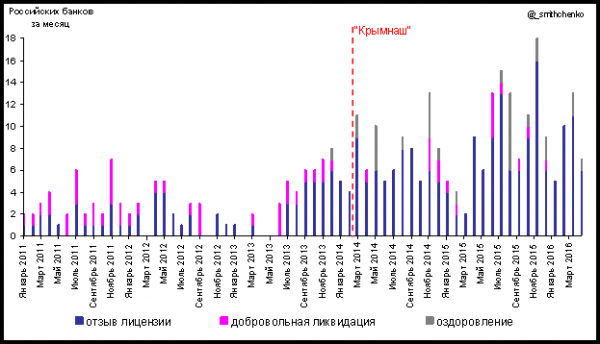

And this situation in Russia has continued for two years. Since the beginning of the Crimean adventure and its associated troubles, Russia is losing on average by 9 banks in the month! Graphically, the price “Kriminala” and subsequent ugly Russian actions looks like this:

Before Putin fancies himself a Napoleon, but refused hospitalization, banks in Russia also fell, but much gentler pace: 2-3 not a week and a month, and then not in every. For example, for the entire first quarter of the last peaceful year, 2013, were deprived of their licenses in just two banks. And for the first quarter of 2016 – as much as 26! During the first two weeks of April 2016 fell more banks than the whole of the second quarter of 2013 or 2011. Etc.

In this case, more than two hundred recently chip banks new skates do not come at all: after September 2014 in the Russian Federation there were no reported! Since the establishment of the Bank – the process is delicate and stretchable somewhere for six months, it turns out that banking business in Russia completely lost its appeal at the very moment, as in the Ukrainian Crimea appeared the first green cocoloba.

From over 30 banks passed over the last two years “for improvement”, yet saved none, but a few have “get healthier” to compulsory liquidation. And for 2014-2015 for the rehabilitation of banks was transferred much more than in the previous decade! We have here, we are simply postponing problems for later. And given that the “recovery” of the send medium-sized and large banks from the first-the second hundred on the size of the liabilities, the problems are considerable.

Regularly capitalise banks – the best, most clear proof that the Russian economy not only started growing, but have not even reached the “bottom” and clearly continues to fall further. And Bancomat both a consequence and cause of economic peak: coming out literally every week news about another portion zavernuvshis banks lead to the flight of deposits and their relatively healthy counterparts, Val and destroying the remnants of the Russian economy any credit. Such here dialectics. Once the rubble Bank weakens and at the same time Russia shows its weakness. It is possible to draw statistics can be interpreted differently by facts, propaganda can issue a defeat after a big win, but will not ignore the depositors, which another Bank has ceased to return their money. Against mathematics, Holy smoke, not trample!

From the graphs it is seen that becopad gaining momentum. So, in I quarter of 2016 to Valhalla, took 2.5 times more banks than in the first quarter of 2015! This year I’m expecting somewhere 150-170 rubble banks and that under the most optimistic (for Russia) scenario. If at the time of writing this text (April 14), for 105 days of the year were of distressed banks 35, elementary the proportion calculation takes us on 123 the Bank for the year. But then there is the seasonal factor! If sleepy in the first quarter of 2016 fell 2.5 Bank a week, what will happen in the autumn, when traditionally the increased economic activity will draw out all the problems?! Even if you predict the further situation purely mathematical methods, banks in Russia will be completed by the end of 2018 (during the two years the Federation has lost more than 200 banks and yet there were 617 conventionally “healthy”; it can be assumed that in 2016 she will lose 150, in 2017 – 200; in 2018 – will be stripped of the remaining).

However, this mathematics is too primitive a tool to predict complex dynamic processes. Here again the dialectic: the more falls of banks, the more it scares the investors and they take the money EN masse from banks is still healthy, guaranteed Valia, thus, and. Let me remind you that the most strong Bank without massive financial support from the state would not stand a single outflow even 10% of deposits. However, the Central Bank will not be able to come to the rescue of all banks at the same time – he just did not have enough money for this noble, but a deathtrap! The Russian budget now, in conditions of low energy prices, is somewhere at 60%, that is from here does not need to wait the bailouts, and more problems for them! The RUB, of course, you can print out, but what about the national currency?! To understand the scale of the amount in circulation is about 8.5 trillion cash rubles, while the total debt of banks under 53 trillion (including 16 trillion – deposits of individuals), of which 40% is denominated in hard currency. It is clear that exchange rate jump will cause a further outflow of deposits and the need for a new printing of money that will hit the exchange rate, triggering the next round of panic and shock dolgopiatova… and Zimbabwe isn’t far. Also because the country decided to wrestle with the entire civilized world – and quickly transformed its financial system into a joke.

Global financial institutions also will not be able to help Russia. The entire resource of the notorious IMF, which, in theory, should be used to support several dozen countries, equal to about one-third of a trillion dollars. This is comparable to the exchange (only exchange!) obligations of the Russian banks. That is, the IMF will not be able to go significantly to help Mazarache even if you turn aside all your other programs (and they still try to break!). Russia is too big, so it can be saved from itself. It’s not Ukraine that can be kept afloat forever, tossing on a miserable billion or two per quarter!

Therefore, surprises in the form of a self-sustaining banking panic in Russia and is possible earlier than 2018, for example, this fall. Moreover, in my prediction, if Russia over the next six months are not fully reconciled with the US (Ukraine) and will not receive international emergency assistance in the form of an expression of deep concern for the lifting of sanctions, full-scale financial and banking collapse at Rossiyskie guaranteed to come in winter 2016-17!

It should also be noted that hand in hand with the panic of depositors is usually the bankers panic: once you start to smell roasted, the most fearful are usually rushing to get out of its banks all of the remaining available funds in the offshore, while the depositors are not sold out. The Bank, of course, falls. This is financial suicide for selfish motives, which obviously does not add optimism to the market but adds to the workload of Interpol.

The effect of General banking panic will inevitably be a moratorium on repayment of deposits, restrictions on purchase of foreign currency, loss of confidence in the banks, even the state, and the full, long-lasting financial collapse on 1/7 of the land. Given that the Russian banks to enterprises, population and international institutions about ¾ of a trillion dollars – four annual Russian Federal budget, the panic will not be able to repay any government or international bailouts, and it must be countered by administrative measures (“freezing” of deposits, conversion of foreign currency deposits into rubles at a reduced rate, the brutal executions of crowds of pensioners extremists, etc.). That decade will destroy any trust towards the Russian financial system. However, all this could have much more serious consequences than just the tears of deposition.

Here recall dramatic experiences of Albania, showing how important it is for social stability, the welfare of depositors. In 1997 there suddenly fell a number of financial savings of companies and significant percentage of the population lost their savings. The country started riots and revolts, merged into one full-scale rebellion, the army moved to the side of the people, the government was quite helpless, were all looted weapons depots, etc. Holiday of disobedience escalated into a uniform chaos, which killed and injured more than 5 thousand people; criminal gangs took control of entire cities; famine was threatening. The action managed to stop only by entering into the country many thousands contingent of the Italian army.

But I’m dreaming… But maybe not, if you remember, what was goin ‘ on up recently on the Moscow exchange the food. But in Russia, thousands of times smaller than the number of depositors! While collapsing small banks and their depositors after some time receive compensation (up to 1.4 million rubles – $20 thousand), the system seems to be holding up. But what if you just crash one of the whales – Sberbank (10 trillion rubles), VTB 24 (2 billion), Gazprombank (0,6 trillion), Rosselkhozbank (0.5 trillion), etc.? And there will be a lot of noise, and compensation will not save enough! By the way, by the end of 2015, the Bank reported a net loss of 69 billion rubles, Gazprombank – 34bn, etc. 35 Russian banks showed losses of more than 1 billion rubles each (total of about 0.5 trillion). The loss for the Bank is always an emergency, because they force the Bank to deal out, turning it, in the end, in a pyramid scheme. But if the Bank even shows a loss in the accounts (and he usually has dozens of relatively honest ways some time to pull such a shame) – it means that the situation is almost hopeless.

Now, 7 April 2016 in the Moscow region the training was conducted by the newly formed Rosrazvitie dispersal events. Fake “protesters” were shouting extremist slogan “Return our money” (30 seconds), that would hint at how they see further developments well-informed power…

What is happening in the Russian banking market Pro-Putin “experts” are sometimes called “clearing the market”. What else can they do, poor guy but to reassure passengers of the “Titanic” crazy explanations like: “meeting with an iceberg was”, “not see that the nose under water, the situation is completely under control”, “boat we launch to roll ladies”, “as soon as you reach the bottom – right will start to emerge, blub-blub-blub”, etc. Type, nothing, it’s all a cunning mnogohodovok, it is a normal process, get rid of the weak and scatty. But this biological analogy is totally inappropriate. The rubble ended in quarter 28 (TWENTY EIGHT!!!) after all, banks have managed to survive in adverse economic conditions as much as a year and a half, so not exactly call them absolutely hilakari. It is clear that still live the retired banks stronger, but are they sufficiently strong to survive the subsequent events? After all, the situation in the Russian economy is getting worse literally every day – and without any hope for improvement! So social Darwinism is possible, without financial sector remain, falling straight to the middle ages or military communism! The fact that Russian banks are falling packs, talks about the deep and systemic problems: the large banks they are clearly the same as that of the discarded mass of small and medium (non-payment of loans, Deposit outflows, corruption, unprofitable activities, etc.). Just big banks, as “Titanic”, after the holes in the balance sheet can for some time romantic to stay afloat, to the delight of the passengers in the ballroom… And then he Celine Dion with mournful “Every night in my dreams I see you, I feel you…”.

Also keep in mind that a quarter of its banks for two years Russia has lost in terms of full political stability and strong power! In Russia while there is no mass protests, no local armed conflicts, and no change of political elites; the population still blindly believe the authorities and, thanks to total control over the media, far from realizing the hopelessness of her economic situation. But what will happen with the remnants of the Russian banking system, if, or rather when, you will start with all of the above?

For bankomatom in real time can be seen in my Twitter: @_Smithchenko.

Comrade, remember, familiarizing with the content of this article as a lot of their Russian friends and relatives, You will not only save their savings, but also will bring financial Apocalypse on the Russian Federation!

PS “Got these armagedonik! Russia is too strong, big and rich, like the blue blow up your financial system!” – say the critics. Well, let’s look at the situation in a historical perspective. Take the last 100 years – for most of this period Russia/USSR was even bigger, richer and more powerful, but it is the size and ambition used to play against her! Now, during this time the Russians have almost completely lost their savings entrusted to banks and the state, somewhere 6 times. And every time a reasonable, careful or simply a well-informed minority withdrew their savings from the blow, while the majority confidently said to myself “this just can’t be” and then went to suck a paw, if not worse.

I. 1914-17 years. As a result, not very successful participation of the Russian Empire in the First World war (which she, by and large, and unleashed), domestic prices in 2.5 years has increased four times symmetrically depreciated paper money and Bank deposits. Coins made of precious metals (the main hard currency of the time) simply disappeared from circulation. Moreover, gold was forcibly removed from the government immediately after the outbreak of war, and silver, down to the smallest, desyatiletnij, coins were stashed away the most far-sighted citizens in full accordance with the Law of Gresham. So much so, that patched a population of small coin from 1915 had to be replaced in the treatment of special papers and stamps with an inscription “Has circulation on par with silver subsidiary coins”. From such an interesting life cheerful Ukrainians composed songs such as “Kolis boules srbn money – now Sam brandkolis boules Garn boys – now Sam smarky”; but the stern Russians freaked out and made the February revolution. However, this was just a warm up for the upcoming nightmare.

II. The years of 1917-24. After “great October Socialist Revolution”, the Bolsheviks, in accordance with the precepts of Marx, nationalized banks and confiscated deposits. But for some reason this has not helped to improve public finances, on the contrary – things have only gotten worse. And to plug budget holes, had to start printing paper money in an absolutely unimaginable scale, constantly increasing the value of banknotes. In 1921 was released a banknote of 10 million rubles, then in order not to frighten the working people in large numbers, was carried out denomination, and then another, and another… Inflation for 7 years was measured in the trillions of percent! What happened to the remains in the Bank, I think, no need to explain?

III. 1924-30 years. You’ll laugh, but again the population was divorced! In 1924, to normalize circulation after years of hyperinflation, there were issued silver coins (up to and including the ruble) and the new Treasury notes, exchanged for the silver. Also in parallel to the RUB circulation banknotes were launched-”the money”. Contrary to popular misconception, these gold coins did not equal ten rubles (the exchange rate was floating), but gold coin could be exchanged 7.7 grams of gold. But only theoretically, because the exchange was postponed for an indefinite, but very bright future… in short, people are seduced by the money, believed in new rubles, began to invest in banks and government bonds – and then all went splat! The exchange of chervontsy for gold never took place, and the silver coins in the early 1930s was fully removed from circulation, leaving only the Nickel and paper. By the way, here Moscow successfully used the famine: in 1933 a special state trading was offered to the starving peasants to buy food for patched silver and gold coins (including the Tsar), but not for the Soviet papers.

As for paper money, they are for the 1930s depreciated in 6-10 times. In the same period, from workers compulsorily demanded a significant portion of his salary to invest in government bonds (usually 20 years; life expectancy 45 years not everyone could enjoy the spending of savings). Eventually, every Soviet citizen these bonds was “Yak fantic the fool” (many optimists still keep in their family archives). These savings initially rapidly depreciated (bond yield – 3-4% per annum was significantly less than inflation), then in 1947 the “wrappers” were forcibly exchanged for new ones with a 2/3 loss of value and extension of time, and in 1957 the state decided for them not to pay! Type, communism is soon, why do you need money! And say thank you for not shot!

IV. December 1947. To normalize commodity-money circulation (razblokirovanie in the 1930s), to remove chronic shortages and ration cards, had to deprive the population of the greater part of savings. Comrade Stalin was robbing banks even before the revolution and didn’t seem worried about the ethical side of things. Stalin’s confiscatory monetary reform and related investments in the state savings Bank: deposits of 3 thousand (six-month average salary) were cut by a third, more than $ 10 thousand (the equivalent of one thousand rubles of the Brezhnev era) were forcibly reduced in two times. However, with the state bonds it was even worse – there loss was 67% -80% of face value with a simultaneous increase in term loans (many of the editions were repaid only after 40 years under Gorbachev). But the cash was exchanged with the loss of 90%! Instead of rebel, Soviet citizens came to the conclusion that the savings Bank the most reliable way to store savings: if anything, the government will select the least! Wrong.

V. In the Restructuring of the relationship between money and commodity weight was finally broken, and within three years the shelves emptied in the truest sense of the word. “Pavlovskaya” confiscatory monetary reform (January 1991) included restrictions on the withdrawal of deposits in the savings Bank (other banks for the population in fact was not) 500 rubles per month per person. In parallel, the ruble began to fall rapidly, so it is guaranteed burned nafig all deposits over those miserable couple of thousand, which the investor could theoretically withdraw and invest in goods stood a fantastic line. This was the third direct confiscation of Bank deposits in Russia in 74 years.

VI. In the “dashing nineties” Bank deposits formally, no one confiscated, but with this task brilliantly mastered once again by the raging hyperinflation. The Russian ruble over the decade has depreciated somewhere in 3000 times, in 1998, had to change the banknotes, taking with them three zeros. (By the way, if we consider all monetary reform and inflation, from 1914 to 2016, the ruble has depreciated somewhere in 50 quadrillion times). That is, the correspondent Bank “savings” were not kept very well. With foreign currency deposits was slightly better, but the commercial banks fell regularly, and the Deposit insurance system is not yet implemented. For 24 years, from 1992 to April 2016, ceased operations 2.458 Russian banks (the main Bancomat occurred in the 1990’s); left on 646 today (including “ozdoravlivayuschim”). Good Russian roulette with a probability to survive 1 to 4!

Conclusion. Every difficult period in the history of Russia/USSR necessarily lead to the loss of the most part of cash and Bank savings of the population. But now, thanks to the economic war with the entire civilized world, the Russian Federation has entered a new heavy (possibly final) time in their history! And if even such a prominent (in the opinion of the majority of Russians) to the Manager, like Stalin, at the peak of military and political might of the USSR had to deprive citizens of almost all their savings, what can we expect from round loser Putin?!

*****

from the comments  smithchenko:

smithchenko:

So, sooner or later (by the end of this year, according to my most optimistic estimates) the problems will probably manifest, and large Russian banks, including the largest, Sberbank. And I have a theory that before that event the son of the third (second?) officials of the state put there, to the Bank to finally undress, that is to bring out the maximum assets in favor of Putin’s gang team, while there still is, that output.

The press described that the functionality of Sergei Ivanov will include “established in 2013 “wealth Management”, which is to combine insurance and pension plans, services associated with asset management for both individuals and for legal entities, Depositary, broker services and a number of other areas”. In the “asset management” and other brokerage is exotic, scopate in importance, is clearly unworthy of the position “senior Vice President”. That is, there is apparently something muddy. But in any case, be one of the first persons of such a colossus as “Savings”, without having any experience in banking it means a little ditch Bank. However, Sergei Ivanov have experience on the Supervisory boards of Rosselkhozbank and Gazprombank. Both banks are very large (6-7 and third place in terms of assets), both state. And both just hopelessly losing record (by the end of 2015 the total book loss of more than 100 billion rubles; the real, surely, about five times). While the main task of the Supervisory Board in order to avoid losses! In short, not very good this Ivanov banker, if you look at the results.

Thus, the need for Russians to mentally prepare for the next, sixth in the last hundred years the loss of their savings. In Sberbank, by the way, account for a third of Russian deposits, and when trouble starts – the Russian Federation will remain without banking sector in General.

Originally posted by  smithchenko at Bankomat in Russia: the results of the quarter

smithchenko at Bankomat in Russia: the results of the quarter