Debts on mortgage loans soaring, but the banks are not in a hurry to confiscate cars

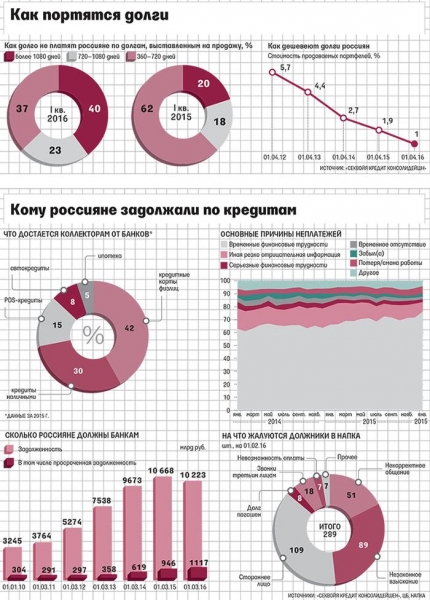

The fall of incomes of Russians provoked problems with the servicing of loans. Now every tenth auto loan is problematic with the term of delay of 90 days. This is stated in the research company “Sequoia credit consolidation” (“News”). But take away the credit cars banks are in no hurry, preferring to refer autogage collectors. Moreover, the debts are much “younger” lately.

According to “Sequoia”, on September 1, 2016, a delay of Russians on auto loans reached 82.5 billion rubles. With the beginning of the year increased by 20%. Of the 1.4 million issued to citizens of loans 10% are problematic, on the same date last year the figure was 7 percent. All, according to the President “Sequoia” Elena Dokuchaeva, 200 thousand of the overdue loans of the 1.4 million active, and this figure takes into account all the loans with payment delays for a period of one day.

In the total volume of overdue retail (896,7 billion rubles on July 1, 2016, according to the latest data of the Central Bank) in arrears loans takes almost a tenth. The owners always had a high payment discipline, because the loan on the car is the collateral, but the crisis has gotten to them.

— In 2014, autothermic went out on the first late payment in 18 months, in 2015 — after 16 months, in 2016 — a year, — said Elena Dokuchaeva.

As explained by President of Sequoia, this contributes to a decline in real income of Russians (by 4.4% yoy, according to Rosstat), as well as continued high levels of over-indebtedness (in 2016 on single borrower accounts for 1.8 of the loan, in the past year — 1.7). Rates on car loans remain high — especially in comparison with the cost autocad abroad. Rates on car loans in the United States do not exceed 4% in Germany and 5.5% in France rates on car loans is 5-7%, in Russia — 7-26% per annum.

Growth in overdue loans in the loans segment due to the fact that on the background of reducing the volume of the market is “aging” debts on loans issued in 2012-2013, when banks have practiced a more liberal credit policy, — said Elena Dokuchaeva. Now, many lending institutions have changed the strategy of issuing, and the quality of the portfolio of the “young loans” has improved markedly, but their number decreased.

And profsystem began to receive debts at an earlier period of delay.

— It enables collectors to work not only at the stage of collecting the full amount of the loan issued, and return borrowers to a schedule of payments, preventing a default and keeping the client for the Bank, — said the President of “Sequoia”.

The fact that banks do not want non-core assets on the balance sheet is a burden on capital. Storage of seized autosaloon entails additional costs, which is also impractical in a crisis. In turn, for customers loss not always loss of personal transport and the need to look for other options of transportation. Avtozaemschikov lose all interest paid and deprived of the opportunity to use your car including for commercial purposes, for example to work in taxi services. Therefore, parties are easier to negotiate.

— It is unlikely that customers should expect some aggression from banks, especially as we are talking about that type of lending where the collateral is provided, — said predpravleniya Bank “Ugra” Dmitry Shilyaev. — In the case of loans Bank customers are usually much more creditworthy, significantly less than the number of scams, and always have the option of removing the vehicle.

Head of Department on work with problem debts of the group and Joined Sergei Golets says that the credit organization is not interested from the first days of delay to foreclose on the car and all efforts to try to repay the loan within the payment schedule.

Only if this fails, banks are beginning actions for repossession of car, — said the representative of the Bank. — First credit organisations try to convince the borrower to voluntarily sell the car and the money to repay the debt. If this fails, creditors go to court and the courts sell the car.

Sergei Golets noted that in the case of voluntary implementation of the credit machine, the amount of redeemable debt is higher, and the implementation in the courts, usually strongly stretched in time (which the car loses a significant portion of its value). Thus, the expert advises avtozaemschikov not to bring the process to the court: if you cannot repay the loan it is better to sell the car yourself and release maximum funds to cover the debt.