The world financial elite wants to use SDR as the leading global reserve currency in the near future. Before the meeting of G20 Central Bank governors and Finance Ministers in Chengdu, China, 22-23 July, some scientists have started to push the idea of widespread use of SDR (currently worth $ 1,39).

The so-called special drawing rights (SDR or SDRs) created by IMF based on real currencies: the Euro, the yen, the dollar and the pound sterling.

“The establishment of the SDR as the leading global reserve currency will have far-reaching beneficial consequences,” wrote Jose Antonio Ocampo, Professor at Columbia University, Project Syndicate, 8 July. — This will allow more active use of SDRs in IMF programs, the government could issue SDR-denominated bonds. Additionally, private banks can increase the use of this currency, as well as some European banks used the so-called European currency unit (ECU), helping to pave the way for the Euro.”

The IMF supports the idea

The IMF on July 15 published a document which States that “expanding the role of SDRs could contribute to the normal functioning of the international monetary and financial system”.

Private corporations could issue bonds in SDR, and banks to lend in SDRs or use a special market version of the M-SDR.

The IMF has experimented with these M-SDR in the 1970s and 1980s, when banks had SDR deposits by 5-7 billion and the company issued SDR bonds at 563 million . This is an insignificant amount, but the experiment showed that the concept works in practice.

After the G20 meeting, July 25, Deputy Director of the International Bureau of the people’s Bank of China Zhou Juan said that the international organization on the development of Asian Infrastructure and Investment Bank (AIIB) could issue SDR bonds in China at the end of August, according to Chinese newspaper Caixin.

Zhou said that “the SDR-denominated bonds should be attractive to formal investors in a preliminary stage, since they can provide a variety of investment products and the depreciation of the exchange rate and interest rate risks”.

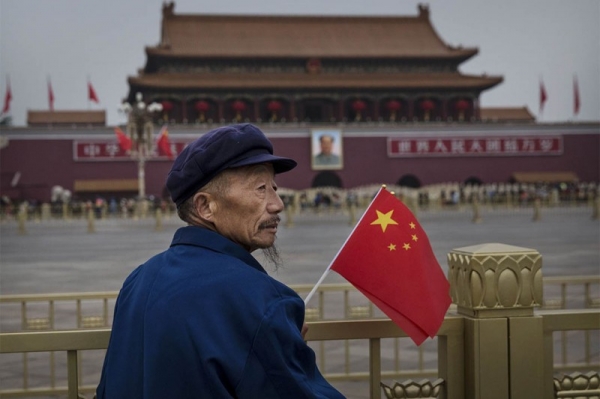

China openly called for the use of SDRs to replace the dollar as the world reserve currency. “China is pushing for widespread use SDR, is a way to challenge the dominance of the dollar without pushing the yuan as a direct competitor,” said Reuters,” Julian Evans-Pritchard, China economist from Capital Economics in Singapore.

The IMF made the analysis and came to the conclusion that SDR-denominated bonds would reduce the volatility and risk and also reduce costs. “M-SDR can therefore be attractive to investors and issuers as a way of diversifying,” writes Fund.

A good solution for China?

The use of SDR, will allow domestic Chinese investors to buy domestic SDR bonds with a significant foreign currency component, this will help reduce capital outflows that have grown in the past 18 months, experts say.

If Chinese investors can buy bonds or other debt instruments in the SDR in China, they will not engage in smuggling gold across the border in Hong Kong or to buy Italian football clubs.

China lost $ 676 billion only in Beijing in 2015, and currency reserves are approaching the critical level of $ 2.7 trillion ($ 3.2 trillion). According to the IMF, which is the minimum needed to sustain the economy.

The IMF in mid-July, said: “M-SDR, issued in the onshore market in China may reduce the demand for foreign currency and reduce the outflow of capital, allowing domestic investors to diversify their currency risk.

Of course, China, IMF and global economists will meet many problems during the implementation of its plan, including the absence of a clearing mechanism and liquidity problems or simply a lack of demand for extra product that nobody knows or understands.

Unnecessary because Central banks and other financial institutions have already launched their diversified currency portfolios and do not need the IMF to decide what is more suitable for their own needs.

There is no demand for this product because it already exists over forty years and was not adopted by private players. Calling for its wider use only government officials, Chinese state-owned banks or state-controlled international institutions that are unable to make independent decisions.

However, such problems never stopped neither the IMF nor China.