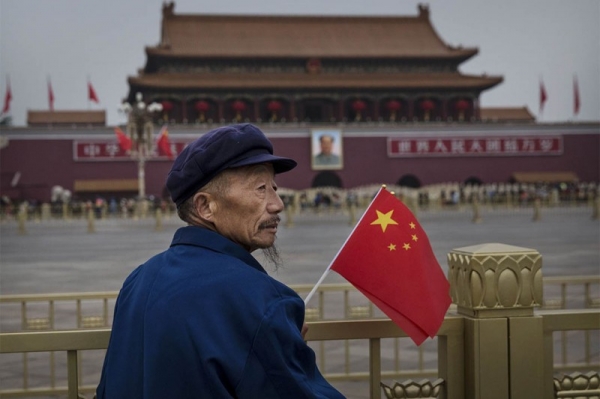

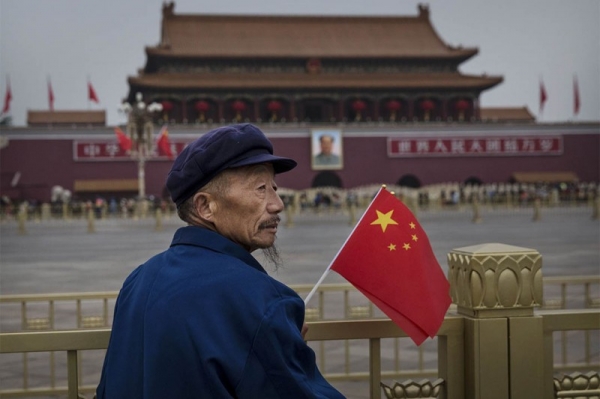

Around since 2010 in the game “China against the world” and he loses the whole world. In this situation an illustration of what is happening – the Philippine President, shows a different finger and said obscenities to the address of the American President, and simultaneously enters into an agreement with the old enemy in China.

What is the “Chinese power”? That at the stage of reorientation of the economy toward exports, China has killed the low prices of many competitors. In dollar terms the cost to the Chinese counterparts captured the hearts of not only consumers, but manufacturers are quickly transferred to China their production. (For example, one of the ideas trump the return of plants in the United States, not to give “blood jobs” to the Chinese).

The volume of production has allowed China not only to survive in the harsh conditions reduce the value of its currency, but to increase our reserves in dollars and that is very important – gold.

The insidiousness of this power is that the possession of relatively large reserves of gold and currencies leads to undesirable strong influence on the other members of the financial turnover; all processes that affect the Chinese economy will have a Domino affect world markets. Total debt (total debt) of China is very high. At a relatively low state debt, Chinese banks and corporations owed more than $ 28 trillion dollars, that is a record 237% of GDP, higher than the US or Germany. These debts led to the outflow of capital and reduce investment activity. Not catastrophically, but still. The outflow of funds led to the fact that the Chinese yuan started slowly and then not so quietly to decline against the dollar. In addition, due to problems with exports, China had to support the devaluation of the yuan, which led to even more capital flight. This may increase the already considerably a bubble in the Chinese real estate market. The fact that in China there is a huge boom in apartments in big cities, they are bought at the stage of projects (!), but due to the expensive lands are risky. But in smaller towns, entire blocks are empty – and the developers have nothing to pay with creditors (here it is an example of education debt). The depreciating yuan could including pulling down property prices, which would encourage the formation of more bladder. To prevent this unfortunate outcome, China began to spend its reserves to stabilize the exchange rate. And when China starts to spend their resources, markets begins to sausage.

Total: to boost exports, China had to reduce the value of the yuan, and to maintain your investment and peace of mind in domestic markets – to raise it. Chinese foreign exchange reserves have fallen at a record rate in August 2015. According to Bloomberg, they declined to 93,6 billion dollars to 3.56 trillion. The Chinese government, using a flexible peg of the yuan to the U.S. currency, made weaker for three and a half percent, which was unprecedented in scale devaluation over the last 20 years. Prior to this, Chinese foreign exchange reserves has steadily increased in the last 35 years. In the early 1980-ies they made about $ 3 billion, and last year reached a historic high of $ 4 trillion.

In early March 2016, the International rating Agency Moody’s took the decision to downgrade the Outlook on the credit rating of China from “stable” to “negative.” But it is worth noting that Moody’s is a private structure of wall Street, so his actions are often the fiction for the game on the market. However, the processes which were launched by China, is gaining momentum. Instead of reducing the sale of stocks, China it has increased. And sold out now nothing like US Treasury bonds (about the fact that Moody’s private structure – it is already written).

Last month China sold by the Central Bank of US $ 33 billion. It can be assumed that this is what is covered by the devaluation of the yuan. But this is only one of the reasons. As, for example, and Saudi Arabia, which sold the same securities for $ 3.5 billion, because there is nothing more to compensate for the lack of money due to cheap oil, and because the CSA warned that it is not necessary to adopt a law on 11 September.

By the way, Russia also reduced their investments — $ 700 million to 87.5 billion. But 700 million is not a value that can greatly affect the value of any currency, so this point cost lowered.

Can you talk about that China is drowning US and the dollar? Probably still too early. As there is no point in talking about what China sells us debt is the main US debt to China in gold, and it keeps the States for, I’m sorry, causal space. But China today is trying to eliminate artificially created a shortage of dollar in the market, to exclude the possibility of not only strengthening the global currency, but also to reduce risks for their domestic markets. What is Beijing doing?

First, it celebrates the inclusion of the yuan in the basket of reserve currencies of the IMF. (We are talking about a basket of currencies, based on which is calculated the value of special drawing rights (SDR) of the IMF. This is a payment tool that produces the IMF and which is not traded in the financial markets. SDR are used for calculations between the Fund and its members. First of all, in the SDR, the IMF gives loans to countries that suffer from the crisis. The composition of the backing basket and rate of the SDR, the currency in which will receive assistance country.) Because it allows him in the future, not only to avoid losses when trading dollar transactions, but also to flood the world with their money. Experts Goldman Sachs believe that in the conditions of outflow of capital from China “more and more money leaves the country in yuan, not dollars”. But the yuan is by definition much stronger than the dollar, as the yuan is on the production, and the dollar – speculation, fraud, and rotten wall Street. The other reserve currency, the IMF is the United States dollar, Australian dollar, canadian dollar, Euro, yen, sterling and Swiss franc. The yuan will have a weight of 11% to 42% in the us and 31% in European currencies.

Secondly, the Deputy Commerce Minister of China Qian Kamin at the Economic forum of the Shanghai cooperation organization (SCO) said about the need to create a free trade zone to facilitate regional economic cooperation between the countries-members of the organization. Qian Kamin called for greater coordination and greater transparency of policies of cross-border investment and stressed the desirability of protectionism. And thirdly, the BRICS countries, including China, insisting on the necessity of calculation in national currencies, which reduces demand for the dollar and lead to its weakening.

Thirdly, China had a unique chance which can efficiency to compete with GDP. “New silk road” and “Maritime silk road” is a large – scale logistics projects, to enable them to capture monopoly on transportation. For three years, China did not hesitate captures this way and it even has insurance in the form of Edge-channel (via the Malay Peninsula of Thailand), which connects the Pacific and Indian oceans (cost – $ 25 billion). And when you consider that China has Gwadar (Asia, the port city in the area of the Strait of Hormuz) and soon to be naval base in Djibouti (Africa, the Strait of Bab-El-Mandeb), it is easy to determine the primary purpose of the Beijing – control over the transit from the Asia-Pacific region to Europe (https://regnum.ru/news/polit/2195021.html).

Now this is what yuan can do for our ruble. At first glance, his invasion of a great game is a positive thing. Still to play it will be on the decline of the dollar, make the “currency competition”, etc. But on the other hand, the emergence of such a currency, the Euro, is also supposed to make a difference in the financial life. But to live was better than just Europe, and that only those countries that were not American bombs, hinting at the undesirability of the idea of a second world currency. To make predictions on the effect of one theory to another is an ungrateful business. But if all-taki to try to play psychic and predict what will happen with the active suppression of demand for the dollar to replace it using the Chinese currency, the first thing, you should expect that our Central Bank would buy that dollar, so that our products remain competitive (and I remind you that we have a course on production and exports – we also want to be like the Chinese), and so the ruble is in danger of sinking. Yes, and that gas oil sold at good prices to the benefit of the budget, the dollar is at a 30 – well, not comme Il faut.

Another point. If the yuan strengthened, it is possible to expect some reduction of their exports will be more expensive than before. But at the same if our Central Bank will play in lowering our exports can rise, but that would be that, in such amounts and in the same competitive industries to sell. But if the revenues will be stable, then we will always be able to sell at least something produced in the public sector. For example, weapons. Okay, not only weapons and not only from the state sector. But light, textile, and what is most offensive – all that is connected with the plastic (in the country of neftedobycha!!!) we can’t afford. Here if you learn to stamp, for example, dolls and cars with Chinese speed – then, Beijing will be able to win (environment, profitability, labor and technology – this case is solved with a strong desire).

For those who are not willing to spend a lot of time on the text, the main conclusions are:

1. The Chinese yuan became the reserve currency of the IMF – which means that all operations on granting loans and financial assistance 11% is composed of currency of the PRC.

2. China is taking steps to reduce the demand for dollar to create a natural competition and strengthen its currency.

3. China has to face challenges and the forced devaluation of the yuan because of the need to support exports.

4. China is faced with the outflow of capital.

5. China awaits the emergence of the mortgage bubble.

6. China sells U.S. securities, but not the gold reserves – they are, on the contrary, increases.7. China in the future will be a logistics hegemony in the whole Asian region.

This does not mean you have to impose the yuan and the classics “remember this tweet.” This means that China scored on too much responsibility, got a lot of influence, but did not calculate the growth rates of consumption of their own people. If communism can defeat the structural crisis and to balance the domestic economy, he is not afraid “Moody’s” and their stupid ratings.