Photo by REUTERS / Mark Blinch

The technology of the blockchain may be the new wave, which is expected to create thousands of startups and their products have already attracted hundreds of millions of investor dollars

Just a couple of decades the world has experienced several technological revolutions. We went through the boom of the Internet, the wave of IP telephony, and now the global market is emerging on a wave of boom of Internet technologies in the Finance and banking products. New feature — technology of the blockchain. Her idea is simple — a decentralized database, the transaction validation which is carried out simultaneously by thousands of users. They confirm the authenticity of the committed database changes, so it was impossible to fake. The technology of the blockchain may be the new wave, which is expected to create thousands of startups and their products have already attracted hundreds of millions of investor dollars. Over the past two years invested more than $850 million, to investors in the industry there are banks Goldman Sachs and BBVA, stock exchanges NYSE and NASDAQ, payment systems VISA and MasterCard.

The number of players grows rapidly. Investors have already invested in about 200 companies, the largest round of investment has exceeded $100 million (the company 21.Inc), and development occurs not only in the field of bitcoin, based on the technology of the blockchain, but in the technology itself.

The technology of the blockchain has a set of characteristics, which originally had Linux as an open operating system or Skype, using Protocol Voice over IP.

The technology of the blockchain has a set of characteristics, which originally had Linux as an open operating system or Skype, using Protocol Voice over IP.

High reliability, communications infrastructure, low cost, decentralization and the full transparency of all operations is to make this technology popular in the traditionally conservative financial sector.

Anyone interested in confirmation of such operations? Of course, banks. They can use the blockchain as an alternative system of Bank payments SWIFT. The most famous projects in this area — almost Ripple with $40 million investment Bank and a consortium of R3, which creates a private blockchain. The last project was interested in more than 40 major banks, including Barclays, Credit Suisse, Morgan Stanley, Citi, UBS, Deutsche Bank, etc.

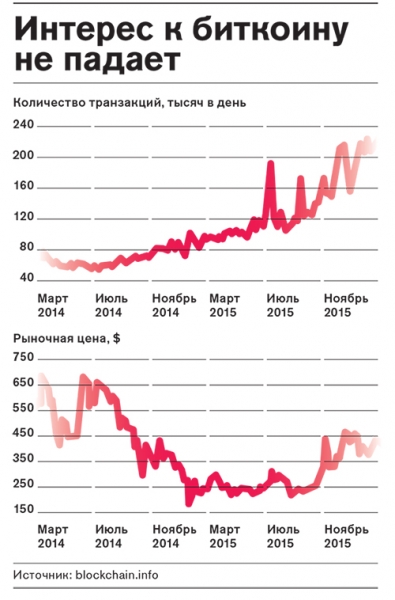

Also technology is used for micro – and mini-payments — this niche was not interesting to banks. The blockchain allows you to send a small amount for a small fee or even free. This would simplify the charge by the copyright holder for the content. The problem is not that mind paying 10 cents for the book or music, but the fact that it is so uncomfortable that it is easier to do generally, thus supporting the piracy in the network. Today for payments bitcoin is used extensively: for it is possible to buy a ticket in airBaltic, computer Dell or a Cup of coffee in a new York Starbucks. The number of outlets accepting bitcoins, and the number of transactions increases in waves. More than 105 000 merchants already accept bitcoin by the end of 2016, according to forecasts, their number will increase to 150 000. Now a day passes over 250,000 bitcoin transactions, representing more than a twofold increase since the beginning of the year.

<iframe id=”AdFox_iframe_852747″ style=”font-size: 14px; line-height: 1;” frameborder=”0″ width=”1″ height=”1″></iframe>

Another possibility for banks is the client identification system. For example, all credit institutions must follow the procedures KYC (“know your customer”), and the application of technology of the blockchain could afford to run this procedure only once. Verification and client tens and hundreds of banks participating in the system could automatically make it easier for other members of the system that uses the blockchain. There are many other operations for the technology of the blockchain, such as a securities transaction on stock exchanges and depositories, or those that require the transaction to be confirmed.

Banks are seriously interested in the blockchain technology, but their use can be much broader. One need only mention the possibility of using technology as an alternative financial system in the event of war or catastrophes. The system of exchange of rights of ownership in respect of assets and confirmation of their in the direction of bitcoin and the blockchain evolved in a very near future, and this technology can be applied to anything: stock, square meters or a barrel of oil.