Volume sold to collection agencies debts increased sharply.

Russian banks increasingly difficult to cope with the growth of overdue debts, follows from recent data from the National Association of professional collection agencies (NAPCA) and the First collection Agency. So they sell to collection companies more and more bad debts. But collectors and serious problem in order to recover its loans.

Last year, just 22 of the Bank for the first time became the participants of the cession market (the assignment of rights of claim under loan agreements). If earlier the credit institutions coped with the recovery largely on their own and only occasionally attracted collectors, but now they had to get rid of “toxic” assets, so they were forced to sell portfolios of delay.

— The increase in the volume of non-performing loans was one of the main reasons for the financial performance of banks last year. Due to the deteriorating financial condition of customers, almost all large retail banks last year showed losses, — says the analyst of PSB Dmitry Monastyrshina.

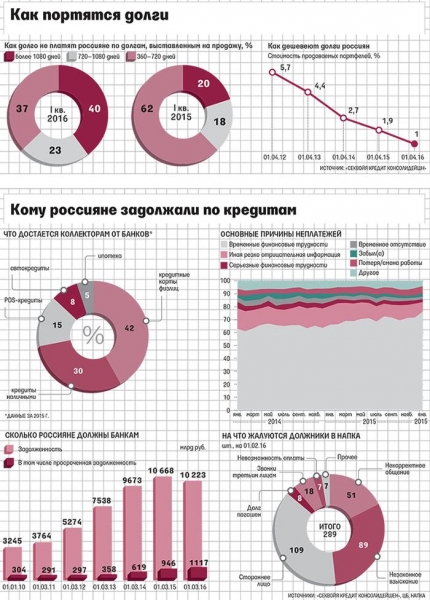

The expert also recalled that, according to the Central Bank, in 2015 the overdue retail loan portfolios in the banking system have risen sharply — by as much as 196 billion rubles and amounted to $ 864 billion (8.1 per cent of total outstanding to retail loans). At the end of 2014 the share of overdue loans in the retail loans portfolio was much smaller at the level of 5.9%.

In 2015 the cession market has passed 164 of the tender, the total amount of debt assignment by banks reached a record 0.5 trillion rubles (493 billion). In comparison with 2014 growth in the volume of transactions amounted to 68%. In 2014 assignment market increased by only 35%. According to NAPCA, for the first two months of 2016 have already held tenders for the transfer of debts in the amount of 50 billion rubles.

Deal with collectors are becoming less favorable for banks: in 2015, the collection companies were willing to pay for overdue debts in two times less than the year before. The price of the cession market began to decline in 2012: then collectors purchased debts and costs 4.4% of the rated portfolio, in 2013 — only for 2.7%, in 2014 — 1.5%. In 2015, the average purchase price fell below 1% (average of 0.85% of outstanding portfolio).

As before, the banks mostly sell to collectors debts of up to 20 thousand rubles (their share is 28% against 35% in 2014 of the total market), but last year, credit institutions were more likely to get rid of loans for substantially larger amounts, which collectors refer to middle and high debt levels.

In the segment with the debt level from 20 thousand to 50 thousand rubles share of sales increased by 4% and in the segment from 100 thousand to 150 thousand an increase of 3%. The ratio in the segment of most expensive deals has remained the same: only 11% of the market of the assignment of accounts for transactions from 100 thousand to 300 thousand rubles, only 5% of cases bankers sell debt in the amount of 300-500 thousand rubles, and in 3% — in the most exceptional cases willing to part with bad debts for the sum from 500 thousand to 1 million rubles. Only 1% of the assignment market has to deal with debts of over 1 million rubles.

Overdue portfolios sold by banks, becoming “fresh”, and the explosive growth occurred in sales of overdue debt in the segment from one year to two years: these debts now amount to slightly less than half of the assignment market. In the structure of borrowers-defaulters were mostly women, accounting for 55% of loans sold to collectors. A quarter of the debtors live in the Central Federal district.

However, the borrowers are not willing to pay for loans even under the pressure of collectors. According to NAPCA buyers Club, in 2015 became significantly less debtors that after the first conversation with the officer promised to pay the debt. By the end of last year, such assurances have been given only 25% of the debtors or their relatives, whereas in spring 2014 the successful (from the standpoint of collectors) contacts with the debtors was not less than 45%.

Is reduced and the amount of monthly payments. On average, the debtors of the leading banks have a debt from 10 thousand to 50 thousand rubles, and the delay for up to one year (and such the majority), now slowly pay your debts. Their monthly payments dropped by almost a third — from an average of 8 thousand to 6 thousand rubles. The percentage of those who, having had more than a six-month debt paid off in one payment, fell dramatically from 40% in early 2014 to just under 10% at the end of 2015.

According to General Director of the First Bureau of collection Paul Michele, almost 70% of debtors — people under the age of 45 years.

— The economically active population, which means good prospect of foreclosure after the debtor is released from personal crisis, he explained “Izvestia”. For more effective work of collection agencies, obviously will have to change their approaches to debt collection, said Michel.

— Many borrowers have more than two loans so the agencies will have to learn to consolidate different debts for a single debtor in one hand, he summed up.