instagram.com/domkadoni Former member of “the battle of psychics” and now host of the show “Dom-2” Vlad Kadono decided to get our own countryside housing — black mage bought the house in ten kilometers from Moscow on the Warsaw highway. Such direction Vlad was not chosen arbitrarily from a new mansion …

Read More »The metamorphosis of the mortgage market

In the last two years the traditions of another official of the highest echelon for the umpteenth time called on the Russians to hurry up with the purchase of housing, while its cost from day to day has started to grow. But the statistics of real estate agencies shows that …

Read More »Experts have calculated is sufficient for mortgage salary

Average monthly loan payment in Russia is 27 thousand rubles Analysts of the Bank “DeltaCredit” calculated required income for a mortgage loan in Russia. In their study, banking analysts came from the average cost per square meter in the regions, reports news Agency RNS. For the calculation was chosen a …

Read More »The inhabitants of the Kuril Islands will receive a mortgage at 0% for the construction and purchase of houses

Residents of the Kuril Islands will receive interest-free loans at 0% for the construction and purchase of housing, according to the government of the Sakhalin region. “It’s about providing mortgages for residents of the Kuril Islands at 0% through Sakhalin mortgage Agency. They will have the choice to live in …

Read More »Mortgage bankers accused of excessive strictness

The share of mortgage transactions in the real estate market of Moscow in the first half of 2016 amounted to 29.7 percent, remaining at the same level as last year. The lack of growth is due to the fact that the banks are severely cut off unwanted candidates: welcome level …

Read More »To take out a mortgage or to wait and save

This theme – housing issue (which has spoiled the Muscovites according to Bulgakov) relevant to me personally, so it’s not just theoretical calculations and posts. My task is (in the eyes of the wife), when we buy an apartment? I will try my readers to the figures to explain what …

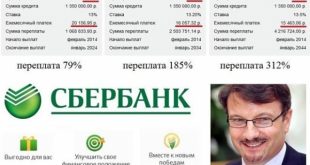

Read More »Enter whether in Russia mortgage slavery

In April, the media leaked devastating news. In the state Duma were amendments to the Civil code related to mortgages. It seems nothing special, if not one of the wording – “the loan amount can be returned ahead of schedule only with the consent of the lender”. These lines could …

Read More »Will you take out a mortgage in the new environment?

Russians may lose the opportunity to prepay the mortgage without the consent of the Bank. Currently this right is enshrined in the Civil code, but after making some amendments, the borrowers will lose it. As many studies show, today, large loans long term seem to be dangerous and that, and …

Read More »Due to fraud with the Bank mortgage loans Wells Fargo will pay a fine of 1.2 billion dollars

In the USA there was a scandal involving one of the largest American banks. As reported RIA Novosti, we are talking about Wells Fargo Bank who provided false information on mortgage programs with state participation. The Bank will pay a fine of 1.2 billion dollars. Between may 2001 and December …

Read More »Mortgage quickly began to deteriorate

Mortgage borrowers go on late. According to Central Bank data, the strongest growth of arrears on the mortgage in February was observed in the segment of early arrears — up to 30 days. Market participants indicate that the reason is the deterioration in the financial condition of borrowers, many …

Read More »