MOSCOW (Reuters) – the Size of pensions of Russians will be reduced annually under even the most favorable situation and in 15-20 years will lose about a quarter, regardless of the preservation or abolition of the storage element.

Retirement speaking at the Congress, former Finance Minister Alexei Kudrin said that the current pension system is not able to maintain the level of pensions even at the present minimum value and again urged the authorities to consider raising the retirement age and to develop incentives for voluntary savings.

“What awaits us? Lowering the replacement ratio (the ratio of the average pension to the average wage)… in the next 15-20 years by 10 percent (from the current 38 per cent).

It will continue to decline steadily due to the demographic situation,” Kudrin said, adding that in developed countries this figure is 60-70 percent sostavyat with regard to voluntary savings, and a minimum level in international practice is considered to be 40 percent.

The calculations take into account the most favourable conditions – the payment of the funded part and the return on its investment by 1% above inflation, slowing consumer prices growth to 3-4 percent a year and the indexation of insurance part of pensions to the inflation rate, Kudrin said. To prevent the reduction of the replacement ratio and to compensate for the lack of resources, authorities will have to increase budgetary transfers to the Pension Fund from 2 to 3 percent of GDP.

The Finance Ministry annually spends a trillion rubles on the closing holes of the Pension Fund. Finance Minister Anton Siluanov said that the transfer from the Federal budget to the Pension Fund in 2016 will amount to 3 trillion rubles, compared with 2 trillion in 2015

Reduction in pension will occur as if keeping pension savings and in case of their abolition, but from the point of view of Economics, the preservation of the storage element is necessary because it is a significant resource for investment and development of financial markets, said former Finance Minister.

Social and financial-economic bloc of the government a few years arguing over the fate of the compulsory accumulative pensions, and while the authorities have for the third year in a row confiscating citizens ‘ pension savings because of a lack of money for current expenses.

“I’d like to believe that another year of such decision (about the freezing of pension savings) will not happen,” he tried to reassure the participants of the pension Congress Deputy economy Minister Nikolai Podguzov. Kudrin said that now being at the helm of the Ministry, would prefer to cover the hole in the budget at the expense of the national welfare Fund, but not at the expense of pension contributions of citizens.

“I would Fund the national Blagosostoyanie took those 300-350 billion rubles, which is not enough that originate from the freezing. To do this, NWF was created – to close such large gaps. And all of the last four years, it was necessary to take out, not keeping us on the hook every year,” he said. Estimated Podguzov, a three-year moratorium on the transfer of mandatory savings private Fund managers worth about 900 billion rubles of deficiencies and neoinvestor.

In case of refusal of the authorities from the mandatory funded part will be a question of what to do with already accumulated to 3.7 trillion rubles, said Kudrin, who a year ago warned that authorities may withdraw these contributions . Sources told Reuters that the Finance Ministry prepares together with the Bank transfer of the mandatory system on a voluntary footing .

According to Kudrin, the authorities should increase incentives for voluntary savings, without disrupting the mandatory system, voluntary savings will not be formed quickly amid a lack of culture and financial literacy

. The AGE that currently has the government, in particular, the abolition of the regressive scale of insurance contributions, these are temporary solutions that can improve the situation for 2-3 years, Kudrin said, once again proposing to raise the retirement age to 63 years for men and women, raising it to three months and six months respectively.

“In the third year of raising the retirement age we will have an additional resource of 500 billion rubles, almost 0.4 percent of GDP, in the sixth year to 1.0 trillion rubles, or 0.8% of GDP, tenth year to 2.0 trillion roubles, or 1.2 percent of GDP and within 15 years it will be a 3.0 trillion rubles, 1.7 per cent of GDP, which would additionally provide an opportunity to balance the pension system,” counted the former Minister of Finance. “We need to adopt a more strategic decision to create a system that will be sustainable and long-term.

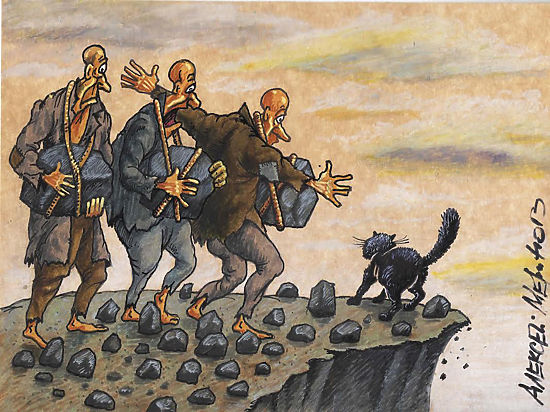

But instead of decision making, which increases trust in the system, we have every year decisions are made that impair this trust and prospects for business. It reminds me of an image from a fairy tale about Karlsson when he would come every day, dug out the stone of a peach and tested it, grow it or not.”