For the first time over the past 15 years their real incomes began to decline steadily

How are the seniors in crisis? And what they can expect from the authorities in the future? We talked about it with the economist and Deputy Director of the Institute of social policy NIU “Higher school of Economics” Oksana Sinyavskaya.

The results of the HSE research alas, disappointing: for the first time in 15 years the real income of the elderly of Russians began to decline steadily, and if you do not take systemic measures in future pensioners in the mass may be in the same place where was in the late 90s. In deep poverty…

Of Russia’s 144 million people to 34.4 million receive old-age pension. Almost every fourth.

Pensioners – the vanguard of Russian voters: they are more active than others bother to vote, and their relation to power largely depends on how much monthly Retirement Fund. And how pension provides at least a very modest but decent standard of existence.

The average size of old-age pension from 1 February 2016 in Russia is about 12 600 rubles. Average means average: it takes into account the pensions of deputies, Ministers, well-paid managers, military personnel and prosecutors and the retirement of librarians and cleaners…

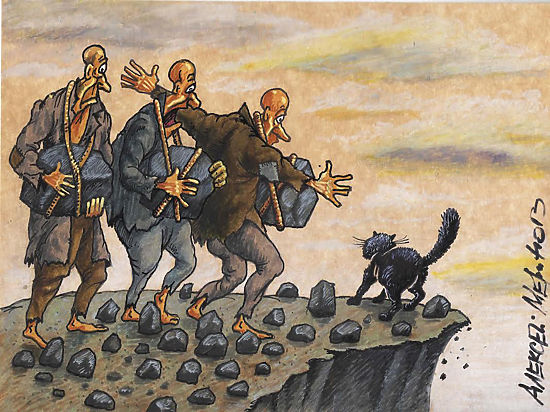

photo: Alexei Merinov

— Judging by the results of your research, Russian pensioners to the beginning of the crisis the accumulated fat and were not the poorest in the country. Is that so?

— If to speak about absolute poverty, as it measures the Federal state statistics service, i.e. to be the threshold of the subsistence minimum of the pensioner, in 2014 the poor among Russians over working age was 6.4 percent — that’s less than the average for the population.

But since the basis of the estimated subsistence minimum are specific representations about the level and structure of consumption of different social groups, the question always arises: whether the consumption of a pensioner so significantly different from the consumption of people of working age, do not underestimated this indicator? (The subsistence minimum of a pensioner is 20% lower than the subsistence minimum of the able-bodied. — “MK”.)

Second question: how and when there is a decrease in consumption. Hardly the image of a woman’s life in 55 years is very different from her lifestyle in 54 years, 60-year-old man from 59-year-old. Experts have long offered to move the border to the age when there is a decrease in employment, for example, after age 65, or at age economic inactivity since 73 years. In this case, the levels of poverty among the elderly will be slightly higher.

Many pensioners live in households with other pensioners or with children, grandchildren. It is therefore important to understand how poverty varies in different types of households. According to the Russian monitoring of economic situation and health of the population, which was conducted by the HSE, on average across all households at the end of 2013, poverty level income was about 14% and households with pensioners — 10%, and in this approach, the pensioners looked relatively safely.

Among households consisting only of pensioners, on the eve of the crisis, the indicators of income poverty have been close to zero. It is clear why: more than a third of pensioners, about 13 million people are officially working, not to mention informal income in addition since 2010 non-working pensioners receive a Supplement to the regional subsistence level, if assessed pension below this level. The poor we still have families with children.

Help “MK”: “According to Rosstat, the Federal subsistence minimum in Russia in average in the third quarter of 2014 amounted to 8086 rubles a month, while the subsistence minimum of able-bodied – 8283 rubles, pensioner – 6308 rubles, and children – 7452 ruble. In the third quarter of 2015 due to the growth of prices and tariffs average subsistence minimum has grown to 9673 rubles a month, the subsistence minimum of able-bodied to 10436 rubles, pensioner – 7951 rubles, child – 9396 rubles.

The cost of living in Moscow in the third quarter of 2015 averaged 15141 ruble, the subsistence minimum of able-bodied – 17296 rubles, pensioner – 10670 rubles, child – 13080 rubles.

But in addition to the calculated statistical indicator of regional subsistence minimum in each region there is a regional subsistence minimum established by the budget entity and is used when determining the number of citizens eligible for social support and supplements to pensions. It can be higher or lower than the estimated regional subsistence minimum. In Moscow it above.”

— Many refer to the official subsistence minimum level is not poverty, but of poverty. How convincing it looks?

We are talking about the minimum standard of consumption. From the point of view of consumption of products and goods it looks quite convincing. However, it still does not include spending on health and education services, as it is believed that the state provides them for free…

In European countries, widespread so-called relative concept of poverty, in which its threshold is considered income 60% of median salary. (Median salary income, below and above which 50% of the population. — “MK”.) If we apply this approach to the income of Russians, the situation before the crisis looked a little worse. The poor had almost every fifth household. But in households where no pensioners, the poverty rate was 29%, where they have, 14%, and in households where pensioners is around 4%. That is, the concept of relative income of the poor we had more, but, first, not as much as on the absolute, and secondly, the pensioners were still in a better position.

So estimates on median income and cost of living is comparable. Another thing is that for a decent existence is not enough to have the income at the level of the subsistence minimum, you need at least two to two and a half of the subsistence minimum per family member — this allows you to consume anything else, except simple food and payment of basic services.

— So, when we say that in recent years the position of pensioners has improved, we largely mean that it has improved compared to families with children?

– It has improved in comparison with families with children and compared with how they lived retirees for a decade or more ago.

But the seniors have specific problems that are not solved and are in crisis, with falling levels of income will become more and more acute sound.

A long period of low pensions and salaries in the 90-ies have led to a large accumulated nepotreblenie in terms of durable goods, low levels of savings, and a pension sufficient to eliminate it.

If you dig a little deeper, things are relatively good between the two extremes: “young” retirees, often where there is a salary (sometimes they even “fed” adult children), and in those older than 80 years, when the increased pension is paid.

The interval from 65 to 79 years was more complex: income from work, as a rule, disappears, the pension standard and the need for health services and social services begins to grow. And here the worst affected are just single pensioners, predominantly women…

If a woman lives alone and is not working, and needed some treatment that she could get for free there the problems begin. There are the elderly, who often lack money to buy food, but primarily for the mass of the pensioner the main problem is the inaccessibility of free medical care and medicines.

photo: Gennady Cherkasov

Back to poverty

— How much has the situation changed with the beginning of the crisis?

— While not radically. But for the first time in the last 15 years we see the drop in real pensions after the crisis of 1998 all income and pensions, including, have been growing steadily, and in real terms too. 2008-2009 became a turning point for pensioners: pensions finally exceeded the pre-reform level of 1991. (Real income is the amount of goods and services that you can buy for this amount. —“MK”.)

— You want to say that the pension then became equal to 132 Soviet rubles? Can’t believe it.

— Undoubtedly changed the structure of consumption has dramatically increased inequality, but from the point of view adjusted for inflation — Yes, pensions have reached the pre-reform level, and then exceeded by 20-25%. Because pensions, unlike salaries and other incomes, are poorly differentiated, this means that the majority of pensioners in real terms they are now higher than they were in 1991. It is the result of a policy which, I believe, began after the monetization of benefits. When pensioners in early 2005, took to the streets, showing their protest potential, the pensions have to be indexed much more active than previously. Particularly active process in 2008-2010.

— It was the Golden age for Russian pensioners?

In the 2008-2009 crisis they were the only winners social group. Except for fear of the government after the events of 2005 played a role, and an understanding that seniors are an important part of the electorate and mass customers of the largest banks. Money in the Treasury was found, pensioners supported.

— Now there is no money, the oil prices are completely different…

— Prospects not so iridescent. The government, primarily the Ministry of Finance, stands for a maximum reduction of indexation of any social benefits. But for pensioners the situation is still better than the working-age population with children, because the reduction in real pensions is slower than the decline in real wages. Last year the pension indexed by 11.4%, i.e. approximately on the level of inflation and the reaction of the Russian labour market was quite typical: almost did not increase unemployment, but wages slipped.

In the first half of 2015 real wages fell compared with the first half of 2014 up to 91,5%, pensions — up to 95.5%. According to preliminary estimates, in 2015 overall, real wages have fallen to 90.5%, and pensions — to 96.2% from the 2014 level.

Of course, averages embellish the situation, and the real purchasing power of pensions declined much more. After all if to look at dynamics of growth of prices for food products, detergents and cleaning products and medicines, for these three categories comprise the lion’s share of consumption of pensioners, the prices grew especially quickly. Contrary to popular belief, less than the average prices for utilities — the authorities understood that there may be strong social tensions and hampered the growth of tariffs.

Help “MK”: “According to Rosstat, the average monthly gross nominal salary in Russia in November 2015 was 33 347 roubles, in November 2014 it was 32546 RUB. Dirty.

The ratio between average and median wage can be seen from the following example: in August 2015, the average salary was $ 32176 rubles, and the median – 23548 rubles. “Dirty”, i.e. without deduction of tax.

Average salary in Moscow in mid-2015 was about 55 thousand rubles per month.

The average salary is dumped into a common pot salaries of all employees, and highly paid, and well paid, divided by the number of these workers”.

— And what could be the effects of the decoupling of working pensioners and the unemployed from the indexation of pensions only last and just 4%?

Given the fact that working pensioners make up about a third of all retirees on average in nominal terms the pension will grow by a maximum of 2.5–3%. And the most optimistic forecast of inflation for 2016, which the Ministry of economic development published in the fall of 2015 and in which nobody believes, is 6%. This means that the decline of pensions in real terms this year will be stronger than in the past. And the relative welfare of pensioners in relation to employed disappears. But for working pensioners is still more profitable to stay working.

— Indexing in 490 rubles still smaller than even a small income in 3-5 thousand rubles?

In fact of the matter. Even low-paid pensioners in the regions where they have low pensions, it is still unprofitable to withdraw from the labor market, unless, of course, the amount of their pensions and wages will not be below the regional subsistence minimum, but there are only a few. That is the reality.

To work longer or pension less?

— It turns out that mass Exodus in the shadow of working pensioners should not be afraid?

— Not yet — rather, we can expect that in crisis conditions, when increasing competition for jobs, pensioners will begin to push out from the labour market, particularly of budgetary institutions in the regions. And then more and more retirees will live on a pension…

The question is, what will happen next. The government only postponed, but not stopped finding ways to reduce employee retirement income.

Last year sounded two proposals: the Finance Ministry wanted to stop paying fixed part of the pension (in 2016 it 4558,93 ruble. — “MK”) to all pensioners with incomes of more than 2.5 times the subsistence minimum, and the labour Ministry has proposed not to pay pensions to those who receive more than a million rubles of revenue per year.

Won line of labor, he prepared the corresponding bill, but in the course of the discussion it became clear that the system of the personified account in the Pension Fund is not configured to continuously collect information, and information processing occurs at the specified intervals. This could result in people ceasing to work the next day after the entry into force of the new rules, had to wait another year until he starts to pay a pension with no other source of income. The document was sent for revision…

But the idea never died and when the pension system will be adjusted by continuous monitoring of incomes in real time, I think that the issue of non-payment of part or all of a pension for working pensioners the government will return. And that’s when we can expect the outflow of retirees from the formal labour market.

We saw something similar in 1998-2001, when there were two manner of appointment of pensions: one gave a slightly higher pension, but was forbidden to work, and another gave a lower pension, but was allowed to work. People immediately realized that there was a drop in formal employment, but according to the polls it was evident that informal employment is quite compensated.

But wages for working pensioners to pay contributions to the Pension Fund — whether it will lead to a reduction of revenue in the PF?

The lawmaker believes that people in any case will be more profitable to work. I don’t agree with it. At work will only pensioners with decent jobs and good guarantees to maintain employment is a very narrow segment of the most skilled workers, mainly in Metropolitan areas.

Can stay those who do not have enough experience for a full pension, but they are also few. The rest either leave the labour market in the hope of a Supplement to a subsistence level, or try to find the gray income, and in this sense the loss of revenue for the pension system will certainly be.

Moreover as the current situation for pension systems are quite favorable: for working pensioners to pay premiums, but their pension this may increase only slightly, within a certain limit, no matter how many years they worked, plus they don’t pay indexation. I think in the context of economic crisis and ageing of the population proposals to limit payments to working pensioners is untimely and contrary to the global trend.

— A global trend — to pay the salary and pension?

— We are often in discussions it is said that the pension is to compensate for lost health, and nowhere, supposedly this is not working it paid. 20 years ago it was true. But now more countries are adopting various flexible schemes and trying to give the opportunity to obtain and salaries, and at least part of the pension, because we are interested in keeping older workers in the labour market in conditions of population ageing. We with aging are actually a face, but nonetheless go in the opposite direction.

— In what countries the pension is paid partially working?

For example, in Estonia, Poland, USA.

— In this case, where the retirement age is higher?

— As a rule, above. This low, as we have, in Europe there are only Ukraine and Belarus. This theme is still perceived by the government as very painful, moreover, in the fall it acted very strange with the slogan: we refuse to raise the retirement age, but will hold the short index. This short-sighted position. Yes, according to opinion polls, the population is against, but against mostly people of retirement age, which is already none of our business.

Besides all being presented so that people get the impression: tomorrow we Wake up and the retirement age of 65! Never such reforms does not hold thus. European countries increase rapidly from 1 to 4 months per year. The fastest acceptable option is for six months per year.

The option that we wanted to apply to officials, but not yet decided?

— Yes. A very sharp increase was just two examples — Kazakhstan and Georgia in the 90-ies, but why are we on them? Experts have long called for given the low life expectancy among men at least, to equalize the retirement age for men and women at 60 years. Women this will give you a bonus: many employers refuse to hire women approaching retirement age, and banks consider this limit when issuing credit…

If continue to adopt less effective solutions like the refusal to pay pensions to working pensioners or very low indexation, when the authorities will finally realize that without raising the retirement age is still not enough, they will do it in the most radical way, that’s too bad.

To the election of pensioners will prescribe a sedative

— It is clear, when they realize — after the elections of 2018… last year it was seen as the government suffered before birth scheme, which deprive working pensioners of indexation. Reactive behavior — that there is a hole, need to shut it quickly, looking for a way now to save money, not how to optimally solve the problem…

– Alas, many of the actions and decisions of the government in the last two years give the impression of unpreparedness for such a development, and we see just a fire with very adverse strategic consequences.

Absolutely all the experts consider necessary a new complex situation around the pension system, because the inevitable process of population ageing is added the long period of difficult economic conditions, and we need to understand what should be the most efficient design of the pension system.

Instead, there are discussions of point plots, extended the moratorium on formation of accumulative part of pension that jeopardizes the formation of a pension capital for future generations of pensioners born in 1967 and younger… But these people will massively retire in 2022, which is around the corner, and the longer the moratorium, the less they will get through a savings system, and the question arises on how the government compensates for these losses through a distribution system and where would you get the money.

Plus a huge, long-hanging burden of early retirement… From 2013, the employers, among which are major mining corporations, pay additional fees for the reasoning of early voters in PF, but in crisis they again talk about the need for a comprehensive solution: there is a strategic sector of the economy, there are the interests of the state in the far North, and it is necessary to specify how must be shared responsibility between employers, government and employees themselves, if we don’t want to use these territories only in shifts, as does the Arctic circle in Canada.

But in any case, if higher premiums are paid for only three years, they do not cover the costs for the payment of pensions to current reasoning of early voters…

— Yes, we still pay them from a common pot.

All these issues exist, call the experts to solve them, but things are still frozen, time, unfortunately, goes in, and the problems in the long run growing.

— How much does the reasoning of early voters we now have about?

— Hard to say. Information about the structure of pensioners, which is currently published by Rosstat, the very scanty compared to what it was 10 years ago. But in 2010, according to government figures, more than one third of pension assignment was early, and the reasoning of early voters from total number of pensioners — 30%. I don’t think anything has changed.

— And before the election of 2016 promised a second indexation of pensions to non-working pensioners will be?

— Most likely. But I’m not sure on the rate of inflation. The budget has no money, and then the indexing will go in the minimum values.

And pensioners will gradually return to where they could get out for 15 years?

— Unfortunately, Yes. Yet the real value of pensions better than they were 6-7 years ago, but, if the crisis will take long and pronounced, the situation of pensioners will gradually return to the former, very low level.

Additional disturbing factors that affect the well-being of retirees, a lot. And if from 2008 to 2013, when the state increased its support for older people, they believed that the situation in the future will remain the same or improve, but now, I think we will see negative expectations.

And new mass protests by the pensioners?

— Hard to say. While I don’t think such incidents can be massive. Before the elections the authorities will try to keep soothing rhetoric, will promise to act in the interests of retirees will spend one more indexation. But after the elections the situation may become severe.

Marina Ozerova