Two years after the annexation of Crimea to Russia, the borrowers, living on the Peninsula seem to have lost their special position. In spite of loud statements of the authorities, in the very near future Crimeans still have to start paying on loans taken earlier from the Ukrainian banks. By law, the relevant rules were introduced in late 2015, but until now their implementation is not reached, in order to prevent social tension in the region.

On the website of the Foundation for the protection of depositors of the Crimea (FSW), a list of organizations that are using the DIA received the right to collect from the citizens of the Crimea debts on loans purchased from Ukrainian banks. At the moment three such organizations: LLC “Yuk “Legal initiative”” (Krasnodar), JSC “Stock converse centre” (Moscow) and LLC “DJ Finans Rus” (St.-Petersburg). According to Agency on insurance of contributions (ASV, parent company FSW), the total volume of credit requirements of Crimeans purchased by these organizations from Ukrainian banks (Fidobank, OTP Bank, Alfa-Bank), is slightly less than RUB 1 billion, the largest creditor is JSC “Stock converse centre” with the requirements to 19.5 thousand citizens worth 818,2 million rubles for the Ukrainian Alfa-Bank. In total, according to the DIA, the DIA asked 15 organizations that are purchasers of claims on loans of Ukrainian banks Crimeans, but 12 of them received a waiver in connection with the failure to provide a full package of documents. However, to apply they can an unlimited number of times, so that the number of claimants with Crimean Ukrainian debt via FSW may increase. Since the departure from Crimea of the Ukrainian banks in the spring of 2014, no large-scale practical action to recover them issued to the Crimean residents loans is not undertaken.

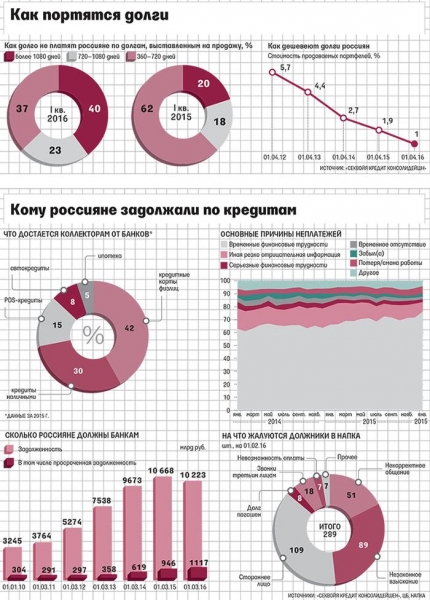

At the time of accession of Crimea to Russia, the debt on loans to Ukrainian banks, according to the Crimean authorities, was about 350 thousand Crimean. And according to the Independent Association of Ukrainian banks, as of 1 February 2014 (most recent data available), Ukrainian banks provided to borrowers of the Crimea the credits for the sum of 16,6 billion UAH. In terms of rubles based on the exchange rate on 18 Mar 2014 (this date is fixed by the size of the debt in accordance with the law), it was 62,77 billion. Data on the volume of credit requirements of Ukrainian banks Crimeans purchased by Russian companies and what are the potential amounts of recovery, in ASV do not have.

The DIA was empowered to settle differences in the collection of debts from the Crimean Ukrainian credit pursuant to a law adopted in late 2015,— 422-FZ. He found that to require repayment of loans issued by Ukrainian banks to the annexation of Crimea to Russia, the only Russian organization, which bought the debts from the original creditors. The duty to monitor the process of collection (unless the parties themselves agree otherwise) the law was assigned to the DIA. More than a year FSW avoided claimants, referring to their discrepancy cases the requirements of the law. According to interlocutors of “Kommersant” familiar with the situation, it was important to avoid social tension that could trigger the collection of debts through the DIA before the elections (the Duma elections in Russia took place in September of this year), but continue to refuse to accept applications is not possible.

The fact that the recovery from the debt of the Crimean people in Ukrainian loans by government agencies will cause a protest, the experts no doubt. “I think that the citizens of the Peninsula, inspired by the special situation of the region and the different benefits could count that these debts will eventually be forgiven,— said Deputy Director auditorsko-the consulting company “FinExpertiza” Natalia Borzov.— Many borrowers are likely to be disappointed by this turn of events. Psychologically, people probably already accustomed to the fact that these debts were in the past.” The feeling that the debts of the Ukrainian banks will disappear along with the annexation of Crimea to Russia, was created by the residents of the Peninsula since its annexation. So, in April 2014 Vladimir Putin during a straight line, answering a question of the inhabitant of the Crimea, how to be a loan to the Privat-Bank at the car, said, “Well, ride safely. Don’t want Mr Kolomoisky (the main owner of Privat Bank.— “B”) with Finkelstein (head of the Crimean Privat-Bank.— “B”) to obtain money from you is their business.”

Actively encouraged not to pay their debts to Ukrainian banks, the head of the Crimea Sergey Aksenov. “No refunds Ukrainian banks and those who bought their debts will not be. We will accept any regulations and legislation to the Crimean was not possible to force to recover these amounts”,— he assured citizens in March 2015.

The adoption of the law, which determined the order of repayment of debts of citizens, aroused a storm of displeasure in the Crimea, but given that up to concrete steps, the case is still not reached, it quickly subsided. And representatives of the Crimean authorities did not forget to cheer up the citizens. So, a few days ago the Deputy of the state Duma of the Crimea Andrei Kozenko was assured that the problem loans will be resolved. “Today in Crimea there was a serious team of representatives in the State Duma, and I really want our residents have stopped worrying about the Ukrainian credit — we will be able to protect Crimeans”,— he said.

Against this background, the recovery of debts from the Crimean people in Ukrainian loans even with FSW looks difcult task. “The annexation of Crimea took place over two and a half years ago. Not far off is the expiration of the three-year Statute of limitations. This circumstance must also be considered in the context of the assessment of the chances”,— said the partner of BMS Law Firm Denis Frolov. “The most important thing in this situation is to be sure that in the contracts it stipulates the right of the creditor to transfer the debt to a third party, because in this there is room for legal maneuvering and possible disputes— continues Lidings’ partner Andrey Zelenin.— While it is clear that some borrowers will be unhappy with the fact that the debts still have to put out, when maybe it was the expectation that this issue will be resolved”. But the fact that it was not possible to extinguish the credit, is not exempt from debt, but only from the payment of fines and penalties, he concludes.

Ksenia Dementieva, Yulia Lokshina