The National Association of professional collection agencies believe that gun ownership is evidence the debtor has valuable property

Collectors continue to prepare for the introduction of regulation in the market of debt collection. Profsystem appealed to the Federal bailiff service (FSSP) with a request to grant them access to data on registered borrowers arms (the letter is in “News”). In fact, collectors want to get the bailiffs assistance to access the data of the territorial OVD (controlled by the Ministry of internal Affairs), where the FSSP sends requests to the Executive production.

In a letter to NAPCA explained that the initiative will contribute to more effective recovery of overdue debts from borrowers in the framework of enforcement proceedings.

— The weapon is evidence of the presence of the debtor’s valuable property (weapons used for the protection of the property itself is a valuable property), — told “Izvestia” Director of the NAPCA Boris Voronin. — Collectors need to access information about indirect indicators of the presence or absence of income from the debtor.

As explained by the “Izvestia” a source close to the Bank, for the recovery of arrears problems can face not only the borrowers.

— When collectors come to the debtors, they can expect anything: some borrowers begin to defend, — the interlocutor explained. — Therefore, the claimants need access to the data on the registered citizens weapons. Such incidents were few, but with the growth of overdue loans innovation is very important.

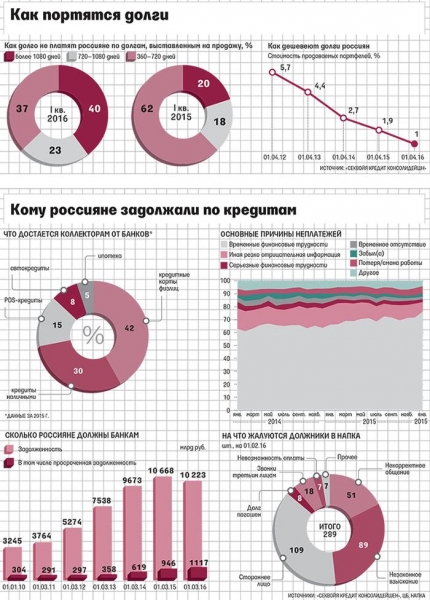

According to the Central Bank on July 1, 2016, the accumulated amount of overdue debts on consumer credits amounted to 898,7 billion. Since the beginning of the year rose 3.9%.

— Given the growth of debt and the aggressiveness of some borrowers, the initiative will help to prevent possible incidents with firearms, — said the managing partner of the audit company “2K” Tamara Kasyanova.

According to Tamara Kasyanov, the main problems in the implementation of initiatives related to its technical component: the need to ensure adequate protection of information about citizens owning firearms.

— If this information is for some reason hitting the Internet that have become public, gun owners may find themselves in an unpleasant situation, — said the representative of “2K”. Accordingly, access to such personal information imposes greater demands on the professionalism of the claimants: they will be obliged to use it only in the framework of its activities for reference purposes.

The head of the center for collection of non-contact with customers of the Bank Viktor Ulanov sure that honest customers to pay for their information, there is no need, if the partner selected the Bank with a good reputation.

— As for the customers who pursue evil intent, evading from performance of its obligations, the information about the presence of weapons they have would be very helpful to protect employees working in the field of recovery, — said the representative of the Bank. “Severe collectors” sometimes work even fragile girls, and for us security is important both to our clients and employees.

Senior lawyer of lawyer Bureau “A2″ Ekaterina Ilyina does not understand, why give the collector such powerful leverage of the abuse”.

— How the work of privzetega can help data on the property of the debtor not pledged and are not associated with the accrued arrears on the loan? To dispose of the debtor’s property for repayment of the resulting debt is entitled only to the court, to arrest such property only to the bailiffs, — says Ekaterina ilina. — The collectors there is no such authority and can not be.

According to her, data on property of the borrowers obtained in FTS, the traffic police or the interior Ministry, in no way will help the collectors to collect the debt as long as they act in accordance with the law and not commit against the debtor or its property, illegal acts, aimed at causing harm.

Ekaterina ilina reminded that according to article 37 of the Penal code “is not a crime causing harm to an attacker in self defense… if this assault had involved violence, life-threatening defending or other person, or with direct threat of application of such violence”.That is, the collectors have nothing to fear, said the representative of “A2”.

Prior to the adoption of the law on collection activity, was criticized mainly the creditor debt, still using methods of soldering iron and”. The Central Bank and law enforcement agencies are actively combating such “black” collectors in 2015. At the end of 2014 at the forum of the popular front, President Vladimir Putin said that law enforcement authorities should intervene if debt collection organizations operate illegally while trying to recover from the debtor’s funds on loans.

Now the “white” market participants seek protection from a future regulator. In addition, be sure to NAPCA, you need to develop a “road map” for implementation of electronic document management. Profsystem want to receive from the bailiffs information in their requests to the banks, the answers to these queries, regulations on search, seizure and handling of penalties on the identified cash withdrawal from the accounts of arrests. Collectors also insist on giving them information on the queries to identify the property status of the debtor and the answers from the traffic police, the IRS, the fed, the Federal migration service, Pension Fund, the Registrar, the Central address Bureau.

“We understand that such work cannot be done immediately, would require spending from the members of NAPCA for improvement of IT systems and secure communication channels — to the letter. Ready to host a working meeting with participation of employees of the Federal bailiff service and representatives of NAPCA”.

Official representatives of the Federal bailiff service said that to talk about any encounters with NAPCA will only be possible after formalizing services as overseer of the collectors on”.