“Daughter” of Sberbank is looking for new ways of influencing non-payers.

Russian collection companies looking for new ways to impact on borrowers. Once in “Activitiesother” (Bureau of collection of the savings Bank) was faced with increasing incidence of swearing debtors, which led to a turnover call center, the company decided to file a lawsuit against matermania. There were also other reasons to initiate legal proceedings with debtors.

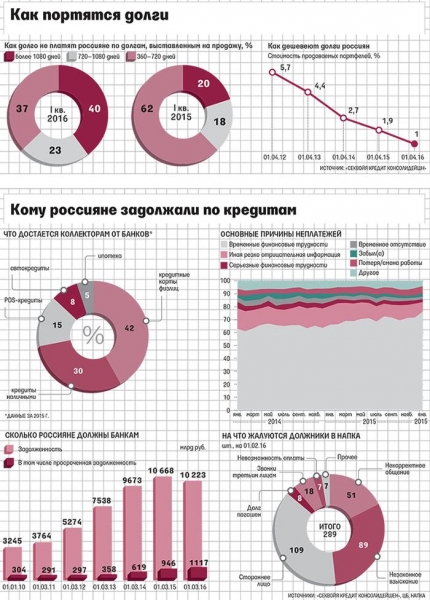

With the beginning of the year all the cases of debtors who repeatedly obscenely abused employees, the company decided to transfer the courts to recover the debt in court. As told “Izvestia” in “Activitiesother”, this has led to a rapid increase of court cases from 30% to 41% (of the portfolio) in the first months of 2016.

— If earlier the company appealed to the court when it was economically justified, we are now ready to go to court, and on the principal points. We value our best shots. Hope it will be a signal to customers, for the market, the situation will begin to change, because with people, even if they are collectors, you can’t communicate in such a rude manner, — explained the General Director “Activitiesother” Dmitry Teplitsky.

Similar measures in the company and apply to debtors who write complaints to all authorities on the Agency, “not actually having a reason, thus trying to delay the process of pre-trial settlement and to exert pressure on the company.”

— We raise our phone conversations are complaining debtors within the procedure of quality control, once again making sure that there are no reasons for complaints. Literally in the beginning of the year one of such cases was dismantled by the debtor for the purpose to evade responsibility wrote plaintive letters, sending them to all possible addresses that only have enough imagination, in the office of the President of the Russian Federation, the Central Bank, the Prosecutor General, Roskomnadzor, the Federal service, NAPCA, etc. on the list, hoping to evade the payment of arrears. The record, which we recorded, about 270 complaints from one customer. Experience shows that in such cases, the receivables of the client, usually to pay in a state that occurs upon receipt of the invitation to court. All unfounded complaints, we are ready to sue, says Teplitsky.

In other collection companies say that the decision of the collection company until the precedent for the market.

— The number of appeals to the court of the First collection Bureau is not associated with worsening behavioral characteristics of debtors (insults to collectors, etc.), the number of claims is determined by the economic feasibility, assessment of the prospects of recovery, the volume of portfolio at work, — have explained in a press-service of the PCB (which controls 40% of the assignment market). According to the President of the company “Sequoia Credit consolidation” Elena Dokuchaeva, the sharp increase of litigation with the debtors under concession contracts on the market yet.

However, the procedure for the enforcement of the court always takes the side of collectors.

— It is worth noting that in the court collection Agency are trying to address in only one case, when the agreement with the debtor cannot, but there is an understanding that he has the opportunity to repay the debt. Thus, on average, about 20% of the purchased debts are repaid forcibly after receiving the court decision, which in 100% of cases supports the direction of Agency, since we are talking about Bank debt, for which there is clear documentation that explained Dokuchaev.

According to collectors, the solution of the issue through the court is not advantageous to the debtor, because of educational logic in this decision is present. When the debtor comes in contact with a specialist to recover, he has the opportunity to develop an individual plan of debt repayment, to agree about a discount, ask for installments, i.e. to find the optimal solution that will suit both parties, emphasized Dokuchaev.

— Refusing to communicate with professional collection agencies, debtor trapped in a “debt trap”. However, in our experience, refuse to communicate with collection agencies due to the view that they will soon prohibit, not more than 7% of debtors, after talking with them and explaining the current situation, their share drops to 4%. It is worth noting that the current situation is caused by improper feeding of the media, as well as low financial literacy of the population, says Dokuchaev.

According to lawyers, whatever the motivation was behind the actions of the collectors, they can react to the actions of debtors in the legal field and including may sue the debtor because of the overly annoying complaints.

— Collectors have the right to appeal to the court under the loan agreement in connection with the ensuing delay, the question to realize this right or not, it remains at their discretion whether they follow a kind of threshold amounts or emotional criteria. From the point of view of the law it has nothing to do: collectors have the right to a judicial settlement of the dispute, everything else is a question of economic feasibility: is it worth spending 50 thousand rubles on court procedures, to get 15 thousand? At their discretion, — says the partner of legal firm Lidings Andrey Zelenin.