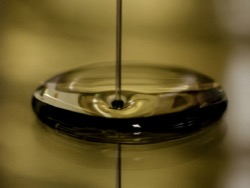

The probability of oversupply of oil on the world market remains, this is indicated by global data mining, it follows from the analytical review of Sberbank CIB.

Since the beginning of summer, the number of drilling rigs in the US increased by 6 units and the total number increased to 40. In the end of June, when commodity prices reached a local maximum, oil fell 10%, according to RBC.

The review indicates that the oil-producing U.S. companies are actively hedged against falling oil prices, as well as attract equity capital for payment of a debt or the purchase of new deposits, increasing the demand. According to Bloomberg, since January the company has raised more than $16 billion of equity capital.

The growth potential of oil prices is limited, but possible in the case of interest for risk from global investors, analysts stress. The price of oil could rise to $50 per barrel if a long time has been stopped its supplies from Russia and Iraq through the Bosporus due to the attempted coup d’état in Turkey. On Saturday, the Turkish authorities closed the Bosporus for the passage of tankers, for safety reasons, for fear of terrorist attacks against it. However, Sunday deliveries were resumed.