“Who’s the world’s worst investor in the last 18 months? For example not far to seek — it, Russian President Vladimir Putin,” — says in his article in The Wall Street Journal’s Andy Kessler, in the past managing a hedge Fund. According to the author, Putin “is wrongly played in a long with a giant energy portfolio controls and too many commodities. In addition, he has a huge debt, and its rate for the currency was so bad that he deserves the nickname “Vlad the Impaler”. Maybe he’ll drag RF together with him on the bottom”.

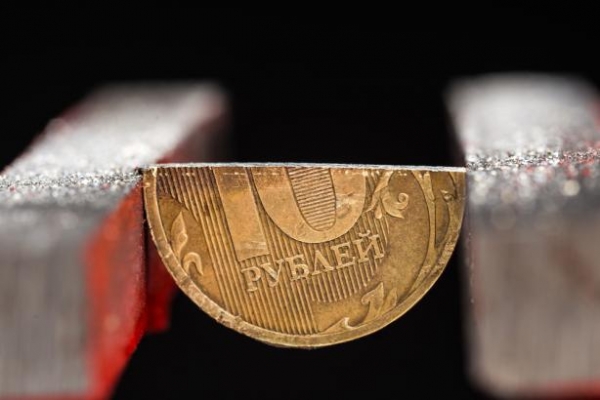

In the opinion of Kessler, oil prices may fall to $ 20 plus per barrel, and “energy accounts for nearly a quarter of Russia’s GDP”. “The Russian ruble is falling like a sack of potatoes,” writes the author.

However, Kessler and finds “good” news: Russia’s foreign debt decreased from 733 billion in mid-2014 to 515 billion in January 2016. But, according to the Central Bank, 83% of debt was denominated in dollars or euros, so the debt grows with the weakening of the ruble.

“Putin’s game of “chicken” in Kiev had caused him financial sanctions (last week Goldman Sachs refused to insure a deal with Russian bonds), and even the Chinese apparently are not willing to Finance the debt restructuring of Russian companies”, — said in the article.

The Russian economy is gripped in a strong recession. Defense spending grow.

Russian foreign exchange reserves “will quickly disappear in a static situation, and even faster if the oil price falls to 20 dollars, and the exchange rate is 100 rubles per dollar”, — said in the article.

“Thanks to sanctions, the boom frekinga in the U.S. and a strong dollar for loosening Putin’s power,” concludes the author.