The labour Ministry has prepared a bill to extend preferential tariff of premiums as a replacement for their major reforms.

The Ministry of labour and social protection of the Russian Federation introduced amendments to the tax legislation in terms of insurance premiums. The Agency proposes to extend the preferential tariff, providing for deduction of 30% of the wage Fund, and not to return to 34%, which is scheduled for 2019. While the Ministry has calculated that extending the breaks for businesses will require increasing transfers from the budget to the Pension Fund on 488 billion. Experts and businesses believe that the extension of preferential rates of insurance contributions social welfare office tries to commit the current state of Affairs is long overdue reform.

Prepared by the Ministry, the bill is distracting from what declared social unit earlier. In particular, he insisted on the return rate of 34% (insurance premiums replaced the unified social tax in 2010), which operated only in 2011. The changes led to the departure of the business into the shadows, reducing revenues to extra-budgetary funds (PFR, FSS and FOMS), and also numerous complaints from business representatives. Therefore, in 2012 it was decided to return to the rate of 30%. However, when it became known about the idea of the Ministry of Finance to reduce the rate of contribution after the transfer of the administration of the Federal tax service, the Ministry of labor changed its position and prepared a draft that preserves a preferential rate.

However, the Agency cites the calculation that keeping the rate of insurance contributions for compulsory pension insurance in the amount of 22% for the period up to 2019 will lead to a decrease in revenues at 806 billion rubles. The rate of 10% of amounts exceeding the limit value base for calculating insurance contributions (at the moment — 718 thousand rubles a year), will increase revenues to 318 billion rubles. Thus, the saving rate of insurance contributions to 2019 will require the allocation of Federal budget funds for compensation of lost incomes of the FIU in the amount 487,8 billion in 2019.

The Finance Ministry had earlier presented his vision for reforming the insurance premiums was proposed to abandon the low coefficients for the high salaries. In addition, the Finance Ministry has proposed gradually reduced and the contribution rate up to 29% in 2017, 28% in 2018 26% in 2019. According to the Minister of labour Maxim Topilin, the proposal was not accepted. President of RSPP (the Russian Union of Industrialists and entrepreneurs) Aleksandr Shokhin in conversation with “Izvestia” said that soon I would choose labor because the idea of the Ministry of Finance have risks and are not fully developed.

— I would suggest option not to touch anything and to calculate carefully. Yet, relatively speaking, we were not prepared for the changes. Therefore it is better to leave 30% of the threshold base. In this respect we are closer to the labor Ministry, — said Alexander Shokhin.

According to President RSPP, the reduction rate with the introduction of a flat scale would have serious disadvantages.

For some industries, such as telecommunications and the financial sector, this is a real increase in the burden on business. They calculated that if the Finance Ministry’s proposal, that burden comparable the current rate is 20%. This discussion is not about exercise as such, but about the load on a particular industry. And also about whether it is necessary to impose high insurance premiums PAYROLL in industries with high wages, particularly in technologically advanced, — said Alexander Shokhin.

In principle need to change tactics and strategy, the head of the expert center under the Commissioner for the President on protection of entrepreneurs ‘ rights Anastasia Alekhnovich.

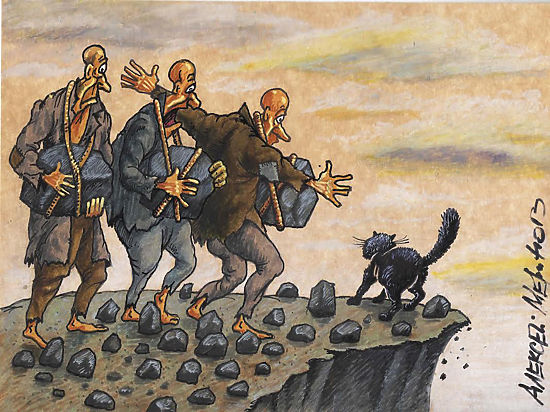

You need to engage in rethinking the whole system of functioning of pension systems, compulsory and voluntary medical service, it is necessary to make suggestions on reducing the load on the PAYROLL and the removal of wages from the shadow. Everyone will benefit from it. And colleagues are trying to take the path of least resistance is give the signal, “exactly reduce will not.” Plus ask for additional funds from the budget on an ineffective system, says Anastasia Alekhnovich.

According to the expert, as an alternative it would be worthwhile to move in the direction of motivate citizens to accumulate pension funds and pay health care services. This can be achieved through the introduction of flexible differentiation of the payments system, when every citizen knows that the more he pays, the greater the volume of the rights and the best quality of services he receives.

— At some acceptable level of joint and several liability should be, but when it becomes the only alternative, it kills the motivation and desire to preserve, — the expert believes.

According to her, it is common practice worldwide to reduce the burden on the payroll in times of crisis. While in Russia the load while, on the contrary, grows.