Came fresh data on the size of the major economies of the world. Russia, of course, continues to be one of them. According to the CIA we are now sixth, one step above Brazil and on the step below Germany. According to the world Bank we fifth, more than Germany, but smaller than Japan:

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2001rank.html

http://regnum.ru/news/economy/2087829.html

However, we must remember that the world Bank provides data only for 2014, but more recent data will probably show that Germany is again slightly ahead of us and broke out on the fifth place.

Look at the whole picture. From 2000 to 2014, Russia’s GDP grew by 260%, from 2014 to 2015 fell 4%, again, according to the CIA, world Bank and other rukopasnij experts:

http://ruxpert.ru/Статистика:ВВП_России

Perhaps this talk of “wild drop” of the Russian economy and of the “lost 15 years” can be closed safely. Even with the sad of 2015, our economy has grown over the past 15 years in 3,5 times, and the current crisis pause in growth does not negate the powerful pull of previous years.

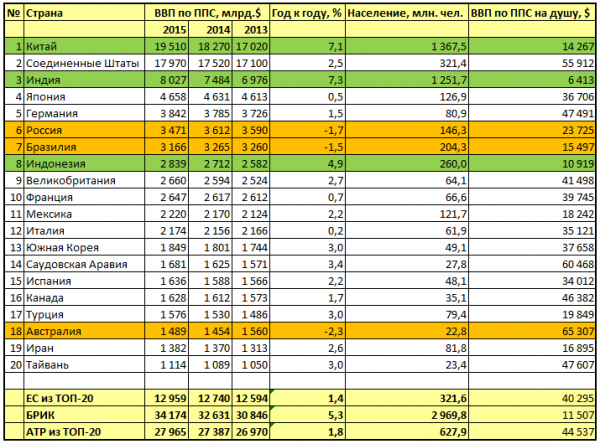

Let us turn now to the situation in the world. A list of the twenty largest economies according to the CIA is as follows:

http://aftershock.news/?q=node/376563

As you can see, the world has changed. If until recently, many believed that everything important happens in the US (and in the US colonies), now that China has become the largest economy in the world, and three of the BRICS countries entered the top ten, ignore the changes became more difficult.

The United States, which used to be the “king of the mountain”, was in a very difficult situation. Loss first place inevitably entails a loss of ability to suck from the planet “dollar tribute” and tribute the loss of a dollar means a complete financial collapse — followed by the need for a long time and strained to glue the broken shards in the American economy.

Of course, this problem became visible yesterday and not day before yesterday. The Americans in advance amounted to an audacious plan that in case of successful execution would allow them more time to Rob the rest of the world and to hold thus on top of.

The plan was very simple, and because it had some chance of success. The idea was to set fire to the planet — and make thereby all the money to seek salvation in the quiet American Harbor. Arab spring, ISIS, Euromaidan, “the Syrian” refugees, the Transatlantic partnership… even if you don’t follow the news, you know that last years was pretty hectic.

The main direction of injection of the poison of American steel for cheap dollar loans, which in abundance were distributed to everyone — including Russian companies. Quoting the article  crimsonalter, which, by the way, I recommend reading in full:

crimsonalter, which, by the way, I recommend reading in full:

http://politrussia.com/ekonomika/konets-amerikanskogo-blitskriga-875/

For several years the fed has been able to plant a cheap currency liquidity of the whole world. On the background of objectively existing needs of the rest of the world in cheap loans, “infusion” went on hurrah, and to some extent contributed to the relief of severe symptoms (not causes!) the first wave of the financial crisis. It is weak to pay attention, but even companies from China managed to accumulate dollar-denominated loans of nearly a trillion dollars.

And in 2015, the Americans decided it was time to make the entire planet a lot of pain, and provoked the “breaking the dollar” or “included dollar vacuum cleaner”. The rise of rates by the fed, a sharp reduction in the availability of dollar liquidity and, consequently, a sharp appreciation of the dollar against all other currencies was to induce in the world (excluding the USA) the economy is a deflationary shock, i.e. a sharp devaluation of assets, local currency, shares, bonds.

The shock was to cause the credit crisis companies and States, not able to repay their dollar loans. Against this background, combined with “iron” promise by the fed to raise the rate and further capital had to run to America.

Fortunately for us, the Americans plan didn’t work. The December rate hike by the fed has led to the fact that together began to fall all markets: including American. Money ran not in the US, but e.g. in physical gold up to U.S. bonds and the American stock market some paltry rushing spray of the capital.

Meanwhile, Russia, which is nice, took the brunt of one of the first: the Americans shut off the tap dollar liquidity in 2014. As a result, as you remember, in the country there is a shortage of dollars and the ruble has fallen sharply — but the expected crash did not happen, and so far the Americans have no financial tools to make our economy hurts.

What will happen next?

Contrary to the belief of conspiracy theorists, in global politics it is quite difficult to do anything secretly — any serious action requires the participation of a huge number of politicians and officials, which the organizers are coordinating quite openly, through public statements and through articles in the media.

This means that if we do not see now the USA has a plan “B”, then most likely, no plan B the Americans do not have. Therefore, we can expect further convulsions — enable POPS in the US, dull, delaying the inevitable collapse and, finally, purification of hyperinflation.

Can’t say I’m upset at this prospect. The world financial system is now stalled, and to break the deadlock without going through severe crisis obviously will not work. And, to be fair, the main impact of the crisis will take it is those States that most actively worked on its creation.