You may owe the Bank a million and not know anything about it until collectors. For more than a thousand residents suddenly found themselves in debt from AKB “Banking house”. People are forced to give loans they did not take. The first auction for the sale of such a non-existent debt collectors will take place in early November.

Such bad history

The heroine inevitably one of the bad credit history became Petersburger Alla Dmitrieva (name changed). One morning she received a registered letter from the state Corporation “Agency on insurance of contributions”. The document demanded that Alla immediately – within 7 working days – returned to duty for a certain Bogdan Albertov, who three years ago took the credit in Bank AKB “Banking house” and does not give. As followed from the letter, Alla was the guarantor have Albertov in 2013, but since then the Bank has a Banking house, the Central Bank revoked the license. Now the Affairs of the Bank engaged in a state “Agency on insurance of contributions”, which requires debts from the defaulters and their guarantors. The loan amount in the letter were not specified.

After receiving the letter, the woman at first surprised, then laughed, then got scared. According to her, and Albertown she’s a stranger, the surety never at anybody was not. After learning the amount she allegedly owes the Bank almost fainted: 3 681 280 rubles!

– From this terrible debt?! she wonders.

Bank name seemed vaguely familiar. Alla recalled that in 2012 the company opened a contribution there. In February 2013, the contribution was closed, took the money. Since then she has stopped all relations with the Bank. But the Bank didn’t seem to stop.

As follows from received a letter in October 2013 AKB “Banking house” made her a guarantor for the loan. According to Alla, it happened without her knowledge, but with the use of personal data, which were available in the Bank.

– Pure Scam! The worst thing is that it is unclear where to go, who to ask for help to prove you don’t owe anyone anything. Because there are no documents to prove it! – going through it.

“Forging signatures, they were lazy”

First Alla appealed to the Agency for Deposit insurance. The Agency, according to her, was met by unfriendly, rude in the spirit of “you have a lot, I have one.” Was asked to come and write a statement saying that do not know, did not take, not participated. Then wait 30 days while they investigate.

But the Internet has found a great community affected by AKB “Banking house”, which is also – unbeknownst to them – recorded in debtors. According to Alla, the community has more than a thousand people. “Her” borrower Bogdan Alberto, whom she is supposed to return the debt, was also among the victims.

A stiff letter demanding the return of the debt Albertov came in April 2016. The man says that no credit did not take, but also was once a contributor to the “Banking house”. He wrote a complaint to the Agency for Deposit insurance appointed bankruptcy Trustee of the bankrupt “Banking house”. Three months later received a copy of the contract he allegedly entered into with the Bank.

– The document is completely unlike my signature! Greedy bankers, apparently, are so insolent that even forging signatures, they were lazy, says Alberto.

With a fake contract, he went to the police. But there application is not accepted.

I was told that the reason to submit is not: because the criminal case already instituted. I’m not the only one. The victims are many. There is a consequence. Upstairs, in Moscow, all aware of the situation, including Elvira Nabiullina ( Minister, head of the Central Bank. – Ed.). Those people who have signed our contracts with the Bank, was called in for questioning. These are the two real aunt, confirmed that they are all documents signed. But they are so, they say, bade the user. The user looking for, it is hidden behind the border, – said Bohdan.

According to him, the investigator explained to him that even if all bankers are villains going to jail, the victim is not going to help. While all the fake contracts are not officially recognized as such, people will continue to be enrolled in the debtors. But to recognize contracts invalid, the court can only.

Information obtained from investigators, confirmed in the office of the bankruptcy Trustee GK “Agency on insurance of contributions” by G. A. Shubin, engaged in the business of “Banking house”. They know that the staff of a broken Bank were involved in the falsification of contracts.

Such affected lot at the Bank. Not all is understood. Some borrowers have managed to prove in court that the loans were not issued, – reported in the device Manager.

But to immediately recognize all such contracts null and void in the Agency for Deposit insurance do not want. The argument is this: under the guise of fake borrowers can escape from real liability – that is, those who actually took out loans at the Bank.

On 7 November 2016, the Agency for Deposit insurance appointed the first e-auction for the sale of overdue loans, “Banking house”. Just put 200 lots. One lot – one credit agreement. Among them are credit allegedly issued by Bogdan Albertov, the guarantor (in fact – caplitalism) which acts as Alla Dmitrieva.

– The Agency published on the Internet my personal information and the amount allegedly overdue me credit. That is, I was publicly called by the debtor, discrediting not only my credit history, but now the good name – outraged Bogdan Albertov.

The Agency believe that doing the law.

– We have all the documents for these loans. We expose them to bid only if the original loan documents. We do not know the real or fake contracts – to explain their position.

What happens when the debts of the random victims of “Banking house” will buy the collectors?

– We are afraid that we will begin to slack off, embarrass him in front of colleagues, neighbors, although we are not to blame, but rather the victims going through Alla Dmitrieva.

The Agency on insurance of contributions consolation.

– Maybe your debts no one will buy. Today few are willing to associate with such bad credit, calm down there.

Random victim

According to Bogdan, the number of victims of credit fraud “Banking house” in St. Petersburg at the moment has reached a thousand people. It’s probably still increase, as long as not all the “debtor” aware of their “debt”. The victims were divided into three categories.

First – investors. They came to their deposits and found out that it is not a Bank they have, and they Bank. Bankers are “copied” them from depositors to borrowers.

In the second category were the people who were once the contributions to the “Banking house.” Their data were used for fraud in new credit agreements.

In the third category were not random people.

– Their data is picked up somewhere and they hung up the loans. Most of them did not pay attention to letters from the Agency on insurance of contributions – just threw them as spam. After the third or fourth letter, some began to open the message and grow our ranks. These people appear gradually. Perhaps they would be more than all the others, – says Bogdan.

Since April of last year as the other one and a half thousand people – the life of Bohdan Albertov changed much. Now he studies law, requesting the documents, goes to the authorities. Preparing to prove in court that the Bank did not take.

In its place, tomorrow could be anyone.

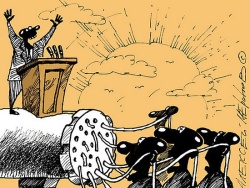

The state against the victims

St. Petersburg Bank “Banking house” license was revoked in the spring of 2016. After inspection and inventory, the organization discovered a large shortage. Say, we are talking about the disappearance of more than three billion rubles. Presumably, fictitious loans were issued in order for this shortage to hide. Summer opened a criminal case under article 159, part 4 of the criminal code – “Fraud in especially large size”. The investigation conducted by employees of GSU SK the Russian Federation across Petersburg with the participation of the FSB economic security service in St. Petersburg and Leningrad region. According to media reports, the former acting Chairman of the management Board Irina Lykova, the daughter of co-owner of the Bank Evgeny Lykov, brought part of the funds for the accounts of companies in Finland. Lykova spouse is a Finnish citizen.

The scheme that was used here was used in the other burst banks.

Similar example is the situation with Russia, whose license was revoked in January of this year. Former co-owner of the Bank in hiding abroad, he is accused of asset Stripping worth more than a billion rubles. A hole in the Bank’s financial statements 210 billion was partially plugged with fake credits. Recently several borrowers, which were decorated with such loans, failed to prove in court that they didn’t take it.

The Central Bank continues to revoke licenses. He has recently revoked the licences of Military-industrial Bank (top 100), and Centralbank “Aymanibank” (top 150). The state, dealing with the Bank bailout, does not help victims of their actions to citizens. On the contrary, each of the “debtors necessarily” have to sue the state (Agency for Deposit insurance is a state-owned company), proving that they didn’t steal, and they have.