Non-state pension funds (NPF) and the state management company Vnesheconombank can get expanded powers to participate in large-scale privatization this year. A proposal was prepared by the Ministry of economic development, and, according to the head of the Ministry Alexei speaker, it has already been approved by the President.

Only the government expects to gain from privatization this year to 1 trillion rubles. According to the head of the Ministry of economic development, privatization is hardly possible until the summer, and the price of transactions will be low.

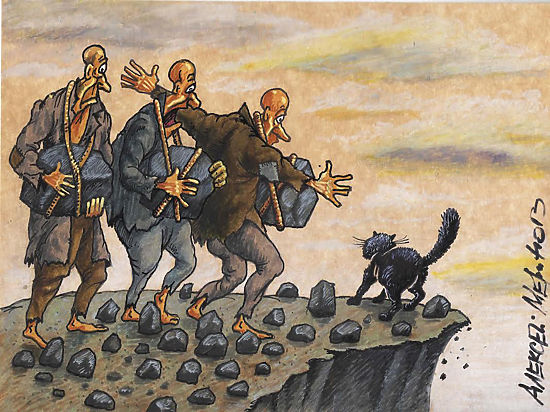

The authorities recognize that to go on sale under such conditions is unprofitable, but necessary, given the low oil prices. With an average price of 40 dollars for barrel the budgeted deficit will make 3%, at lower 4-5%. On the background of the fact that the leading Western banks have refused placing of the Russian Eurobonds for $ 3 billion, the search for the sources of funds becomes very important.

So on stage were pension funds, although the thought of attracting their investment in Russian state assets were voiced earlier. Now for NPF, there are certain restrictions that do not allow them to invest in the purchase of shares of 300-400 billion rubles, which are now on their accounts in the form of Unallocated balances. Exactly the same amount of power counting.

Experts believe planned for privatization in 2016 part of the state “Bashneft”, ALROSA, VTB, and possibly Rosneft’s a very valuable asset. But the money that the NPF will have the opportunity to invest in them, too worthy. According to the analyst IFC Markets Dmitry Lukashova, on the designated amount you can buy 70% planned to sell the state-owned Rosneft, or 13-17% of the shares of state-owned 50% of the savings Bank, or shares in several companies.

Generally, the involvement of pension funds to privatization of state property positive for the participants of NPF. “This money needs to invest and the realization that high prices to sell state-owned stakes in privatized companies now will not work, gave rise to the idea to make Russian pensioners, and not to foreign investors”, – says the Professor of the Department of banking of greater new York.G.In.Plekhanov Lazarus Badalov. In his opinion, any of the listed packages is a good investment, as shares of commodity companies are at the bottom now and in the future should significantly grow in price.

The main contenders for serious capitalization growth in the medium term, when the commodity markets go into a phase of growth, CEO service quick trade stocks “Source” Robert Bagratuni calls Rosneft and ALROSA. These paper are assumed to purchase the strategists of the NPF in the first place. If we talk about the long-term attractiveness, it is rather ALROSA, believes managing Director of “BCS Ultima” Stanislav Novikov. “For a long investment, we now advise clients to buy only from their proposed privatization of the list,” he says.

Russian business also needs long-term investments, which are worldwide money from pension funds. The companies will receive long-term investors interested in growth of capitalisation of the asset and the state additional money in the budget. The population, which, in fact, is the source of this money, will be invited to become co-investors of state-owned companies, investments in shares which are very attractive tool. However, the efficacy of such investments depends on the policy of a specific Fund, to ensure experience and integrity which nobody can. Those whose funds are already in private UK and NPF, will be able to make a decision and move in another Fund, the “undecideds” left in the web, deprived of this right since January of 2016.