The monetary experiment of the key Central banks of the world lowered rates to negative values, is a ticking time bomb, the explosion which will inevitably be accompanied by crisis – primarily for pension funds, says international rating Agency Fitch in a report published on Wednesday review.

At the moment, due to the policy of negative rates of world Central Bank, issuing the reserve currency, of bonds by about $ 10 trillion bring investors a yield below zero. In fact, buyers of a number of sovereign securities – Japan, Germany and Switzerland, not only do not receive the coupon income, but on the contrary – you have to pay extra to keep their money in these instruments.

Every year investors lose 24 billion dollars due to the negative rates, according to Fitch. First, it is pension funds for which the state bonds as the most reliable instrument, are based on the investment portfolio.

The situation is compounded by the fact that the pension system of all key economies in the world exists in a regime the acute shortage of funds. In the US and the UK it is a total of 520 billion dollars, and for developed countries as a whole reaches 78 trillion, according to Fitch.

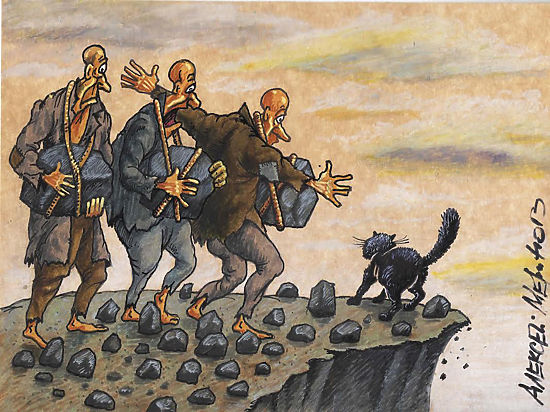

“The deficits of the pension funds are ticking time bomb. Unfortunately, it’s such a bomb, which will break slowly, giving the perception of crisis. The good news is that we have time to rectify the situation. Bad news is that, most likely, until the crisis, no action will be taken”, – complains one of the authors of the review, Fitch Charles Millard.

To obtain at least the minimum income, investors have to buy longer term securities, however, and the stakes are extremely low, which does not allow pension funds to obtain the desired yield.

So, even in 30-year bonds in Japan, USA, Germany and the UK it is now possible to receive the income of 0.26%, 2,64%, 0,91% and 2.34% per annum.

“It is obvious that the policy of negative rates is forcing investors to buy riskier assets. In any case, the risk of unintended consequences increases as banks, consumers and businesses adapt to a more uncertain economic environment in which negative rates are becoming more common,” reads the Fitch report.