The Central Bank said that the formation of the budget remains very challenging.

On whether the budget is something fundamentally different from last year and there have changed in the Russian economy that is in better or worse enough to affect the budget process, BAFS “the Economy today” said Nikita Maslennikov, head of Finance and Economics” Institute of contemporary development.

The solution to the retirement benefit – a great testimony to the fact that during electrorloge cycle the government is doing everything possible not to reduce the level of social security of citizens. However, already in the near future should think about structural reform of the social sectors from the point of view of increasing their effectiveness.

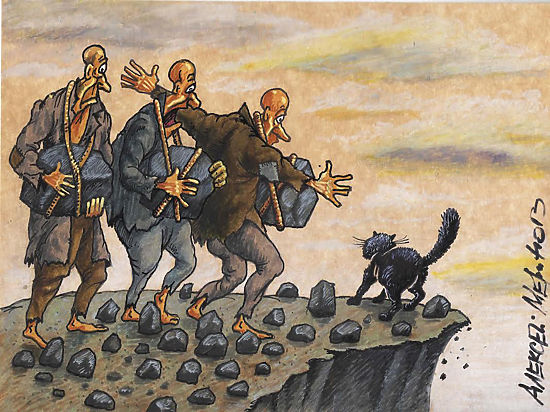

“This has already been discussed: the need for targeted, more flexible labor market, the decision on encouragement of the persons who have reached retirement age to continue labour activity, and a lot of other, a great number of issues of the social sector. If it does not change, then the social burden will increase from year to year and, in the end, we can get very nasty budgetary situation”, – says Nikita Maslennikov.

This year it is possible to spending budget

As for the features of the budgetary situation of the current year, then, of course, there are certain risks to avoid which will fail, in this connection, it is possible to consider three main versions of events. “It remains equally probable and optimistic course of events regarding the optimization of public expenditure, and the not so good and downright bad scenario in which there is a further growth of budget expenditures and their subsequent financing from the reserve funds and the acceleration of inflation and deceleration of the process of reduction of the key rate. If events develop under the worst scenario, access to recovery growth will occur for a few quarters later,” – said the expert.

In his view, a significant burden on the budget will have a disposable pension payment with the subsequent indexation in February. “On the circle it will be not less than 470 billion roubles.

The question arises, what will mortgaged the funds. And yet one of the most comfortable versions is that we begin, in fact, engage in medium-term fiscal consolidation and to analyze each article with careful attention to the potential savings. This is one of the options.

What will happen with the pension Fund?

And the chances of its realization while there. It is clear that 470 billion – this is a serious reason to freeze pension savings. But the official answers we don’t yet have. Accordingly, the question “What’s next with the pension Fund?” while freezes. There are a lot of questions more than answers.

Fears of Central Bank on fiscal consolidation of the Central Bank is absolutely justified, there is a sense of incompleteness about budget planning. For the Central Bank is the fundamental source from which will be repaid by the budget deficit, which this year will exceed 3% of GDP, what is no secret.

With regard to the reserve funds, this budget issue, and, respectively, and inflation risks. Or is it government borrowing. Of course, the conditions are now quite decent, but the problem is that, in the end, it’s the money we have to borrow from the economy. And if the economy begins to rise, then credit will go due to the deduction of investment potential”, – says Nikita Maslennikov.