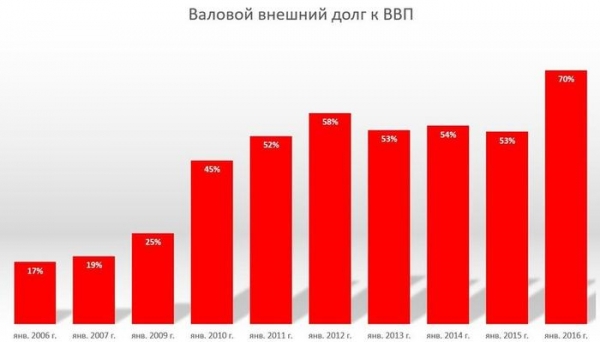

The economy made a circular motion and brought us back almost in the same situation, where we were ten years ago. GDP in dollar terms was lower than in 2010, and the trend of decline is maintained, since exports are falling at a faster pace. GDP-forming of many industry leaders, who is proud of the leadership of the country, are broke. Officially they are not only unprofitable, but also at an alarming rate accumulate arrears. Public debt also continues to grow, and Belarus is in danger of falling into the poverty trap, out of which would be extremely difficult.

The poverty trap is not hyperbole, but a specific economic term that refers to the difficult situation in which the fall of the country with a stagnating economy. One of the signs of the trap of poverty — the huge debt payments, which occupies a significant part of the budget. This money has to take medicine and education — soon the problems begin in these areas, and then the country turns into something African with poor health and education, poor infrastructure and corrupt governance. In the end, formed the conditions under which the state cannot overcome the crisis without outside help.

GDP in 2015 fell below the level in 2008 and 2010 and is $54,8 billion in terms of average annual exchange rate of the national Bank. According to IMF forecasts, the country’s GDP this year will fall another 2.7%. A small increase can only start after 2018 and it is only due to the so-called “low base effect”, when the fall reaches the bottom and starts at least some minimal growth. Although our government look at the situation optimistically and predict GDP growth this year by 0.3%.

*GDP in billion US dollars is calculated based on data of Belstat in Belarusian rubles and average official rates of the Belarusian ruble against the US dollar, 2011 based on quarterly values.

The main reason for the fall in GDP — a decrease of exports, which is now also dropped to the level of 2010. Thus, foreign trade balance remains negative — we as a country continue to import more goods than we sell. That is characteristic: the biggest drop in exports had a time in the industry. It turns out that, in fact, our GDP-forming flagships pull the economy down. If you compare 2010 and 2015, the reduction of exports in areas such as chemical fibers and threads amounted to 20%, the refrigerators 22%, tractors — 25%, trucks — 43%. When considering separately and more closely the category of “trucks” we understand the scale of the disaster: if in 2006 abroad, it sold 13.2 thousand units in 2013 to 10.9 thousand, in the pre-crisis 2014 — 8,8 thousand in 2015 and 3.9 thousand, is the final drop for ten years on 70%!

*based on data of Belstat

It is worth to realize that although to a large extent the collapse of the indicators associated with sagging of the “Russian” market, the main problem still lies in the low competitiveness of our products. Today, as practice shows, Belarusian products are of little interest to buyers from other countries: a decade of modernization did not give the desired results.

The fall in GDP and exports has resulted in a currency gain of the enterprises has decreased significantly, which is reflected in their financial stability. Problems with payments between legal entities began in 2015. We remember that at this time the Ministry of Finance issued foreign currency bonds to support the Minsk tractor works and “Gomselmash”, this was done in order to find these companies any money. But it didn’t help that companies continue to increase receivables and payables: there is a triggering Domino effect, when debts are passed along the chain from large companies to their suppliers.

The share of unprofitable legal entities in the country (including both private and public sectors) for 2012-2015 has increased almost 4 times. Thus by the end of 2015, almost half of the organizations cost-effective indicator of the profitability is in the range of 0 to 5%. This means that at any moment they can become unprofitable. If you add up the unprofitable and low-profit enterprises, their share is close to 60%. As for the industry, the situation is almost catastrophic: for the first two months of 2016 the share of unprofitable enterprises is very close to 50%.

*based on data of Belstat

But even better is the situation in the economy depicts the growth of overdue receivables and payables. If profitability is still possible to perform some accounting tricks, which is not very unprofitable factory miraculously turn into low-margin, non-payment these things never are. Debts have debts. Amount payables enterprises over the past three months increased by 5.4% and amounted to 372 trillion Belarusian rubles.

In itself, the increase in accounts payable is not dangerous when the country is experiencing economic growth: companies increasing the “creditors proportional to the increase in production. Much worse when rising overdue loans and receivables: this means that companies are not able to pay its debts. And this is happening in our country at an alarming rate: over the last six months in the real sector, this figure has jumped from 15.5 to 18.5%. The most difficult situation is traditionally develops in three major industries that employed so many people, is agriculture, where overdue payables is 31.6%, construction (20.7 percent) and industry (19,9%). That is, without government support these industries already virtually unable to pay its debts.

Rapidly growing debt for electricity and heating. Over the past two months it has increased by 1.5 times — from $ 7 trillion to 10.8 trillion. Many enterprises simply have no money to pay for fuel and energy resources.

All this, of course, is reflected in the credit market. The proportion of bad debts, according to the national Bank, increased in 1,8 times and by March 2016 to 3.2%, which very negatively affects the financial stability of the banking system.

On the problematic debts of the enterprises have to pay the taxpayers. So, in 2015, the Finance Ministry had to fulfill government guarantees on domestic loans of 6.9 trillion Belarusian rubles, which is two times more than in 2014. in Total on 1 January of the current year the debt of enterprises on executed guarantees of the government amounted to 11 trillion rubles. I repeat: this is the money from the budget, which we replenish with you.

*based on data of Belstat

All these figures indicate that in the current reality the only possibility to somehow change the situation — a full-fledged economic reform. Unfortunately, not even half-measures will help. Certainly the process of these reforms will be painful for the average population. But here it is worth considering which is better — a slow and subtle “fading” with the very sad outcome certain or decisive action that may appear the prospect that we will be able, finally, to break the cycle.