The saving rate in China (investment to GDP) is 18%. This is not enough to modernize the economy. For comparison, in China the figure is 42%, India 27%, in South Korea — 28%. Russia lacks investment.

Hope for foreign investment is also not necessary. They are small. In General the amount of investment the foreign investments account for only 2-4%. And even if we consider organizations with foreign capital participation, it will still be a small amount — 14%. On the basis of the crisis is not going away.

Obviously, you need some additional source of investment. It could stimulate the state due to the issue. But this approach has a lot of enemies. Let’s see how solid their reasoning.

<hr/>

ARGUMENTS AGAINST

Opponents of using the issue as a source of investment (opponents of the emission of the ruble), as a rule, give two arguments:

1. In accordance with the Fisher equation, the money supply should grow at a rate faster than the growth rate of nominal GDP. Otherwise, supposedly there will be inflation:

MV = PQ (where M — quantity of money V — velocity of circulation, P is price and Q is quantity of goods).2

2. Inflation in Russia is primarily monetary in nature — that is supposedly arises mainly due to the increase in the quantity of money.

Both these claims are incorrect. We present the arguments in their refutation. Let’s start with the first one.

<hr/>

THE FISHER EQUATION?

Making a conclusion about the inevitability of inflation in the case of the issue, opponents of the emission of the ruble does not take into account that the real economy is far more complicated than the equations of Fisher.

In reality, the increase in the quantity of money leads to higher prices only in the case when it reaches a critical value. If money supply growth outpaces nominal GDP growth within the safe range burst of inflation will not. This is confirmed by the example of many countries where the money supply for a long time grew more rapidly than nominal GDP. While inflation has not accelerated. This suggests that the emission can be used to start economic growth. It only remains empirically find out what the range of fluctuations in the money supply is safe for our country. This can be done by gradually increasing the stimulation of emission by careful monitoring of the situation with prices.

Opponents of the emission of ruble they say that the faster growth of M2 (money supply) in the absence of adverse economic effects is possible only in developed Western countries, where different structure of the economy and other issues. But among the countries that are successfully developing at high growth of the money supply, are present not only Western countries. Here are some examples, which include and dynamic members, the BRICS, and the post-Soviet countries and post-socialist States of Eastern Europe, and other economies (tab. 1).

Table 1. Dynamics of certain indicators in some countries of the world

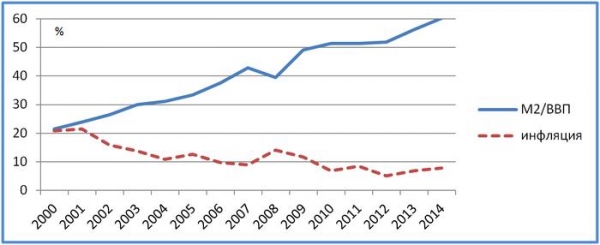

On average in all these countries over the years 2000-2014 nominal GDP growing at 10% per year, and the money supply — as much as 16% per year. As a result, the average monetization ratio (the ratio of M2 to GDP) for these countries increased from 47% in 2000 to 70% in 2014. Despite this, the average annual inflation for these countries were made in 2000-2014 only 5%. This maintains real GDP growth to average 5% per year (Fig. 1).

RIP. 1. The average for the whole population of the above countries over the period 2000-2014 .

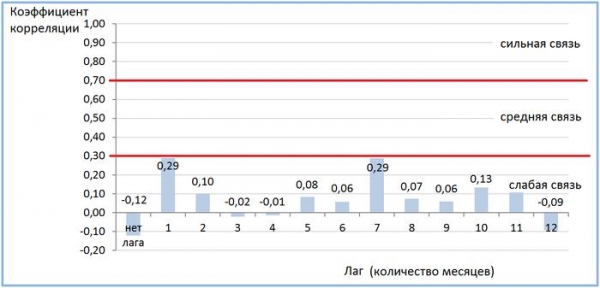

By the way in Russia for 2000-ies, the Fisher equation has not worked. The money supply grew more rapidly than nominal GDP, which resulted in the increase of the coefficient of monetization. Despite this, inflation does not grow, and fall (Fig. 2).

Fig. 2. The dynamics of the coefficient of monetization and inflation in Russia in 2000-ies

<hr/>

MONETARY NATURE OF INFLATION?

Now expose the allegation of mainly monetary character of inflation in Russia. In order to understand how inflation is associated with fluctuations in the money supply, it is necessary to calculate the correlation coefficient between these two indicators. You need to take as much data as possible, we will therefore use data on changes in the money supply and the inflation rate in Russia for each month over the January 1999 to June 2014. Only 185 months.

There is an assumption that inflation occurs in response to the increase in the money supply, but not immediately, but with a certain delay (lag). Therefore, to calculate the correlation coefficient for various lags (1 to 12 months). We obtain the following results (Fig. 3).

Fig. 3. The correlation coefficient between the change in the money supply and inflation in Russia in 2000-2014 years

As we can see, under all the lag correlation between changes in money supply and inflation is weak (strong correlation: ±0.7 to ±1; average linkage: ±0.3 to ±0,699; weak interactions: 0 to ±0,299). We could say that inflation in Russia is caused by the increase in the quantity of money only if the correlation coefficient showed a strong connection. But it is not.

At least some connection between the dynamics of money and inflation can be traced with a lag of 1 month (other values of correlation coefficient are too small, and lag 7 months improbable in view of the considerable distance in time). But even in this case, calculations show that inflation is a monetary factor (money supply growth) is only 8%. The remaining 92% of inflation associated with other factors. In particular, monopolies and inflation expectations.

The budget process in Russia is arranged in such a way that every year in December, responsible for the budget of the agencies inject into the economy the money that they do not have time to distribute throughout the year. As a result, the money supply simultaneously increased by 8-13% (the exception was only the Dec 2008).

Until 2011, steadily observed the phenomenon of the January increase in inflation. It was possible to assume, that the price increase in January, with a lag of 1 month was caused by the December irregular the money supply. However, after the annual indexation of tariffs of natural monopolies was postponed from January to July 1, the January spikes in inflation have disappeared, despite the fact that the annual December jump of the money supply has continued. It became clear that the January increase in prices was due, not the monetary factor, and the indexation of tariffs of natural monopolies and higher prices of other manufacturers, which were timed to growth of tariffs and the beginning of the fiscal year. Monetary nature January price increase seen in the behavior of inflation in January 2009 — the rise in prices has increased, despite the lack of monetary growth (Fig. 4).

Fig. 4. The dynamics of growth of M2 and inflation from the previous month in Russia

<hr/>

THE SAFE LIMITS OF EMISSION

In December 2011, the economy was off-loaded to 2.6 trillion rubles In December 2012 — RUB 2.3 trillion In December 2013 to 2.2 trillion RUB. And in December 2015, money supply increased by 2.5 trillion RUB. In all these cases, the increase in money supply had almost no effect on inflation. Obviously, the safe range of capacity-M2 is large enough and allows efficient use of the emission mechanism to support investment. It would seem that the state should actively use this tool.

In January 2015, Russia launched the program of project financing, in which shall occur the refinancing of commercial banks by the Central Bank for concessional lending for investment projects. But what is the volume of refinancing under this program? Initially in 2015 specialized governmental Commission has approved loans amounting to 235 billion rubles, the Central Bank put a limit of refinancing in the amount of 100 billion rubles For implementation of the program, the Central Bank promised to increase the limit. However, in March 2016, he suddenly quit playing, and actually froze the issuance of loans under the program of project financing. Thus, the Central Bank has restricted the issue of investment of a hundred billion rubles. And it within time period more than a year.

Despite the fact that (as we have seen above) increase the money supply by 2.5 trillion rubles in one month is not able to cause serious inflation risks.

The surprise is and the size of the interest rates on project financing. The Central Bank provides money to authorized banks at the rate of 9%. Margin of commercial banks is limited to 2.5%. In the end, the cost of credit for the final borrower is 11.5%. Why would so inflate the cost of subsidized loan — is not clear. At such rate loan is higher than the average profitability of Russian enterprises, which is about 9%. In this scenario, foreign lending at 3-4% still remains more humane for Russian business than lending through its own Central Bank. But not all businesses can afford to borrow abroad. It is the prerogative of the larger firms. Therefore, only a quarter of loans taken for investment in foreign countries.

The main argument of the community Bank against project Finance — risk-taking banks and the Central Bank. The reaction of commercial banks predictable. They have limited margin under the program, and they are unhappy. But what hear from the Central Bank in fact, the assertion that the economy should not be developed because it is not in the interests of the Central Bank? The question arises: banks exist to serve the economy, or Vice versa — the real sector exist for the welfare of the banks?

Excessive inflation phobia deprive the economy of growth opportunities. These data indicate a potential emission source of investment. Possible options for its use should be carefully studied and applied in practice. However, at the highest level of government this is no solution.