Formally, the crisis in Russia continues, 2014. But actually it started back in 2013 — that’s when there was a downturn in certain sectors. All this time the dynamics of investment leaves much to be desired. According to the latest data (February 2016 to February 2015) the annual decline was 8.4%. This means projecting the crisis in the future. The underfunding of business today means losses tomorrow. At the moment, money for investment is not enough, but that guarantees shortages and in the longer term. If bad luck leads Russia in a vicious circle of recession.

The idea that money in the country, is not quite correct. Actually the money is there. It’s just that they are derived from the real economy to the speculative turnover.

MYSTERIES OF HISTORY

It is considered that the era of European prosperity began in the XIV century, and was associated with the Renaissance. However, the reconstruction of the economic life of Europeans has shown that at least in an economic sense it is not. In X–XIII centuries the European world had experienced one of the most successful periods in its history. Throughout Europe built cities, churches, bridges, windmills etc. In the XIII century in Austria even constructed the first experimental greenhouse.

However, by the fourteenth and fifteenth centuries the economic boom is over. The rapid development of economy and crafts is replaced by desolation. The following comparable economic growth will be associated only with the industrial revolution. The end of the economic miracle X-XIII centuries could be explained by the plague, the atrocities of the Inquisition, religious wars, etc. But a few years ago a book was published by a Belgian researcher Bernard Lietaer “the Soul of money”, in which the author explained the reasons for the economic boom of Europe of X-XIII centuries and of the crisis later time.

It appears, from the tenth to the thirteenth centuries in European countries had a monetary system with a demurrage — a fee simple, for the storage of money. The fact that the services of moneylenders in their modern form at that time did not exist and people donating money in the Bank, didn’t get a cent and, on the contrary, were paid for keeping their savings. Money did not stay in the stores — and the constantly revolving in turnover, was invested in profitable enterprises and spent on consumption. Cash is virtually no turnover was limited, as the coins were not minted from precious metals, and the lack of them was not. The lack of opportunities to invest wealth to anything but the real sector, forced the capital to work for the benefit of people. This was due to an economic boom.1

But to the XIV century triumphed monetary system based on precious metals. Cash deficit immediately undermined economic system. And appeared on the political stage, lenders have dealt the final blow to the economy, moving money out of real turnover in the financial sector. This historic example is a perfect illustration of what leads to the withdrawal of money in speculative transactions. This is what happened in Russia today.

PAPER INSTEAD OF MACHINES

As you know, one of the main factors of attractiveness of investment is the expected rate of return. The higher it is, the more attractive the business to a potential investor. Now let’s see where to invest prudently the Russian businessman. You can invest in the real sector. Then will make a profit of about 8.5%. But this average. And so it can vary from 5.1% in construction to 22.2% in mining (Fig. 1).

Fig. 1. The profitability of sold goods, products and services 2014 %

By the way the loan rate for manufacturing companies is on average almost 14%, which is higher than the average return. But this is only for the largest and most reliable borrowers loans cost 14%. The majority is forced to pay more and often get rejected in getting a loan — banks are not sure of the client and prefer to play it safe. Many industries cut off from credit. But back to options investing.

In addition to investments in the real economy there is an option to purchase currency. Here, the profit may exceed 100%. Those who bought dollars at 34 rubles in mid-2014, and sold them at the end of the year for 70 rubles — and he did. As Lenin said, referring to Marx, he referred to Thomas Joseph Dunning: “Provide 10% [profit], and the capital agrees any application, at 20% it becomes animated, at 50% is positively ready to break to itself a head, at 100% it tramples on all human laws, at 300% there is no such crime on which he would not dare, even on pain of gallows”.

In Russia there is all that is done to our businessmen were willing to flout norms of humanity, but not yet removed limitations on any crime. Although with the active participation of the Central Bank and the approval of President Putin we are consistently moving.

Finally, there is the option just to put money in the Bank. The current level of Deposit rates (almost 10%) allows you to store them on much more favorable terms than investment in the real sector (see the correlation with profitability). Risks — minimal: no need to build something, to search technology, to attract labor, conduct numerous coordination, to pay a lot of bribes, etc. Just open the Deposit and let some drip percentage.

Part of the contribution, of course, will be eaten by inflation, but the final result will still be on average more profitable than investment in machinery or agriculture. And such trouble as “will eat inflation” is very conditional. People don’t goes with your added money on the consumer goods market, where you can only grieve for the inflationary shrinkage of funds. But money from the businessman in turnover, in the accumulation, not consumption. It solves other problems. And what’s inflation?

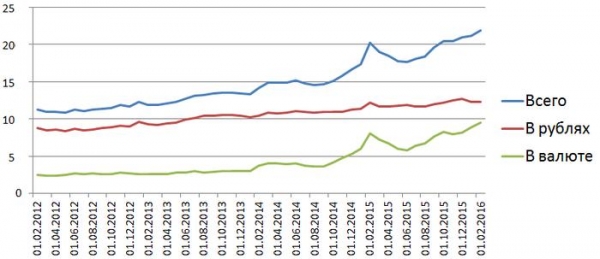

The gradual transition of companies to a strategy of accumulation of cash in the currency and Bank deposits is also reflected in the statistics (Fig. 2). Interesting peak in early 2015. Public policy actions by the Central Bank, as can be seen, is very affected by a withdrawal from production traffic. The authorities would not have to work, don’t need to do the production. Engage in hoarding, rent-seeking, financial operations, rental parasitism. Amazing policy!

Fig. 2. The total amount of funds, Bank deposits (deposits) and other borrowed funds of legal entities in rubles, foreign currency and precious metals, trillion rubles.

Since the beginning of 2014, Bank deposits of Russian legal entities increased by 64% and reached 22 trillion rubles (44% of whom have been accumulated in a foreign currency). Ruble deposits grew by 20%, currency in 3 times. And this despite the fact that the intensity of the external economic turnover in Russia fell. Question: why are businesses so much money? The answer is simple: keep these savings deposits is more profitable than to invest.

Over the last two years the turnover of the Russian industrial enterprises at current prices increased by 13%. Consequently, the amount of funds for its provision, logically, will have to rise by a comparable amount, but not by 64%. Even allowing for the devaluation of funds in the accounts of Russian legal entities were supposed to reach no more than 19.7 trillion rubles. It turns out that 2.3 trillion rubles on accounts of lying relatively speaking unreasonably. In other words, investment potential of the Russian economy is not implemented in 2.3 trillion rubles because entrepreneurs don’t see the point. Instead of producing machines, equipment, tools, etc. they are invested in the green paper. Formally, this can also be called an investment. But unlike normal investments, these investments do not create anything new and useful for the common man. All they generate is a profit of speculators. Profit from nothing — literally from the air.

Air investments is a new specialization of Russia in the world division of labor. But as you know, if it arrived, so somewhere out. If enriched financial speculators, so someone has to get poorer. That someone in Russia is the workers of the real sector and the economy in General. Material increment of wealth is not happening. Their interests are subordinated to the interests of the speculative class. It is the public policy of parasitism.

Sadly, but development institutions (Investment Fund, the Fund of assistance to reforming of housing and communal services, Vnesheconombank, etc.) the majority also followed a speculative way. Functioning on the principles of sustainability, they replicated a classic commercial logic of profit. The massive use of practice financial scroll tools designed to support innovation. It is not difficult. At first, we set very high standards for potential recipients of funds, and then (when no one can get them) are declared temporarily free money and raspakhivayutsya to the banks. One of the first this option was utilized in the Corporation “Rosnano” under the leadership of Chubais.

While in Switzerland, for example, the state sets a negative rate of return on the deposits of commercial banks at the Central Bank, makes money work. So what is done in Russia (in the presence of different approaches and methods of regulation) — is a conscious choice.

And let’s not forget about the rests of budgetary funds on accounts of credit institutions that exceed 5.3 trillion rubles. It is public money at the disposal of the state. That appeal directly to them reveals the state approach, the type of public policy. This money largely also are locked up in the sump, unused investment resources. Of course, part of these funds, that is, are “associated”. For example, the accounts of Vnesheconombank placed 195 billion rubles from the national welfare Fund. However, not all funds on the accounts of the budget accumulated in there reasonably. A considerable part of them was a long time to be spent on targeted needs.

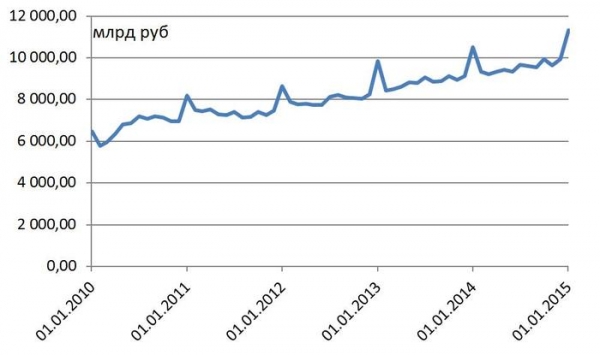

This situation often occurs at the end of the year. The fact that each year public authorities do not hasten to transfer the funds to final recipients and performers. The reasons are mainly two: the poor performance of the bureaucracy and the desire to be welded on bribery-kickbacks schemes of communication with recipients. In the end, before the New year in the accounts of the Federal budget accumulated an impressive amount, which in an emergency mode scatter on ministries, departments and regional authorities. This is reflected in the statistics of the monetary base, which jumps up every year before the New year and after it is withdrawn back. Of course, any efficiency of development money in such a short time can not speak (Fig. 3).

Fig. 3. Dynamics of monetary base in Russia

CONCLUSION

The assertion that the hand of the market is smarter than the brain of any state of the Manager, is no longer tenable. Perfect market (without government intervention) is not only able to maximize the results, but may introduce economy into a state of artificial stupor of progress, when in the presence of all necessary resources for the development of the economy stalling out of the blue. To overcome such situations and requires state intervention. Only the optimal combination of market and non-market mechanisms allows to build a thriving economy.

As far as the economic policy of Putin’s time — it is a rental economy, economy of parasitism. Development in this economy cannot be in principle.