Presidential adviser commented on the basic tenets of the new project of the Bank of Russia.

Not long ago, the Board of Directors of the Central Bank published on the official website of multipage project “the Basic directions uniform state monetary-credit policy for 2017 and 2018 and 2019”. “MK” has studied it, along with presidential adviser Sergei Glazyev, who agreed to comment on the main tenets of the document.

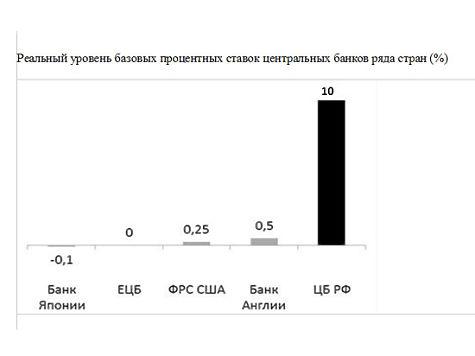

— Let’s start not with the project, and its authors. What do you think, what has caused the recent statement by the head of the Central Bank of Elvira Nabiullina about keeping the key rate at 10% until early 2017?

It is based on the opinion about the redundancy of the debt burden in the economy. The project is written: “it is Necessary to lower market interest rates in nominal terms is not ahead of the slowdown in inflation and inflation expectations, maintaining a savings activity and at the same time suppressing the tendency toward borrowing in the economy, including limiting the undesirable increase in the debt burden”. The authors do not understand that the excessive increase of debt burden for most sectors of the economy was not due to the increase in borrowings and increase in interest rates has made many previously successful businesses insolvent.

In this regard, all statements about “maintaining the restrained credit activity” look like a cynical mockery of drowning, which after the landing of a vessel aground refusing to provide swimming facilities.

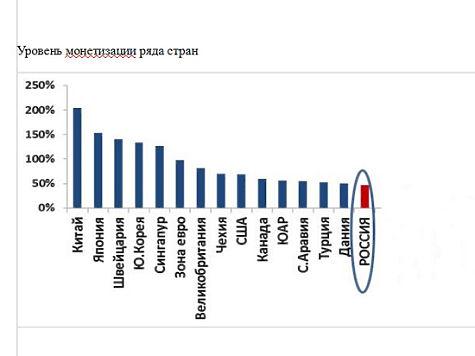

Currently, the ratio of loans to GDP in the Russian economy is 42%, which is several times lower than in advanced countries. If we proceed from the real needs of simple reproduction of the economy, we should recognize that objective due to the demand for loans is satisfied no more than on half, and in some industries is not satisfied at all. This is the main reason for neogrounded production capacity, the insignificance of import-substitution and the cessation of economic growth.

The last went into a recession after a sharp rise in the key rate. Enterprises were forced to return loans, and the curtailment of production, investment, on the one hand, and to raise prices to cover increased interest rates on the other.

Now a quote from “the Basic directions…” about the ruble. “The floating exchange rate regime… creates incentives for correct responses of all participants of economic relations in the changing external environment, providing optimum adjustment to the it economy.”

— What kind of “correct response” say the authors? Flow of money in the currency market, volume of transactions which has grown five-fold and over an order of magnitude exceeded the level of economic activity? Waiver of investment projects as a result of the double rise in price of imported equipment? On the dollarization of the economy in connection with the impossibility of planning of trading operations in roubles and devaluation of ruble savings? If by “optimal adjustment” means the flight from the rouble, the decline in the already insufficient for the reproduction of the economy of investment, we have to state the obvious inadequacy of understanding of the objectives of macroeconomic regulation of the Bank of Russia.

Enterprises considering the unpredictability of the ruble as the main negative factors causing uncertainty and depressing any business activity.

Absurd is the claim that “element mitigate the impact of negative factors on the economy is left floating ruble exchange rate”. In fact, the freely floating exchange rate does not soften, and multiplies the action of external factors.

On the contrary, in this mode, the speculators enhance the effect of the shock using any fluctuations in the external economic environment for rocking the currency market with the purpose of extracting profits.

This passage is just a bad excuse for the further preservation of the free navigation of the ruble in the interests of currency speculators, which makes it impossible to maintain the necessary diversification of the economy investment activity and, consequently, the disposal of raw dependence.

Finally, the regime of free floating of the ruble became the main factor of inflation and the destabilization of the Russian economy that plunged her into stagflation. In fact, the Bank of Russia gives the international exchange rate speculators, which controls the Moscow stock exchange.

It is not excluded that the observed in recent months, the upward trend of the ruble will soon be replaced by the artificial collapse, as was done in 2014, 2008 and 1998.

Next: “the Strategy of inflation targeting (it had been announced by the Central Bank at the end of 2013. — “MK”) is most suitable for Russia at the modern stage, especially in adverse and volatile situation on the world markets, limited access of the Russian economy to external financing”.

— The policy of “targeting” cannot achieve its goals because it involves an artificial increase in interest rates, deterioration of conditions and reduction of credit, and of free swimming of rouble. The first entails falling investment and production, its degradation, increasing costs and therefore reducing the purchasing power of money. The second transmit rate fixing international speculators who were rocking the course, causing inflationary wave. Therefore, the transition to the “targeting” of inflation resulted in not her two-fold reduction as planned of the Central Bank, but rather a two-fold increase, as expected.

Having an objective resource indicators the opportunity to grow at a rate of 8% per year, the Russian economy was hit with this trajectory. The total damage from this policy is estimated at 20 trillion rubles unproduced GDP, 3 trillion rubles of investments to be done, more than 10 trillion rubles in lost income population.

The Central Bank does not understand the meaning of the ongoing worldwide monetary and industrial policies, which focused on the promotion of investment in the renewal and modernization of the production sector based on the rapid growth of new technological order and accompanied by quantitative easing, negative interest rates and deficit budgets financed by earmarked money issue.

— The project has such promise: “In the next three years there will be a surplus of liquidity.” Do you agree?

All this is akin to the statement about the surplus food in the famine-stricken country, whose population is unable to purchase the required products as a result of overpricing by monopolists and the state.

If we proceed from the needs of simple reproduction of the economy, objectively, the lack of liquidity is not less than 5 trillion rubles, which was seized after the transition to a policy of “targeting” of inflation. To this sum should be added $200 billion paid to foreign creditors after the introduction of anti-Russian sanctions.

A significant amount of money was reallocated due to an administrative revocation of licenses of many commercial banks, “capitalization” and “rehabilitation” of some of them, as well as payment of guaranteed compensation to depositors, including at the expense of credit issue of the Central Bank the Agency on insurance of contributions (estimated at 3 years of at least 3.5 trillion rubles).

Thus, rejecting the need for a recovery of the monetization of the economy by market and budgetary channels, the Central Bank conducts monetary emission voluntaristic way, capping at the expense of her marriage (improper supervision) in their work.

In General, the transition to expanded reproduction of the economy is impossible without proper monetization at the expense of domestic sources, which according to international experience should be not less than 80% of GDP. However, the project “the Basic directions…” provides for the preservation of monetization at the current level, is clearly insufficient.

And again. Inflation is primarily a monetary nature. This, in particular, is evidenced by the fact that the total money supply growth in the Russian economy for 2000-2015 was many times higher than the amount of the total inflation.

— In this case, the intention of the Central Bank, “the main instruments of monetary policy will be Deposit auctions”.

— I believe they will work to increase the existing shortage of liquidity, the consequence of which will be further artificial contraction of the money supply with all its consequences: the fall of production and investment with a parallel depreciation in the purchasing power of money, i.e. inflation.

The use of this tool as the primary means cutting off the loan from production with profitability lower interest rates on deposits of the Central Bank. Because it is tied to the key rate which it is proposed to retain relatively high levels, manufacturing industry, agriculture, construction, transport will be cut off from credit.

— However, the document rightly recognizes that the dynamics of Bank lending and a corresponding increase in the money supply represent a derivative from the needs of the economy.

— It is obvious that in the current situation, the low demand for money is primarily a result of prohibitively high interest rates, which greatly exceeds the average level of profitability in industries, and lower domestic demand — largely due to the devaluation of the ruble. Of course, it is not possible to use “dear” money in the economy. Lower interest rates will automatically lead to enhanced demand for loans and will contribute to the financing of investment through Bank lending.

Since the start in 2014 “a moderately tight monetary policy of the Central Bank” the intensity of bankruptcies has increased dramatically. Especially affected borrowers, implement long-term investment projects and became bankrupt due to unilateral revision of the terms of the loan. Policy of the Central Bank to raise interest rates provokes banks to raider seizures of customer assets by deliberate deterioration of the conditions of their lending, which may not foster the launch of sustainable economic growth.

The Bank of Russia is pursuing a policy which becomes progressive technological backwardness and lower competitiveness of the economy, which leads to its degradation, high inflation backdrop and the impoverishment of the population.