Why the IMF and Rothschild is sentenced to the global economy

The IMF is waiting for the collapse of the global economy. Jacob Rothschild encouraged not to rely on the US, the EU or China — they are not able to save the world from a new crisis. “Ribbon.ru” to find out what place Russia will occupy in the process of tectonic shift of global economic and financial system.

Sketches of collapse

The risk of collapse of the global economic system increases. On 8 March at the session of the National Association of Economics and business, said Deputy Director of the IMF David Lipton. He acknowledged that the world economy is in a “really difficult situation”. Lipton outlined two key problems, which cause him to paint a bleak picture of the future. The first is the fall in demand and the slowdown of the planetary GDP. The second is the risk associated with increased volatility of commodity and financial markets.

The IMF representative appealed to the leaders of the States of the world: “It’s time to support economic activity and to restore the stability of the global economy”. Recommendations Lipton is simple: the state in such difficult times must take stimulus measures, otherwise disaster is inevitable.

Earlier, the international monetary Fund downgraded its forecast for growth in global GDP. The IMF expects that in 2016 it will increase by 3.4 percent (0.2 percent less than in the previous forecast).

In unison warnings David Lipton said the head of investment Fund RIT Capital Partners Jacob Rothschild. In early March he contacted his clients with a letter in which he explained that currently, some countries are experiencing “serious problems” because of rising dollar and falling prices for raw materials they find it difficult to repay foreign currency debts. In several of these States Rothschild put Russia, Ukraine, Kazakhstan, Nigeria and Brazil.

But this particular. Lord Rothschild was more worried about the state of the world economy as a whole. “The list of challenges facing investors, is a frightening prospect. Stimulating the quantitative easing program stops working. The extent of the slowdown of the Chinese economy are not clear. The development of the economies of the EU and the US is disappointing. The situation in Greece is daunting, and the country faced an unprecedented flow of migrants,” he enumerates.

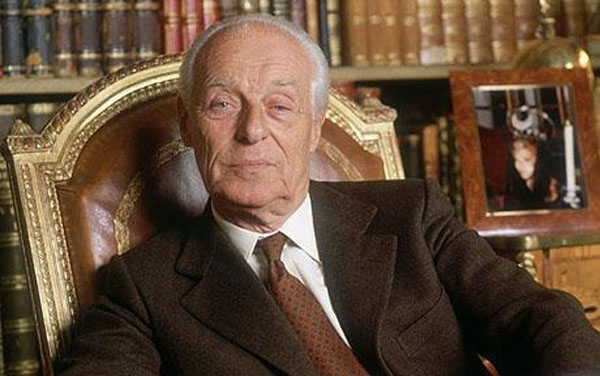

Jacob Rothschild disappointed in the growth economies of the European Union and the United States

At the same time, Jacob Rothschild is confident that in 2016 the Fund will not experience difficulties. “Problems create opportunities. I have no doubt in our ability to identify them and benefit from them”, — such words ends the letter by the head of RIT Capital Partners. All this does not negate the fact that the world must prepare for the era of change. Someone will work on them, they will lead to the collapse.

Chinese box

The key place in pessimistic predictions, China has taken. One of the world’s largest economies (in 2014, the IMF put China in first place in terms of GDP — is 18.1 trillion dollars, the USA with 17.3 trillion) has entered a period of uncertainty. This was stated by Rothschild, it meant Lipton, the report of which is clearly influenced by negative Chinese statistics.

In February exports from China fell by 25.4% in dollar terms (compared to the same month last year) — this is the worst result since 2009. At the same time imports fell by 13.8 per cent. 2015 country ended with GDP growth at 6.9 per cent. At first glance, the result is beautiful. For example, Russia’s economy in the past year fell by 3.7 percent, the U.S. added 2.4 percent, the European Union grew by 1.8 percent. But for China, developing at a faster pace, the outcome of 2015 have been a bust. So slowly the GDP of the state has not increased for 25 years.

The main Chinese index — Shanghai Composite — is at a level of 2805 points (on 10 March it fell by 2 per cent to 58 points). The reaction of world markets fluctuations eloquently demonstrates how much now depends on the global economy from China. Recall: in January, the American index Dow Jones has fallen more than 900 points. Then it was noted that this has been the weakest start to the year for the United States over the past 119 years. The drop in the U.S. stock market was preceded by the rapid decline Shanghai Composite. 7 January, the index fell more than 7 percent, and trading at the Shanghai stock exchange had to stop.

“Given the fact that China is one of the largest players in the global market, the country’s economic problems also affect its trading partners by reducing expectations about the consumption of raw materials in the world that weighs on prices and, consequently, has a negative impact on the exporting States,” said “the Tape.ru” an analyst of group of companies “Finam” Bogdan Zvarich.

“The Chinese economy will decelerate to growth rates of developed countries. This in itself is not dangerous, — has explained in conversation with “Tape.ru” Advisor on macroeconomics General Director of the brokerage house “OTKRITIE” Sergey Chestnov. Dangerous high level of debt. Some optimism inspires the fact that almost the entire debt of the PRC. And manage it well”.

Indeed, the total debt of China recently swelled very quickly. In 2014, according to consulting company McKinsey&Co, volume reached 28 trillion (155 per cent of GDP). For comparison: the same indicator in the US at the moment to 19.1 trillion (105% of GDP), and according to a former head of the accounting chamber of the United States Dave Walker total debt is 65 trillion.

David Lipton called on politicians to restore the stability of the global economic system

China with all its problems could trigger a new global crisis. Billionaire George Soros does not exclude the recurrence of 2008. Will accelerate the collapse of the Chinese government, trying to translate the country on a new track — with a model based on production and investment, to an economy of consumption and services. “When I watch the financial markets, I see serious challenges,” Soros warned investors in early January.

The place with the edge

According to Sergey Carboni from “Opening”, the words Lipton about the collapse of the world economy is overly emotional assessment. “Very likely for a long period of stagnation, similar to the stagflation of the 1970s”, says the expert. The state of stagflation characterized by a simultaneous occurrence of two processes: economic depression (the slowing down of GDP growth, recession, rising unemployment) and inflation.

In the forthcoming economic performance of Russia in any case prepared for the role of the observer. The contribution of our country into the global economy is not so great — a little more than 3 percent. By 2020, Russia’s share will decrease to 2.5 per cent (the worst in the entire history of the country since the collapse of the USSR), predicted the former Finance Minister Alexei Kudrin.

And growth within the country should not wait. All forecasts indicate that Russia’s GDP in 2016 will not be back in the plus zone. Predicts the decline in the economy and the big three international rating agencies — Moody’s (1.5 percent), S&P (2.5 percent) and Fitch (1.3 percent). The IMF predicted a decline of 1 percent, world Bank’s 0.7 percent.

“The worsening global economy will lead to the withdrawal of funds from emerging markets. But Russia is not threatened, as in recent times, most of the foreign capital has already flowed out of the country due to external pressure and sanctions,” — says Bogdan Zvarich. In his opinion, the only factor now could affect the Russian economy, the fall in the prices of raw materials. While the analyst believes that the price of oil is unlikely to fall below $ 25 per barrel.

“Lipton is Dr. Doom (a supervillain from the comic book publisher Marvel — approx. “The tape.ru”). He predicted the crises and always advises them to treat the expansion of trade. New here a little”, — says the chief economist of the rating Agency RusRating Anton Tabah. However, our country that does not help, the expert concludes: “Russia will suffer from commodity cycle and falling demand in the developed world and China. Become an island of stability will prevent sanctions. You have to understand that in Russia the global crisis will add to the problems, and its absence will not restore growth.”