Without which we cannot imagine an efficient economy XXI? Without cash? Soon every vegetable stall Abkhazia will start plastic cards to take. Because the dirty paper Willy-nilly will depart in the past. Without a developed industry? The whole of the country they live happily ever after, earning on tourism and services, dozens of years trading ious. Without the banking sector? In principle, also possible. The advent of crypto-currencies on the parasites, speculators had already put a lot of rustling and sooner or later end in a victory of bitcoin and its analogues.

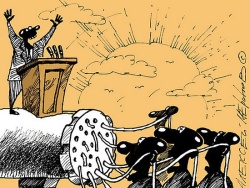

Until that happens, the banking bigwigs organized a decisive assault on our pockets, and making every effort to ensure that every reasonable person on the planet to enjoy life in debt, paying in the fact of its existence-interest organizations urged to bulldoze Karl Marx.

Outrageously acreditava Western Europe and America, the U.S. Federal reserve and his associates undertook developing countries. Industrial China, from the economic point of view all good, except one – his financiers do not know how to inflate “bubbles”, as do colleagues from developed countries. But celestial good learning. Sorry to lay there the population is, by and large, nothing, for to become rich even with a huge industrial leap, most Chinese citizens did not. But the cunning bankers have found a way out.

One of the “red” credit platforms has offered to lend local students… secured the Nude photos. Every age girl can get in debt from 75 to 750 US dollars at 30% a week, risking to become famous to the entire planet or be ashamed of in front of parents, in the case of late payment. And where to watch the Secretary General of the CCP XI Jinping? Apparently, in the bright future, not noticing

At the head of the Russian Central Bank Elvira Nabiullina your own erotic fantasies. The chief financial regulator of the country as a hobby the last couple of years with Nordic serenity watching to see how publicly exposed customers of Russian banks, citizens had the temerity to take an apartment in the mortgage, failing to ashes small and medium businesses. Yesterday’s lowering of the key rate from 11% to 10.5% – one of the subtle bullying. In the current paradoxical situation loans from banks can afford only very rich and not experiencing financial difficulties person able to give on top of the apartment cost about two are the same.

If you believe the polls of analysts of the Ministry of Finance, in the “debt victims of violence” appeared at least 45% of Russians. About 30% of respondents continue to experience his hardships to this day. Thus, about 28% of Russians admit the debt payments.

However, this is nothing more than a “soft erotica”. Our Central Bank prefers the genres harder, than do not hesitate to speak out loud. So Nabiullina spoke against the ban microfinance organizations so that the population has not requested assistance to criminal structures, although it would seem, where much criminal…

For anybody not a secret that those stripped of the Russians to the goal interest rates 400, 500, 900 and above, one flick of the wrist turning the three a half-million in loan debt. Few of the customers get to get away with just nudity. As a rule, are a true master of BDSM, which tactfully called collectors – specially trained monsters, burning alive, raping, breaking arms, legs, noses, leading to nervous breakdowns and suicides… the activities of the inseparable tandem of the lenders and the bulls, as it turned out, quite satisfied with a kind of civilized bankers who then do not hesitate to wear goggles!

We can say that in the beginning of XXI century the credit institution at once showed their true nature and intentions to leave the consumer not only without money but also without underwear. The logical evolution of “our things” will be the trade in human organs – not fully developed and terribly sought-after resource.