Oil continues to rise, as the American stock exchange. Why? Because the fed “has pagelabel” — the upper hand now took the doves, proponents of a rate cut. At the last meeting, the fed not only raised the rate, but rather hinted that the option of reducing also now quite likely. This is another step in the direction of the POPS, a policy of negative interest rates.

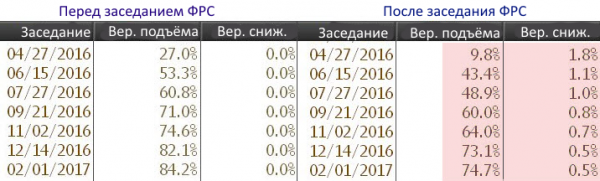

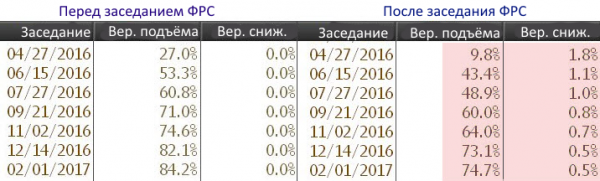

If prior to the meeting, market participants believed that the likelihood of a rate cut in April is equal to zero, but now they regard this probability as zero. Conversely, in a rate hike in April now believe only 10% against 27% previously:

http://www.vestifinance.ru/art…

http://www.zerohedge.com/news/…

As I already wrote many times, ultra-low rates is a dead end road. For example, Japan. Despite the fact that the printing press has long been operating at full capacity, while the yen declined significantly against other currencies, exports from Japan down to:

https://aftershock.news/?q=nod…

This means that the Japanese will be forced to print even more money, even more to lower the rate even more to weaken the yen. But, alas, these jerks will only be able to delay the inevitable.

Similarly, drift in the direction of POPS and other countries conventional of the West. Thus, recently UK banks and Switzerland has left rates at very low levels, and the Bank of Norway even lowered the rate from 0.75% to 0.5% annual:

http://www.vestifinance.ru/art…

So, step by step, a percentage of the interest, the countries of the West get bogged down deeper in the policy of negative interest rates. Predicting the future is easy.

Rates will fall even further. When they will fall significantly below zero, investors will begin to withdraw money from banks, and then for the sake of rescue of the banking system States, the European Union and other POPS mired in the state will be forced to seriously limit circulation of cash — preparation of what in recent months has been actively conducted.

However, POPS has a tensile strength at the level of minus 3-4 percent per annum for businesses and citizens just start to build alternative payment systems, money will begin to flow away from the banks with irresistible force, and this entire protracted history of life in debt over a logical hyperinflation.

I’ll be banal: you cannot live forever on credit. Of course, nice to look through photos of well-fed streets of Denmark or Sweden — but we must understand that real life is somewhat different from the tales of tourist brochures. External debt in Sweden now stands at approximately 115 thousand dollars per Swede: at least for the unearned money to the Swedes and managed to build quite an attractive facade, the real problems in the economy increase.

For example, in Sweden it is quite difficult to find a job: many even agree to work without salary, for free, just to get experience and qualifications. In addition, in Sweden a huge problem with the real estate market: low interest rates inflated the bubble to such a size that its unavoidable collapse can bring down the entire financial system of the country:

http://sverigesradio.se/sida/a…

Of course, no better case and in the United States. About gigantic external debt of the USA to once again mention I do not see sense, instead, to pay attention to another alarming indicator. One of the symbols of America, the largest machine-building Corporation Caterpillar of the country, reports that its sales are declining now 39 months in a row, and fall with acceleration:

https://aftershock.news/?q=nod…

This means that business around the world is no more money to buy more costly after the increase in the dollar’s special equipment type bulldozers and tractors. If the States will not weaken the dollar, including the printing press at full capacity, competitors will simply sweep the American company to reduce world market.

As we understand, that the collapse began?

Famous analyst Mohamed El-Ariane, suggests that the first “honk” the bond market. Quote:

http://www.vestifinance.ru/art…

Investors in bond funds promise daily liquidity — ability to sell assets and obtain cash at once, but we have too little evidence that the bond market will be viable. By this logic, any financial product that promises profits on the same day, exchange-traded funds, for example, looks at least strange.

With this in mind, keep 30% of your portfolio in cash is not “idiotic” decision, even if they do not bring revenue. So fasten your seat belts! The road will be bumpy.

As you can see, the analyst suggests American investors to diversify their assets into cash and keep them at home, in a safe Deposit box. Of course, the banknotes in the safe will not bring income, but, on the other hand, they will not be buried in bursting the Bank or in bonds of any bankrupt company.

By the way, about the bonds. Now again, a wave of exclamations that Russia allegedly “invested in the American economy by buying American debt.” I was going through that duck many times, so I want to ask you — do I need to do another analysis? Or everything is all clear, and the mythical “buying bonds” continue to rebel, only very very blatant trolls?

If necessary, I will not be sorry time to update the chart and once again to write about all of this.

Go back to the policy of Central banks. Our domestic Central Bank, too, adopted the decision on the bet — bet left on the level at 11% per annum, slightly above inflation:

https://aftershock.news/?q=nod…

The rouble on this background (and the background of rising prices of oil) is strengthened. I do not know the plans of the Central Bank, but I can assume that if the ruble will be strengthened further, somewhere in the level 50-60 rubles per dollar the Central Bank will start actively buying up foreign currency to keep the ruble from further strengthening:

http://politrussia.com/news/gl…

Especially interesting now to observe the indignation of the opposition: on the one hand, they claimed that the real level of inflation is not 10, and at least 30 percent, and on the other hand, they also believe that the Central Bank rate should be reduced almost to zero, enabling these enterprises to massively borrow at 5-10% per annum. No contradiction the opposition, of course, don’t see: they just want to take a loan, move in, say, dollars, and sit quietly, watching their debt month by month melts.

Once again, I note that “free” money is not what the economy needs for rapid growth. But, unfortunately, the passion for easy money is indestructible, and the bankers, in turn, do not get tired to tell us how sweet, easy and profitable we will be in the loan.

I remember 10 years ago in the Russian business media was a powerful advertising company microcredit. Then we talked about the kind of startups that have begun to distribute microcredit in the poorest Asian countries in order to help those out of poverty. Say, a poor inhabitant of Bangladesh took a loan of 10 dollars to buy himself shoes and pants, and then found a good job and could easily give the money back: and that’s just such a simple way, the whole country burst out from the economic quagmire on the road to prosperity.

Now we understand that microcredit does not enhance the level of affluence of the community — but then articles in reputable journals looked very convincing.

The same applies to business loans. It is in theory a businessman takes a few million in credit, was buying a machine and then this machine gives millions back. In practice, unfortunately, I know a lot bogged down in loans to firms, but don’t know a single one that would be exclusively using the loans got rich.

Summarize

Now we are seeing the beginning of the final stage of super crisis. The main economy of the planet will be vying to print money and devalue their currencies so as not to bow out of the race before the others.

Russia in this race for survival will be to participate only as a sympathetic spectator. Our foreign debt is extremely low, and the ruble, thanks to the sanctions, has already devalued enough by our industry was more than competitive.

Fritz Moiseevich Morgen