CEO StartTrack Konstantin Shabalin and head of analytical Department at StartTrack Alexander Chikunov has conducted research on the development of e-commerce in Russia. Her observations and conclusions about the main trends of e-Commerce market they shared with “Ribbon.ru”.

The trend

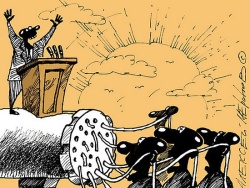

Some two or three years ago investors in e-commerce told us about the upcoming death of offline trading and the transition to online. Futuristic view of the retail in the eyes of the apologists of the e-Commerce looked very nice. The idea was that buying over the Internet, we’ll all be. Time is money, why go shopping? Pressed the button and got the result! On the Internet it is easy to choose a product, not rising from his place, compare prices, read reviews of the courier to take too easy.

Konstantin Shabalin

The development of online sales was expected in all segments of retail trade. “But what about the desire of women to go shopping and try on clothes?” — we asked. In response, the futurists proposed to develop the format of the showrooms. Came, tried, evaluated and ordered. To open and maintain a costly network of offline stores, according to this scenario, looked really ridiculous.

The Internet as the future of retail

Of course, online had to go and retailers specialized in food products. Who wants to stand in line “Auchan” and to spend your whole day off? The capital-intensive nature of online grocery supermarkets is not considered a problem, because with the proper level of orders, the costs of storage, sorting and delivery of food had to pay off.

The main problem of the triumphal procession of e-commerce was considered the logistics. Quality delivery service across Russia — too expensive and difficult. Some relied on drones: fly and deliver the goods — for example, will throw it on a special mesh installed in the yard for such purposes.

Some time passed, and we heard the predictions quite the opposite. “To invest in e-commerce — this is crazy!” — reported to us. The advancement of the Internet more or less large-scale business related to retail, now we need such costs, it is easier to build offline store. If you don’t spend millions per month, buyers you won’t notice.

So what in reality is happening with the market of Internet-trade in Russia? That made our experience in StartTrack and a study on the development of e-commerce.

And still it grows…

E-commerce today is one of the most capital-intensive and customer-oriented areas of the Internet market, covering the sales of many categories of goods and services. Monthly Russians make of 1.19 billion visits to 358 thousand online sites, spending on shopping sites 3.1 billion minutes.

In 2015 e-commerce has experienced great turmoil, as the currency fluctuation has hit the acquisition prices and the decline in real incomes affect purchasing power. However, in 2015, the market grew by almost a quarter and amounted to $ 806 billion, although the rise has largely facilitated the growth of prices, and not the number of orders. But due to its small share in overall retail, e-commerce continues to grow due to the fact that “eats away” the share of the offline.

Photo: Safron Golikov / Kommersant

In the segment “Consumer electronics” in 2015, increased online sales by 3 percent for the year amid declining offline sales by 13 per cent — in rubles. In the goods segment (FMCG) sales grew in rubles by 55 percent, while in the offline — only at 14%.

The biggest players sales are growing. Lamoda turnover for the first half of 2015 has almost doubled and amounted to 3.21 billion. Online sales “M. Video” for the six months increased by 29.2 percent to 8.3 billion roubles from the VAT. Revenue Ozon.ru increased by 38 per cent over six months. Dynamics of sales “the Euronetwork” online, showed during the same period, an increase of 48 percent.

However, with rising prices for Russian buyer “flipped” in the cheaper shops, in particular China. In 2015, 51 percent of online shoppers used Chinese platforms. Cross-border trade in 2015 increased to a record 88 percent in ruble terms, while the share of crossborder the total volume of Russian e-commerce has grown to 20 percent.

Online retailers have panic caused by the capture of the Chinese market. However, Chinese shops contribute to the growth of the market of Internet trade in Russia in General. Crossborder in the crisis has brought online new customers that are now willing to not only shop on AliExpress. Order, for example, a citizen in China, case for smartphone, and if you all want — he wants to order something else. But if, for example, happens to the overlay when buying clothes, which is quite possible, since Asian sizes are not too suitable for Slavic figures, the buyer will begin to look at the pages of the same World.

The format of the year — hypermarkets

In a situation where e-commerce is becoming more capital-intensive due to the costs of promotion in the Russian Internet is developing hypermarkets. In this format, there are 11 online stores, which occupy a fifth of the total turnover of the market. Over the past few years they have played an important role in the consolidation of e-commerce, gaining more and more market share due to the expansion of the product line. In crisis conditions never manifested strong point is the versatility of the range, which allowed us to avoid depending on low-income product categories. This strategy, for example, claimed online hypermarket E96, where none of the product groups in the range of not more than 25 percent, and this rate gradually decreases.

With the consolidation attractive for investment remain niche and highly specialized projects. Except, perhaps, the market of consumer electronics — this segment is already saturated and get a normal profitability is extremely difficult. The second fullness on the e-commerce market was the segment of “shoes, clothing, accessories”, although not long ago here there was a shortage of players.

Photo: Alexander Kryazhev / RIA Novosti

In less monopolized segments of the market, despite the crisis, there has been some growth. For example, in the medium term for investors remains attractive category children’s clothing and sporting goods. This is confirmed by the latest data on the volume of investment in these segments. So, last year Babadu.ru drew 110 million rubles, and Mamsy.ru — about 100 million.

Only the return of investment in e-commerce is now calculated in years — almost as much as the retail offline market. In this sense, trade online and offline so almost on par. To enter major e-commerce business in the short term is already profitable in any segment: all investments will be spent on the fight for market share, capture and keep a customer.

Hybrid formats

Expensive cost of promoting the website and attracting customers to create e-commerce all the more interesting hybrids of online and offline stores. Online supermarkets now actively used offline as a channel to attract new customers and ensure a unified customer experience. For example, recently went offline, these e-commerce giants like Wikimart and “Hardware”. Now they create a large format offline point of sale, uniting the store and the collection point.

Most likely, in a dispute, who in the future will benefit — online or offline, the truth will be somewhere in the middle. And all the growing cost of promoting online will be to push the players in offline of course, while maintaining business on the Internet. While going online is concerned to a greater extent traditional business, but the exit of major online players in offline, too, may soon become a trend.