As the gold market halted its March to the heights, it is necessary to step back and understand why gold is so highly valued in the past 100 years and why it will continue.

Most people have no idea what money is. They think that if they had 100 dollars or euros, they have a real value or reliability.

Few realize that their currency which they called money, have nothing to do with real money. All paper currency is fleeting and returned to its true zero value.

This is because reckless government cling to power by printing or borrowing endless amounts of paper money, hoping to appease the people and buy votes.

Paper money could not serve as real money. It is issued by decree, and not backed by anything but debt and liabilities.

Power corrupts, and money corrupts. It’s a deadly combination that destroys not only people, but also the country. And unfortunately, we have now reached the moment in history when the generated unlimited amount of paper money will destroy also and continents.

Most currencies will suffer the fate of the Zimbabwean hyperinflation

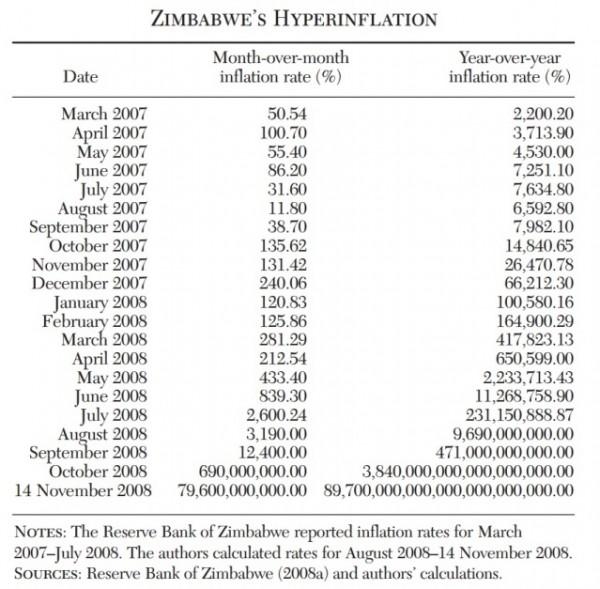

To understand what is and what is not money, we can just look at the example below.

Most people in Zimbabwe believed that their currency is money, their reward for work or manufacture anything. But irresponsible government began to use tricks to hide bad management of the economy, and were forced to print endless amounts of money; in the end, even 100 trillion banknote was worth nothing.

Inflation in Zimbabwe is growing exponentially. In 2008, the annual rate of inflation was estimated by the number 10 with 40 zeros.

What happened in Zimbabwe is an excellent example of how prosperous a country can be ruined by complete mismanagement. The country has been very successful agricultural sector, mostly owned by Brits since the time of southern Rhodesia.

She also has considerable mineral resources. But the value of this was destroyed when the country became independent. And during the tragic decline of Zimbabwe, private land was expropriated, and the company was nationalized.

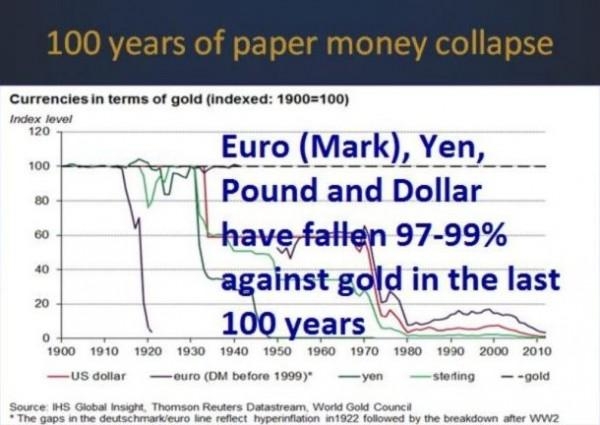

This schedule must see: the death of paper money against gold

So Zimbabwe is a great example of how to destroy the currency, killing private enterprise and replacing it with state intervention and control. Such examples in history are many.

Division of Germany after the Second world war is the best proof of how the country’s economy can be destroyed by the destructive policies of West Germany, a prosperous free market economy, and East Germany, controlled and impoverished Communist economy.

The decline of the U.S. dollar occurred much faster than many people think.

In 1971, for a note of $100, shown above, you could buy 100 grams (about 3 oz) bars are shown. Today it is possible to buy the tiny area in 3% of this gold bullion.

But the U.S. dollar is not the only currency going down. All major currencies are successfully competing in this race — the Euro, the yen, the pound and any other currency.

Gold is natural money and only money to survive

The chart below shows that gold is real money and has a stable purchasing power (straight line at the 100 mark). It executes the function, which must fulfill the money. It is a constant value, which it retained for thousands of years.

One ounce of gold could buy a well made men’s suit 2,000 years ago, 100 years ago today. It is this feature of real money. But if we look at the chart below, we can see that all currency in the last 100 years have lost 97-99% of its value relative to gold.

As the graph shows, the dollar, Euro, yen and the pound remained only 1-3% to zero. The final fall is almost guaranteed, the only question is how much time it will take.

Given the geometric growth of debt, greatly accelerated after 2006, we may see the final destruction of the currencies in the next 5-7 years.

And if not the debt will cause the collapse, it will make $1.5 quadrillion of derivatives in bankruptcy of the counterparties.

Zimbabwe demonstrates perfectly how something that was supposed to serve as money and a store of value, becomes worthless promises, the for transactions or exchange. In the final stages of the period of hyperinflation, the people demanded dollars or gold.

The collapse of the currency — a historical norm

Interestingly, the collapse of the money has been the norm throughout history, as no paper or a political currency has never survived. Therefore, it is not necessary to hope that the use of metallic money will be introduced on a permanent basis.

Yes, the periods of use of metallic money was there, but they rarely lasted long. It seems that the government has such a corrupting influence on those in political circles that the urge to print and spend paper money empty seems completely insurmountable.

If the U.S. dollar will lose its status as a world reserve currency? How would it look like?

A simple solution would be to first get rid of all Central banks, because for them money is not money, but always come back to the cost of printed paper.

Central banks perform two main functions. They artificially manipulate interest rates, they print money.

Manipulating interest rates, they break the natural laws of supply and demand.

With a high demand for money, in a free market interest rates rise to dampen the demand for money. Also high interest rates adequately compensate investors for they have taken high risk.

Unprecedented financial manipulation

What is happening today is completely the opposite of the free market. Global debt has grown by more than 10 times in 25 years and interest rates are at zero or negative level. History does not know such a scale of financial repression or manipulation.

This completely destroys the forces of free market and heralds the unprecedented financial Armageddon. Collision with the natural laws of supply and demand have always had serious consequences.

One thing is certain.

The current financial system cannot survive, since it is based on unsustainable principles. In a flawed system no sound money.

Of course, gold as the only real money, will continue to reflect bad management of the world economy, as in the next few years the currency will complete its movement to zero.

Author: Egon von Greyerz