Russian energy Minister Alexander Novak during his visit to Tehran on 14 March met with the Minister of oil of Iran Bijan Zanganeh and energy Minister Hamid Chitchian. The parties discussed the prospects of freezing of oil production, but to a real understanding did not come. Tehran is not going to stop increasing production until its volume reach four million barrels per day.

Seventeen seventy is better

“Let us leave alone until then, until we come to the frontier (the production of oil — approx. “The tape.Roo”) of four million barrels per day. After that, we joined them”, — said the Minister of oil of Iran Bijan Zanganeh on March 13. He talked about a global Treaty to freeze the production of black gold.

Iran needs to restore positions on the European market. The EU abandoned Iranian oil in July 2012, Iran’s niche in the market occupied Saudi Arabia and Russia. Therefore, the refusal of Bijan Zanganeh to freeze mining perfectly logical and understandable.

March 14, Zanganeh said that Iran considers appropriate price in 70 dollars for barrel. It is obvious that when the current quote is less than 40 dollars per barrel Brent — without concerted action by oil producers not to do. For the stated price level need not only to freeze production at current levels, but a serious reduction.

This issue was discussed on March 14 in Tehran, where went the head of the energy Ministry of Russia Alexander Novak. Based on its results, the official said that Iran’s stance is balanced and reasonable. “Doors are open for Iran,” concluded Novak. In other words, to agree on any concrete steps to freeze the production or to reduce it failed.

The partner of company RusEnergy Mikhail Krutikhin believes that the statement by the Iranian Minister about “the right price” is no more than wishful thinking, but in any case not willing to take any action. “Now Iran is selling its oil to Europe for $ 17 per barrel. However, is heavy oil, with strong admixtures of sulfur compounds, it is more viscous than Russian Urals. But still with such a policy no 70 dollars even on oil Brent the question. Of course, 70 is better than 17, who is arguing? This is the essence of his statements,” the expert explained in an interview with “Tape.ru”.

Krutikhin said that the Iranian heavy oil for further processing usually mixed with lighter varieties (including Russian Urals), therefore for Russian oil demand, considering cheaper and safer transportation of oil (because the oil of the middle East have to be transported by tankers).

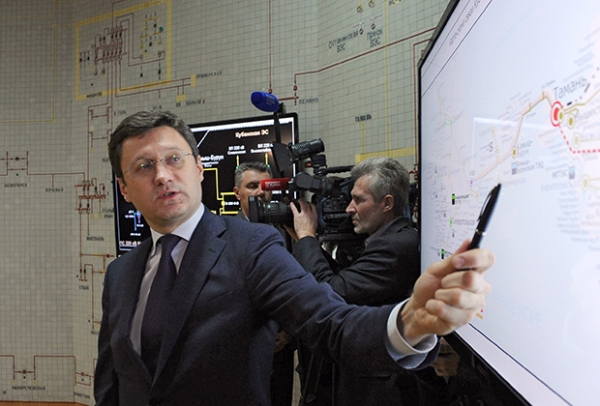

Alexander Novak, Minister of energy of Russia

Photo: Mikhail Klimentyev / RIA Novosti

However, Russian oil has an essential lack — high cost. “Russian companies reduced ends, the price must be below 26-27 dollars per barrel. Cheaper to produce unprofitable,” said Krutikhin. He also noted that the largest Russian oil companies — “LUKOIL”, “Rosneft”, “Surgutneftegaz”, “Gazpromneft” — output is falling, so it was pretty easy to maintain prior arrangement with OPEC to freeze oil production at the level of January 2016.

Mikhail Krutikhin is sure to persuade the Iranians to limit oil production is now impossible. “The odds are zero. Especially when you consider that the competition of Russia and Iran — Saudi Arabia and the US is not going to enter into any agreement.” Recall: foreign Minister of Saudi Arabia Adel al-Jubayr at the end of January stated that manipulate oil prices meaningless, but the balance must come from the market.

Minister Novak believes that the agreement with Iran is only a pleasant addition to the already reached agreements, but not critical. The meeting, which the President of Russia Vladimir Putin with the oilers on March 2, Novak reported that a willingness to freeze oil production at the level of January 2016 publicly confirmed more than 15 countries. The decision to freeze joined the countries that produce 73 percent of oil in the world, and this, according to the Minister, critical mass: even without Iran’s accession to price collusion, the decision will be effective.

Tehran on the sidelines

Agreement with Iran will not fundamentally affect the situation in the oil market — this is the opinion, the chief investment strategist for the company BCS Maxim Shein. He notes that the influence of the Islamic Republic in the oil market has been minimal: “Iran is more of a gas country than oil”. According to the expert, the price impact of large wholesale suppliers who can “pour” into the market on a large scale.

The Iranian oil Minister, Bijan Zanganeh

Photo: Heinz-Peter Bader / Reuters

An important factor of influence on the prices is demographics — the larger the population, the greater the energy consumption. According to the forecast of the famous economist and demographer Nicholas Eberstadt, the world’s population by 2035 will reach a peak and begin to decline. The same thing will happen to the workforce. What follows from these global forecasts? First of all, there’s no point in the oil sector long-term investments that may not pay off 50-60 years. And this applies primarily to the Russian oil industry — after all in Russia there is tight oil, requires serious investment. Against expensive oil works and the development of alternative energy sources. As the expert notes, we expect the global repartition of the oil market, since the modern economic model dependent on consumption, has exhausted itself.

Despite the difference in the assessment of Iran’s influence on oil market and Krutikhin, and Shein meet in the forecast for the biennium: in the opinion of both experts, the average price of the indicative Brent oil will amount to 40-45 dollars per barrel.

Thus, regardless of the outcome of the visit of the Russian Minister of energy (in the course of which, however, were not the only power; the parties discussed, for example, and cooperation in agriculture) should take into account two basic things. First, Tehran will not act to the detriment of themselves and freeze the prey is disadvantageous to him. Secondly, the world has entered an era of relatively low energy prices in the long term, and this must be considered, when creating economic strategies.