Raoul Ilargi Mayer, a long time ago commenting on economic realities, expressed and concise, and provocative:

“It’s over! The entire model, which are based on our society at least how much we can remember, has died. That’s why there was trump.”

“No growth. There was no real growth for several years. All that is left is an empty glowing numbers of stock market performance S&P propped up by ultra-cheap credit, and reverse stock buybacks, and the unemployment rate, which hide unknown how many millions of people not included in the number of workforce. And the lion’s share of that debts, both public and private, that supported the illusion of growth, and now more and more not capable to do that.

…The fake growth only worked on one thing to the public, so those in power could stay in their warm armchairs. But all they have always been, it’s just pull the curtain the Wizard of Oz before the eyes of the people some of the time, and that time has passed.

…That means that the rise of trump, Brakcet, Le Pen, and everything else. This is the end. All that motivated us throughout our life, lost direction and energy.”

Mayer continues:

“We are right in the middle of the most important global turn in recent decades, and in some respects, perhaps for centuries, at the beginning of a genuine revolution, which will be the most important determinant of world order in the coming years, but for some reason nobody talks about it. For me it is unclear.

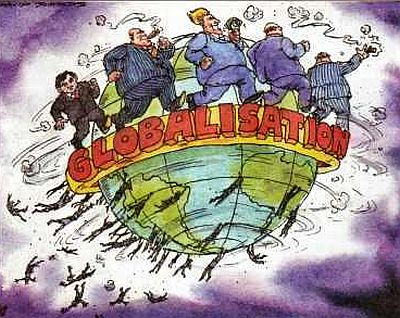

…Global rotation, which we have in mind is the end of global economic growth, which inexorably will lead to the end of centralization (including globalization). This would also mean the end of existence of most international institutions, and especially the most influential.

…Similarly, it will be the end — almost — of all the traditional political parties that have ruled their countries for decades and now have almost a record or record-low support (if you are not quite clear what is happening, look at Europe!).

…It is not the desire or intention of some person or group of people, a matter of “forces” that are beyond our power, which is more powerful and influence than our measly opinions, despite the fact that these forces may be the work of human hands.

…”Mass and smart (not very smart) of people break the head over where it came from trump, and Pexit, and Le Pen, and all these new and terrible phenomenon, and the people and the party, but so to anything and not come, in addition to shaky theories that it’s all in the elderly, or in poor, racist-minded fanatics, people fooled, people who never voted, and even some you like.

It seems that reason does not know and does not understand. Which is weird, because to understand them is not too difficult. Namely, all this is happening because stopped growth. But if the growth stops, the same happens with the expansion and centralization of all the countless kinds and forms in which they occur”.

Next, Meyer writes:

“Globalization as the main driving force, in the past, paneuropejski in the past, and the question of whether the United United States is far from solved. We are moving to mass movements of tens of individual countries, States, and societies eyes which are turned inward. And all of this kind of certain “growing signs of problems”.

…Which makes the whole situation so difficult for the common understanding is that no one wants any of this to admit. Despite the fact that the stories about often the deepening troubles rely on the same causes, which gave birth to trump, and Pexit and Le Pen.

…What political-economic-media machine around the clock, without a break, and churns out reports of positive growth, partly explaining the reluctance to accept the reality and take a sober look at yourself — but only partly. The rest is due to the fact that we all are. We believe that we are worthy of eternal growth.”

The end of “growth”

So really the “growth is over”? Of course, Raoul Ilargi speaks of the “conjunction” (and there are examples of growth in the form of individual waves). But it is clear that a policy of investment based on borrowing and low interest rates give less and less effect on the growth of production — or no effect — even if we talk about GDP growth or trade growth, writes Tyler Durden at ZeroHedge:

“After nearly two years of quantitative easing in the Euro area economic indicators remain very weak. It clarifies IT (Global Analysis from the European Perspective), inflation is still around zero, while GDP growth in the region is to accelerate, started to slow down. According to the ECB, to generate 1 Euro in GDP growth, to print 18.5 euros in QE,…. This year, the ECB has printed almost 600 billion Euro programme of asset purchases (QE)”.

Central banks can create and do create money, but it’s not the same as creating wealth or purchasing power. Transmitting the created loan through the banks which are giving loans to favored customers, Central banks provide purchasing power to one set of economic agents — the purchasing power, which inevitably should be selected from a different set of economic actors within Europe (i.e. be selected by those of ordinary Europeans in the case of the ECB), which, of course, will have less purchasing power, less disposable income available.

Reduced purchasing power is not so obvious (no rampant inflation), because all major currencies are devalued in equal measure — and because the authorities periodically artificially reduce the price of gold, so that there is no clear standard by which people are able to “see” the degree of joint depreciation of their currencies.

And world trade is also shrinking, as is quite elegantly explains Strether Lambert from Corrente:

“Back to traffic: I started with the tracking of cargo… partly because it’s interesting, but more because the carriage of goods for anything material, but tracking something tangible is a much more attractive way to get some understanding about Economics than the economic statistics, not to mention the books, which are interpreted every day wall statovci. And don’t tell me about Larry Summers.

So, what I’ve noticed is a decline and not temporary corrections followed by rebounds, but the decline for several months, and then years. The decline in railway traffic, even if not to take into account coal and grain, and the decline in demand for freight cars. The decline in transport trucks, and the decline of freight cars. Cargo transportation by air transport barely breathing. No rebound for Christmas in the Pacific ports. And now we have the collapse of the Hanjin Shipping company — all of its capital stuck in stuck the courts, although it provided only $ 12 billion or so, and the universal recognition that somehow “we” invested “WA-a-a-y! a lot of money” in large ships and vessels, means (I think) that we need to carry much less cargo than we thought, at least through the oceans.

Meanwhile, in apparent contradiction not only with the gradual collapse of global trade, but with the resistance of the “trade agreements”, there is a warehouse activity is one of the few bright spots in the real estate market, and supply chain management, this field of excitation. Here, a disproportionate amount of psychopaths, and therefore there is growth and dynamic!

And economic statistics, it would seem, says nothing bad happens. The consumers are the motor of the economy, and they feel confident. But, in the end, people need things; man lives in the material world, even if it seems to him that he lives in your device. The mystery, however! Therefore, what I see, this is a contradiction: most goods are transported less, but the numbers say that “all is well”. Am I right or what? Therefore, in the future I’m going to assume that what is important is not the numbers, and things material.”

The false panacea

Or, to heighten the false empiricism: according to Bloomberg in the article “the weakening of the currency is no longer the panacea it once was”:

“According to Bank of America since 2008 global Central banks have cut interest rates 667 times. During this period of 10 currencies of major competitors of the dollar has decreased by 14%, yet the economy of the group of eight has grown on the average on 1%. According to Goldman Sachs since the late 1990-ies the depreciation of the currencies of 23 developed economies with inflation at 10% has increased the volume of net exports is just 0.6% of GDP. This compared with 1.3% GDP growth for the previous twenty years. , U.S. trade with all other countries fell to 3.7 trillion dollars in 2015, with 3.9 trillion dollars in 2014.”

With the “end of growth” the same thing happened with the globalization, even the Financial Times agrees, writes the author, Martin wolf in his column that “the Tide of globalization gives way to low tide”:

“Globalization, at best, stalled. Can it still be reversed? Yes. It requires peace between the great powers… does the loss of speed of globalization? Yes.”

Globalization has stalled — but not because of political tensions (a useful “scapegoat”), but because growth almost stopped in the result of this confluence of factors hindering it — and because we are entering into a debt deflation, squeezing out what’s left of the freely disposable at the disposal of the consumers income. But wolf is right. Inciting tensions with Russia and China in no way save you from weakening the domination of America over the global financial system — even if capital flight to the dollar and could provide the US financial system short-term “surge”.

So mean in fact, “reversal” of globalization? Does this mean the end of neoliberal, financialservices world? It’s hard to say. But don’t expect a quick “turn 180 degrees” — and no apology. The great Financial Crisis of 2008 — at that time — as many believed, marked the end of neoliberalism. But it did not happen — on the contrary, was imposed on the period of budget cuts and austerity, which contributed to the deepening distrust of the existing order of things, but a crisis rooted in the masses, the widespread opinion that “their companies” the authorities are in the wrong direction.

Neoliberalism has created a defense in depth — not least in the European “Troika” and the Eurogroup, which looks after the interests of creditors and which under the laws of the European Union came to dominate the financial and tax policy of the EU.

It is too premature to talk about which side will be challenged prevailing Orthodoxy, but in Russia there is a group of eminent economists, United in the “Stolypin club” and showing increased interest in one longtime opponent of Adam Smith, Friedrich list (mind. 1846) who developed the “national system of political economy.” Sheet supported (divergent interests) of the nation before the interests of the individual. He gave prominence to the national idea and insisted on the special requirements of each nation according to its circumstances and the extent of its development. He brilliantly challenged the sincerity of calls to the developed Nations — particularly Britain — to free trade. He was a kind of forerunner of the anti-globalists.

Post-globalism

Clearly, all this is well within today’s post-globalist mood of mind. Recognition Sheet of need for national industrial strategies and the confirmation of the role of the state as the ultimate guarantor of social cohesion is not some whim championed by a handful of Russian economists. It’s almost mainstream! The UK government Theresa may just break with the neoliberal model, which guided British policy since the 1980s — and breaks away, moving towards lisyanskogo approach.

Whatever it was (coming again this approach fashion more widely), most contemporary British Professor and political philosopher John gray believes that the key point is this:

“Restoring the role of the state is one of the aspects which distinguish the present time from “new times” with Martin Jacques and others commentators in the 1980-ies. Then it seemed that national boundaries disappear, and begins the reign of the global market. This term, I never thought plausible.

Globalized economy existed before 1914, but was based on the lack of democracy. Uncontrolled mobility of capital and labor could increase productivity and create wealth on an unprecedented scale, but also very damaging have an impact on the lives of working people — especially when capitalism fell into one of its periodic crises. When the global market faces serious difficulties, sacrificing neoliberalism to satisfy public demand for security. This is happening today.

If the conflict between global capitalism and national government was one of the contradictions of Thatcherism, the conflict between globalization and democracy canceled the left. From bill Clinton and Tony Blair onwards, the centre-left welcomed the project of a global free market with the same passionate enthusiasm as any of the right. If globalization goes against the cohesion of society, society had to rebuild it to become an appendage of the market. The result was large sections of the population, left to rot in stagnation or poverty, some without any hope to find a productive place in society”

If gray is right that the collision of globalized economies with the problems people are starting to demand that the state pay more attention to their own parochial, national economic situation (and not the utopian problems of a centralized elite), this implies that as soon as globalization — exactly the same happens with the centralization (in all its many manifestations).

Of course, in the European Union, as the icon turned inward centralization, have to think and pay attention to it. Jason Cowley, editor (left) “the New Statesman” says:

“In any case… whatever you call it, [the advent of the “new times”] will not lead to a social democratic revival: it seems that we, in many Western countries, are entering into an era when centre-left parties can form a ruling majority, because the sympathy of their supporters defected to the nationalists, populists and the more radical alternatives.”

The problem of self-deception

So, returning to the words of Ilargi that “we are right in the middle of the most important global turn in recent decades…. and for some reason nobody talks about it. For me it is absolutely unclear”, to which he responds that, ultimately, the reason for this “silence” is in us: “We believe that we are worthy of eternal growth.”

He’s undoubtedly right that it is somehow responsible for the Christian idea of linear progress (here the material sense and not the spiritual); but, from a more pragmatic point of view, is not whether “growth” of the West, financialisation, the global system of the West in General: “it’s about getting “others” from their poverty”?

Recall that Stephen Hadley, former national security Advisor to President George W. Bush directly warned that the experts on foreign policy would be better to pay close attention to growing public discontent: “globalization was a mistake” and that the “elite gradually brought US in trouble.”

“In these elections not only in the trump — says Hadley. — It is in the dissatisfaction of our democracy, and what are we going to do with it… whoever is elected, he will be forced to deal with this frustration”.

In short, if globalization is giving way to discontent, the absence of growth could undermine the whole financialliteracy global project as a whole. Joseph Stiglitz tells us that it was obvious for the past 15 years — last month he said that he warned that “in the developing world, growing resistance to the globalist reforms:

“It seems a mystery to people in developing countries are told that globalization will increase overall well-being. Why then do so many people became so hostile to her? How can something our political leaders — and many economists — said it will improve life for all, to be so hated? One answer, which I from time to time I hear from neo-liberal economists defending this policy that “people began to live better. They just do not know about. Their discontent is a question for psychiatrists and not for economists”.

This “new” discontent, says Stiglitz, is now spreading to developed countries. Maybe it is referring to Hadley when he argues: “globalization was a mistake.” Now she threatens us financial hegemony, and, consequently, the hegemony of the political.