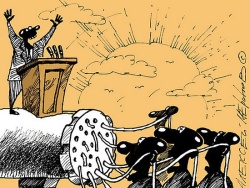

To save American capitalism

As I have said, in their election statements trump has actually announced the transition of America from the rail Bank rails capitalism to industrial capitalism. Implementation of promised trump will require enormous effort. Such a transition, one even attempt such a transition will affect the entire global economy.

The challenge trump to save American capitalism

Trump announced that if he wins will stop further negotiations on the Transatlantic trade and investment partnership (TTIP) is a comprehensive agreement between the United States and the European Union. According to trump (there is, of course, not yet judged by the words) will put a cross on the TRANS-Pacific partnership.

Trump stated its position as follows: trade and economic relations of the USA with the rest of the world will be built through the conclusion of bilateral agreements. Given such a strategy, Washington is not really needed will and the world trade organization (WTO) tariff with its excessive liberalism. Although trump never used the word “protectionism”, but it is expected that it will become the main principle of foreign policy of Washington under the new President. Successful in business, trump knows how to “wring” their partners to the max.

For a century America was ranked first on the turnover of international trade, with the title of “world trading power.” Only in 2014 this indicator has bypassed China. Until the early 70-ies of the last century, America had a surplus in the trade balance, then formed a disadvantage, which to date has reached astronomical proportions. According to the Ministry of Commerce, the trade deficit of the USA in 2015 amounted to 736,2 billion. Here is a list of countries with which trade was for the United States in 2015, the most deficit (the deficit of the balance of mutual trade in goods, billion us dollars): PRC – 365,7 Germany; 74,2; Japan – 68.6 percent; Mexico – 58,4; Vietnam is 30.9.

To some then America is not very worried about these huge deficits – she closed them with a printing press of the Federal reserve system (FRS). In exchange for arriving equipment, consumer goods, raw materials, food America gave other countries the green paper. The reserves of this green paper in other countries are measured in trillions of dollars. However, they continue to come back to America, exchanging into US Treasury bonds, which U.S. authorities close another deficit – the Federal budget deficit. This mechanism is almost-free and perpetual lending of America rest of the world is an important element of banking capitalism of the United States. However, the resource mechanism is limited. A limitation of the state debt and the state budget. The debt cannot grow indefinitely, for maintenance (pay interest). Even if the interest rate on the debt equal to 1 percent, sooner or later, interest payments will devour the entire Federal budget of the United States. About this trump declared last summer and promised to stop the growth of the debt pyramid in America. Moreover, he will try to dismantle it, by starting negotiations with other countries on debt restructuring.

Of course, trump wants to put America back the millions of jobs that float away to China, Mexico, Germany, Japan and dozens of other countries, but not only. His greater task – to save American capitalism in all its form. And he bet on industrial capitalism, with a greater margin of safety than capitalism banking.

Factor protectionism

The trump factor in the economy – is, above all, the factor of protectionism. The effect will be contagious. The winds of protectionism can cover the entire world trade. To calculate all the long-term effects is difficult. While it is clear that protectionism trump will exacerbate U.S.-China relations. The size of the total debt of the Chinese economy is approaching 300% of GDP. To serve such a huge debt, we need to ensure GDP growth of at least 6-7% per year. Has long been a large part of the GDP growth of China is created through the active balance of foreign trade. If the active balance in trade with America will fall even 10-20%, the impact on the economy of the PRC will be sensitive. If a surplus disappear, there will be a full knockdown, and then we can see the effect of falling dominoes: the world economy including the US economy, will be covered with a second wave of the financial crisis.

Factor protectionism will seriously affect the relations of America with Europe. Yes, Europe is now very obedient, carrying out many instructions from Washington, but this behavior is partly explained by the fact that Europe for his obedience he received a good fee in the form of trade surplus with America. Last years it was about $ 100 billion. If Europe will be deprived of such remuneration, incentives to follow the lead of American politics she has diminished.

And then there will be a chain reaction. The Europeans will try to compensate for their trade losses with the United States at the expense of other trading partners. For example, at the expense of Ukraine. It is known, from January 1, 2016, has in trade with the European Union a “special regime” (the regime of free trade zone). However, for 10 months of this year, statistics show that the “square” any “carrots” from Europe was not. I think after a while under the effect of factors trump it starts to get from Europe, only bitter pill in the form of rising trade deficit.

Factor interest rates

Another important factor of trump the economy may be a factor in the interest rate. Trump has repeatedly criticized Barack Obama and fed Chairman Janet Yellen for the fact that they keep the base rate of the Federal reserve at extremely low levels (of 0.25-0.50%). Money in America is almost free, it creates the illusion of health of the U.S. economy. And the money should have its price, otherwise it is not capitalism. Donald trump is a principled opponent of the “cash of communism”, which was established in America after the financial crisis of 2007-2009. The more that the benefits of the “cash of communism,” the American people do not use – enjoy these benefits banks, wall street, blowing the free money on speculation and inflating financial bubbles.

I think that trump have not have time to reach the White house, and the trump factor in relation to interest rates will start to operate. The increase in the base rate of the fed, the global economy will feel immediately. Will increase interest rates on Bank loans and deposits, Treasury and other securities with floating rates, the other financial instruments. Aktiviziruyutsya the inflow of capital into the U.S. economy, will increase the dollar. In other countries, on the contrary, recorded an increase in the outflow of capital declines in exchange rates of national currencies. However, this is only the beginning. When the helm of the Federal reserve and the U.S. Treasury will take in their hands the people from trump, you should expect subsequent increases in base rates the fed and interest rates on Treasury securities. This, in turn, can lead to reversals in international capital flows, the consequences of which are difficult to miscalculation.

I think the team trump trying to figure out these risks to protect themselves from the second wave of the global financial crisis. I believe that if the team trump say, “A”, she will have to say also “B”. Under “A” I mean the policy of trade protectionism under “B” – the introduction of restrictions on cross-border capital flows. That, and the other usually goes in pair.

Speaking of control in the field of capital movement, I mean not only the import of capital (restrictions and prohibitions on imports of “hot”, “short”, “speculative” money), but also its export. I recall that in 1963, President John Kennedy tried to stop the process of de-industrialization of America by high taxation of income received by U.S. corporations from their foreign investments. It was an attempt to stop the outflow of capital from the country, to get them to work for the American economy. After the assassination of Kennedy had no American President did not venture to put a barrier in the path of movement of capital.

I wonder, would Donald trump?

And one more detail. Raising interest rates will inevitably make interest payments (debt servicing costs of the government) of the main articles of the Federal budget. In order to mitigate them, the team, trump will be forced to start talks with holders of United States Treasury securities on the restructuring of US government debt. Previously, such talks were Argentina, Ukraine, Greece. Today, in the unpopular role can be America.

Finally, the factor of trump may take the form of urgent measures to restore order in the banking sector. Trump at one of his programs put the request to restore the glass-Steagall act, signed in 1933 by Franklin Roosevelt. The purpose of the law was to dissolve the credit and investment operations of banks, not to allow banks to use customer funds to play in the financial markets. The world of U.S. banks have since split into Deposit-credit organizations (commercial banks) and investment banks. In 1999, President bill Clinton signed a law abolishing the glass-Steagall act. It was opposed by then many of the policies and sensible business, but banks wall street controlled bill Clinton and provided a favorable decision. After that, America at full speed rushed to the financial crisis in 2007-2009

Now America is moving to the second series of a financial crisis that will be permanent until, until you restore the glass-Steagall act. Today the relative performance of different types of debt the American economy exceed similar indicators of 2007 (on the eve of the first of a series of crisis). To restore the glass-Steagall act had still “yesterday”.

Nobody can say when burst financial bubbles that the banks, wall street managed to cheat during the Obama presidency. But if they burst in the swamp of the crisis will plunge not only American but the whole world economy. I think trump understands the scale of the threat. Therefore, the adoption of the law on the separation of credit and investment operations of US banks may be one of the first initiatives of the new occupant of the White house.