The queue to the exchange. 1998

Thus at the economic helm of the country now, not Primakov, a would-be officials, pomoravlje Golden decade of the oil superten

On 17 August 1998, Russia experienced one of the largest in recent history economic shocks. On this day, the authorities announced a technical default on its debt and stopped supporting the ruble exchange rate. As a result, over the next few months, the ruble against the dollar fell by a third from 6 to 20 “wooden” piece, which resulted in huge inflation and devaluation of the savings of millions of citizens. Thousands of large and small firms, dozens of banks have not experienced a financial disaster. The Russians, fearful and depressed by the events, dubbed this time as “black August.”

However, pretty soon, the crisis was overcome, moreover, the economy of the country even managed to reach a new level of development. However, unfortunately, the authorities are unable to take full advantage of this opportunity by taking the easy way out by eating away the oil rent.

The Genesis of the problem

Of course, like any crisis, the “black August” had its objective reasons. After the USSR collapse the government of his successor — Russia — is facing an acute shortage of funds. Some of the external debts of the Union, which “spilled over” on the shoulders of the Russian Federation, was 96.6 billion.

The state Duma has seen one of its most important tasks in pumping money in the social sphere. MPs adopted decision is recorded in the annual budgets. The government appointed Boris Yeltsin prevailed reformers-liberals, following the recommendations of the International monetary Fund (IMF). And that, in turn, advised Moscow to destroy the public sector and to cut social spending. Along the way, the holders of Ministerial portfolios with gusto derbanit the state budget. And for full happiness of both branches of government and even openly despised each other.

The main way of raising funds for the country’s economy began to loans, and the main mechanism of attracting borrowed funds was selected short-term government obligations, or t-bills.

Hospitalid: all as Mavrodi

It is worth noting that the creators of the GKO — Andrey Kozlov, head of the securities Department of the Central Bank, and Bella Zlatkis, who served from 1991 to 1998 head of the Department of securities and stock market of the Ministry of Finance — nothing new has come up. The Russian authorities had constructed a classic pyramid scheme, going the same way as the swindler Sergei Mavrodi with his infamous company “MMM”.

The first issue of t-bills was held in 1993. Authorities received 885 million rubles, and decided that in their possession a gold mine. A year later bond was sold for 12.8 billion rubles, and in 1997 — the space 502 billion. The explosive growth of the GKO pyramid happened after Yeltsin’s victory on presidential election in 1996.

By the beginning of the crisis of 1998, bonds became the main instrument of budget deficit. The problem was that for each ruble received from the sale of the bonds, the state had to return 5-7. That is, the scheme worked only as long as the Finance Ministry headed by Yakov Urinson and the Central Bank at the helm of which stood Sergei Dubinin, found all the new investors wishing to cash in on the Russian casino.

On the eve of the collapse of the pyramid retirement of bonds of previous issues demanded 56% of revenue, so that on plugging the budget hole was only 44%. It is clear that if the economic crisis has accelerated the collapse of the Scam, this percentage continued to decrease, and the share of debt service grew.

The final story was of course predictable. In more favorable circumstances, he just would come later in a year or two. By the time the defaulted debt of Russia has exceeded 36 billion dollars, one and a half times exceeded the volume of Bank reserves.

Two of the crisis

The collapse of the GKO pyramid was important but not the only component of the crisis that economists like to compare with the current.

Parallels, if you look closely, there really is a lot. In both cases, for example, domestic disasters was preceded by the global economic turmoil. In 1997, foreign investors, speculating on the explosive growth of the Asian tigers, decided it was time to fix the profit, and began to withdraw funds in dollar-denominated assets. Promising “predators” just let to the slaughter. This process has touched the side, however, the price of oil on world markets has slipped to 25 to 28 dollars per barrel (in 1997) to us $ 7-8 per barrel in August 1998, which left Russia without its main source of foreign currency.

At the end of the 1990s, the crisis in Asian economies has led to the fact that investors have tightened requirements for developing countries. The cost of credit has increased significantly. In 2014-2016 the borrowed funds were cut off Western sanctions.

Of course, the two crises are repetitive. 18 years ago, for example, Russia had no financial reserves. Otherwise was conducted monetary policy: the exchange rate of the ruble was artificially inflated, which on the one hand, and the pressure of inflation, and with another — demanded state of permanent monetary injections and made it unprofitable to manufacture products in the country. In 2014, the Central Bank went on a fundamentally different path and helped the speculators to bring down the rate of the national currency. Both the Finance Ministry and the government as a whole saw in the current situation a great opportunity to do nothing and thus formally fulfill social obligations, grasping the weak ruble, as a miracle pill for all ills.

Due to the population

Cheap it really gave a good boost to sectors that export-oriented. But two years of falling real incomes actually “killed” the buyer on the domestic market. Consistently weak ruble also “facilitates” the capitalization of domestic companies and banks, making them weaker than Western competitors.

In 1998, events moved more rapidly and dramatically. The purchasing power of the ruble fell by 4.5 times; in the same extent, the real income of citizens. Import became inaccessible roads, the majority of companies-importers went bankrupt. It gave Russian producers a chance to climb, especially given that many companies had unused capacity inherited from the Soviet Union. However, as later acknowledged Urinson, out of the crisis was largely due to the population.

However, it happens almost always. 2014-2016 is no exception: the funded part of pensions frozen for the third year, the regions slaving away trying loans to raise public sector wages… On the most important state needs “no money” as naively expressed by Prime Minister Dmitry Medvedev. Instead of one large default of Russia inevitably creeps into a series of small.

Cadres decide everything

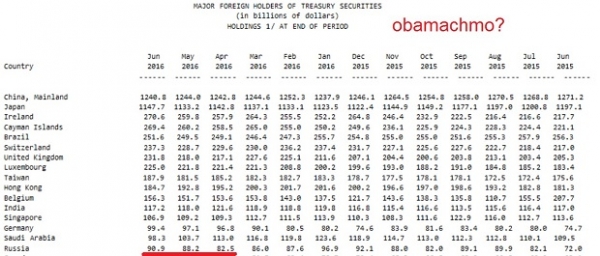

In fact, the money in the country. Russia still ranks among the twenty largest holders of us debt, continuing to sponsor the economy of his “worst friend”. The size of the investment, according to the U.S. Treasury, after declining once again is growing rapidly and now accounting for 90.9 billion.

In 1998, the first step to resolve the crisis was the change in the economic leadership of the country. Is sacrificed Sergey Kiriyenko at the helm of the government stood Yevgeny Primakov. And the first thing that took his “fire brigade”, was restoring order in the economy. Was created Antimonopoly service, has taken steps to control over the circulation of currency, the unjustified increase in prices and rising unemployment. The new Prime Minister has managed to reduce the Bank rates and pushing the lending industry. To the dismay of liberals, Primakov even found the money for the indexation of pensions; the state also took over the regulation of prices for medicines and wage arrears — since the filing of deputies-Communists — became a criminal offence.

The result was not long in coming: in the course of the year the balance of payments improved, inflation has slowed, industrial growth came to 1% per month.

Could such measures make government Chernomyrdin or Kiriyenko? In the spherical vacuum — possible, Yes, but in reality is unlikely. Too many corrupt ties, old stuff, behind-the-scenes interests linked former Ministers and their entourage from the parasites who destroyed the economy.

Now, alas, the leadership of the country there is the same situation. The fact that the Medvedev government is fundamentally unable to cope with the crisis, clearly seen in the murky intrigues of the next stage of privatization, and undertaken at every opportunity, attempts to borrow money from the West, and the picture is provocative, but in fact humiliating for the public statements of the head of the Cabinet.

The government liberals are not just slept ten years of oil, superzan, they seem so learned nothing, stuck in the times of the Dubinin — Urinson. And let the actual leaders of the Central Bank eagerly says that the default of 1998 allegedly to repeat impossible, ” Russia lacks right now of troubles and problems without diving into the abyss of the ruble.

***

The crisis is really able to start a new stage of development of the country. In this the Russians have seen 18 years ago. However, this update must begin with the brain governing the country. If at the time when the situation changes from bad to worse, remain at the helm of the old staff — means that Russia is still ahead.